The simple, inescapable fact is that the State could have lawfully acquired the ‘Eden Gardens’ property for less than $40M. The HDC paid $175M in November 2012 to Point Lisas Park Ltd (PLP) for that property, which is the reason I am calling this an improper use of Public Money.

Despite having available the advice of the Commissioner of State Lands, the Commissioner of Valuations and various attorneys at HDC and so on, the Cabinet approved this transaction. This Cabinet, with two Senior Counsel at its head and several other seasoned legal advisers, appears to have been unaware of, or intentionally ignoring, the legal safeguards.

Some readers may be surprised at those assertions, so here are my reasons for making such.

The last two articles examined the steps leading to the HDC’s purchase of land at ‘Eden Gardens’ in Calcutta Settlement. In my opinion that transaction, as well as the one which preceded it, are both highly improper and very probably unlawful. The HDC purchase must be reversed and the responsible parties investigated/prosecuted as required by our laws.

This ‘Eden Gardens’ episode is an object lesson in what can go wrong when elementary policy is set aside for stated reasons of expediency. Apart from the lack of any Needs Assessment, the unclear role of the Commissioner of State Lands is a source of serious concern. That Commissioner’s role is to advise the State on the strategic implications of its land policies and transactions, so this is a straight example of a case which required a solid input from that critical State Officer.

So, what should have happened? How would a proposal like the ‘Eden Gardens’ one have been handled if the various parts of the system were functioning properly?

When parties are in commercial negotiations, there is always a Plan ‘B’, to be adopted in case the main plan goes awry. Each side has a different Plan ‘B’, since they have different interests.

What was Point Lisas Park’s Plan ‘B’ in case their negotiations with the State were unsuccessful? While we can never know for sure, PLP being a private company, the fact that those lots were widely offered at $400,000 can allow us to form a view as to the benchmark they were likely using.

The State’s Plan ‘B’ is far simpler to establish, since there exists the legal power to compulsorily acquire private property for a public purpose. That was the third unique facility enjoyed by the State as set out in the previous article.

In the case of a landowner making unreasonable demands, the State has the lawful option of compulsorily acquiring the property.

The Land Acquisition Act 1994 (LAA) establishes the right of the State to compulsorily acquire private property for a public purpose. At S.12, the LAA specifies the rules of assessment used to arrive at the sum offered to the owners of private property interests being acquired.

S.12 (4) states –

“…(4) In making an assessment under this section, the Judge is entitled to be furnished with and to consider all returns and assessments of capital value for taxation made or acquiesced in by the claimant and such other returns and assessments as he may require…”

The point in this case being that, having registered a purchase at $5M in February 2010, PLP would have been unable to legally resist a compulsory purchase which adopted that price as its basis. Even if the State, in recognition of the roughly $29M spent by PLP on building the infrastructure for ‘Eden Gardens’, were to add that sum, the final offer would only be about $34M.

Those provisions at S.12 (4) of the LAA are a critical safeguard against persons who might seek to under-declare their properties to evade taxes, then seek to make exorbitant claims if the State seeks to acquire compulsorily. S.12 (4) prevents the State from falling victim to any such games, it is a critical safety-valve to protect our Treasury from those who seek to pay as little as possible when taxes are due, but boldly make huge claims from the Treasury when seeking to sell.

That is why I am calling for this matter to be swiftly investigated and the responsible parties prosecuted to the full extent of the law.

This was in reality a potent dilemma for PLP, in that if they were served with a proper compulsory purchase notice, they would have either had to stick with the $5M figure as a 2010 baseline, or reject that deed and incur the strong penalties at S.84 of the Conveyancing and Law of Property Act.

One of the three deeds executed on Wednesday 3 February 2010 recorded the purchase of ‘Eden Gardens’ for $5M, which is a massive understatement of consideration. The true market value of that undeveloped property at that date would have been of the order of $50M, so the loss of Stamp Duty to the Board of Inland Revenue would have been in excess of $3.0M. The underpayment of Stamp Duty is tantamount to a defect in title of a property. Are we witness to the State making a massive over-payment for marginal lands with defective title?

Did the Cabinet and the HDC receive the proper advice from the Commissioner of State Lands and the Commissioner of Valuations, as well as the other legal advisers? If yes, that advice was plainly not followed, so in that case the question would have to be ‘What caused the Cabinet and the HDC to abandon that sound advice?‘

If the true situation is that the proper advice was not provided, we need to know why. If the advice was not sought, then we need to know why. If the advice was sought, but not provided, those advisers need to be rusticated so that our processes are protected from more of this nonsense.

The State has an overriding duty to comply with the law and be exemplary in its conduct. That is not negotiable, if we are to build a society which is orderly, progressive and just.

Episodes such as the ‘Eden Gardens’ sale and the THA/BOLT deal continue the erosion of Public Trust and the loss of that intangible, almost-forgotten, source of ‘soft power’, the Benefit of the Doubt.

This Prime Minister has made repeated statements that any evidence of wrongdoing will be investigated, so that the offenders can be prosecuted according to law. These three articles have detailed the evidence and breaches of sound public policy, so it is now over to the authorities.

The ‘Eden Gardens’ transaction is a prime example of a large-scale economic crime against the State and the interests of its citizens.

Again, I ask – ‘Who were the beneficiaries?‘

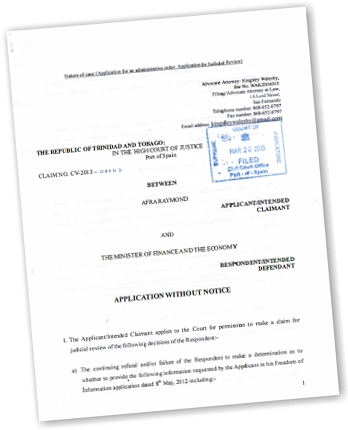

The final point here is that the parties to the PLP purchase and improvement of ‘Eden Gardens’ are now in litigation, with the contractors – SIS Ltd. – suing Point Lisas Park Limited for various monies and demanding an account of the $175M. Case CV 2012 – 5068, so we have interesting times ahead.

This post is about ‘Eden Gardens’, which is on the western side of Calcutta Settlement Road No. 2 in Freeport, just north of Central Park, opposite to Madoo Trace. The property comprises 264 residential lots at an average size of 5,600 square feet, 2 residential/commercial lots, 2 nursery school sites, 2 recreation grounds and 4 playgrounds.

This post is about ‘Eden Gardens’, which is on the western side of Calcutta Settlement Road No. 2 in Freeport, just north of Central Park, opposite to Madoo Trace. The property comprises 264 residential lots at an average size of 5,600 square feet, 2 residential/commercial lots, 2 nursery school sites, 2 recreation grounds and 4 playgrounds.