This is the text of the ‘Emancipation’ column published in the Business Guardian of 30th July 2009 as my attempt to grapple with some of the the unspoken causes and consequences of this huge fiasco.

I am republishing for two reasons…

- Firstly, there have been recent attempts by several people to claim that the Hindu Credit Union part of the Colman Commission is not related to ‘race’…that was surprising since some of those were people who ought to know better – Sir Anthony Colman, the Guardian Editorial-writer and of course, Andre Bagoo. In my opinion a significant part of these two interlinked stories – the CL Financial and HCU collapses – is rooted in our own issues with race. It would be a grave error to dismiss race in trying to understand these crises.

- Secondly, the original column was published before this blog was launched, so this is a way of putting the point to those who missed it on the first subscribers.

I have not had the time to delve into the role of race in the HCU matter, so this is my offering in relation to CL Financial and our own African Emancipation Day celebrations…maybe readers can share with me if they see the relation between this situation and the HCU one…

Emancipation

This week the meaning of Emancipation is considered alongside the CL Financial fiasco. It is a painful, but necessary, task. Those of us concerned to commemorate the Emancipation of African people from slavery must have the courage and clarity to reflect on our past, both the distant and the recent. In reflection we can find direction and perhaps, the beginning of a solution.

How, if at all, is the CL Financial fiasco connected with the story of Emancipation? I deliberately use the word ‘story’ since it is clear that there are many versions of this period in our history. I say ‘our history’ because, whatever the race of today’s readers, the Emancipation journey is of vital concern to the progress of humanity.

There were notable and honourable African leaders who put up strong resistance to the efforts by Europeans to enslave their people. But the sad and inescapable fact is that there were others who thought of the process differently. It is a painful matter to discuss, but the fact is that some African rulers collaborated with the European slave-traders to capture and sell their people. Not all, but enough to make the difference. Without getting into the entire history, which is way beyond the scope of this column, the actions of that group of rulers were enough to ensure the success of the entire monstrous project. The Atlantic slave-trade shaped large elements of today’s world and we have been trying to build a new one ever since. Yes, an immoral and greedy group of rulers put a greater value on their personal enrichment than the well-being of those they were entrusted to lead.

The entire society paid the price for the selfish ambitions of these rulers.

One of the most striking things about the CL Financial fiasco is that Lawrence Duprey is one of us, an indigenous Caribbean man. Yes, a black man, with African blood flowing through his veins and that is something that has not formed part of our public discussion so far. One of the strangest features of these times is how, despite the over-supply of media, critical issues are not discussed. When one considers that the vast majority of the population of the region comes from an African background, it is striking that Lawrence Duprey is the only such tycoon in the region with his level of profile. But wait, I almost forgot that there is another one. Yes, I am speaking about Michael Lee Chin.

Whichever way you slice it, this is extremely telling and as a result Duprey carried a peculiar set of expectations. Because of his unique profile as a black man, the fact is that Lawrence Duprey was the recipient of widespread admiration, envy and wonder. That is our society and that is one of the ways we deal with its ugly realities.

To go further, the leading people in the CL Financial team were also black. Yes, most of the CL Financial team have African blood flowing in their veins. Yes, by now I can hear some readers saying things like – ‘But X or Y doesn’t think that they are Black’ or ‘So what?’ or ‘Exactly what is your point?’. That kind of skepticism is expected when one discusses this kind of issue. In fact it is my view that the underlying attitude is the very problem.

At the same time, let us note that the regulators are themselves black people. Yes, the picture I am painting is that the main players are virtually all black people – the Cabinet, the Central Bank and the CL Financial/CLICO chiefs.

We African people have come from far, both metaphorically and physically. We now find ourselves in a sorry place with this CL Financial fiasco. We have a particular responsibility to do better this time around. There is no escaping that fact.

CLICO was built around the ideal, by its founder Cyril Duprey (Lawrence’s cousin) that ‘Give a man service, give a man value and he will give you more business’. Simple, but strong, those were the foundation stones of CLICO. Truth prevailed and with hard work the company prospered. CLICO developed unprecedented levels of investor confidence, as a black company (indigenous) in which one could have faith. Given our history as African people, that level of investor confidence is no small or incidental thing. It could only have been the result of solid vision and diligent long-term application, to name just two of the qualities of the founder.

CL Financial was established as a holding company and rapid diversification followed, with investments in a number of areas unrelated to conventional insurance business. As a result of its success, CLICO was able to provide most of the cash to pay for the group’s unorthodox expansion.

At that stage, the activities of the group shifted to reflect the new ambitions of its new chiefs, most notably its Executive Chairman, Lawrence Duprey. Those activities ultimately undermined the stability and health of the whole.

The Emancipation story has many lessons, but the central one, from my point of view, is that many of our rulers lost sight of the balance between private wealth/privilege and the public good. Are we doing better now? For us, in this Emancipation week, it is useful to consider the extent to which we have learnt from our past.

The actual behaviour of the CL Financial chiefs and the group’s shareholders in this moment is instructive. At every turn, the public good has been shafted in favour of private wealth. From the payment of dividends while CLICO’s Statutory Fund was in deficit to the payment of dividends to CL Financial shareholders after they wrote for urgent financial assistance from the State. The pledging of assets which had already been pledged and the attempted sale of assets contrary to the original MoU. The shocking statement of CLICO’s new boss that $5.0Bn was missing from its Statutory Fund and the utter silence subsequently as to its whereabouts.

All this shocking behaviour and no sign of any reprimand, charge or censure from our rulers. Instead, we are told that our entire Treasury has been pledged to assist savers and restore shareholder value. Trinidad & Tobago is a land of many firsts, but this is a tragic one.

How did we get to the point of pledging our common wealth to restoring value to a few privileged people who are showing no proper regard for the public good?

Do we have the moral fibre to recognize what has gone wrong in our past and behave differently?

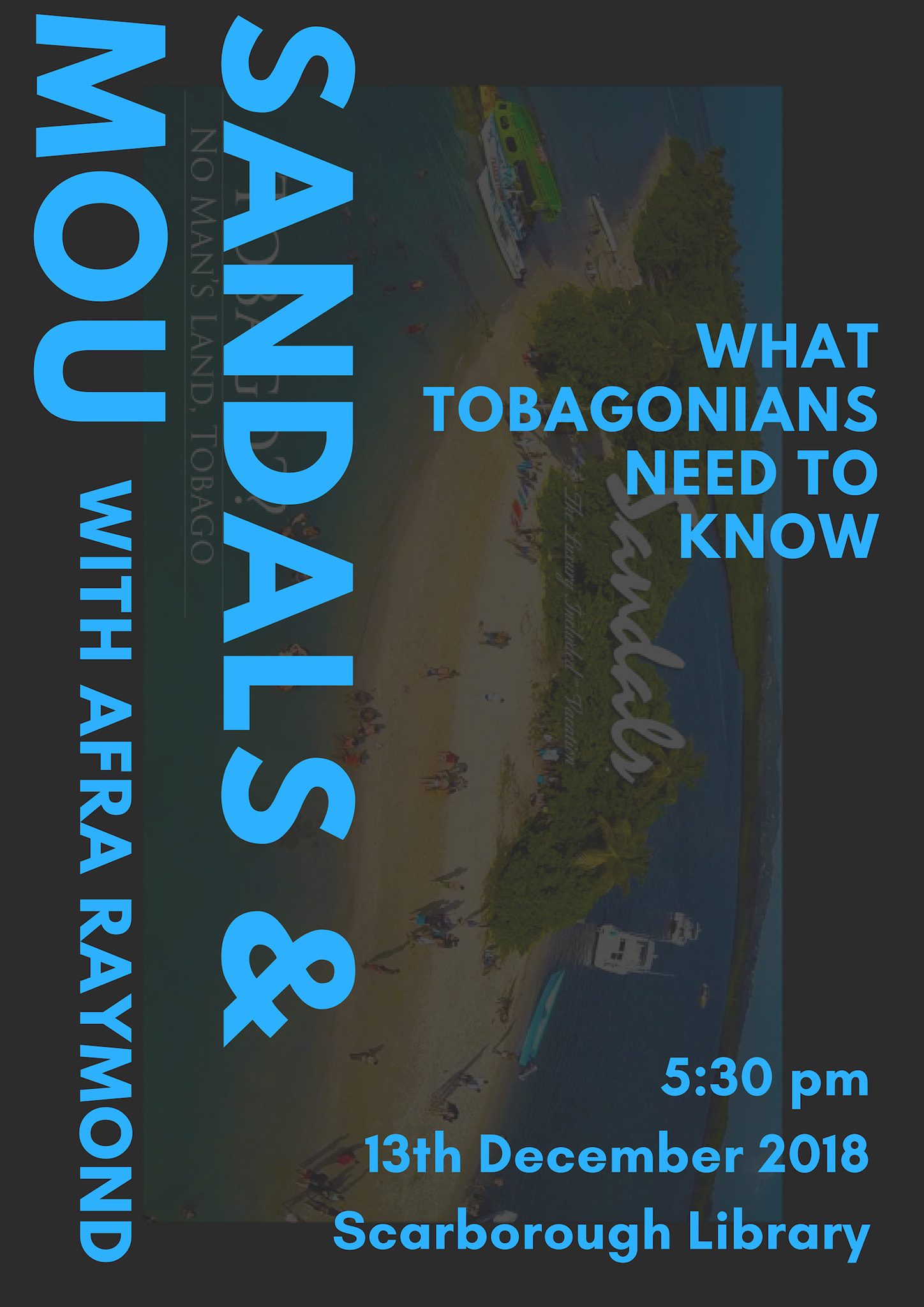

Afra Raymond was the guest speaker of the

Afra Raymond was the guest speaker of the  Afra Raymond was at the Scarborough Public Library in Tobago on 13 December 2018 to speak on his

Afra Raymond was at the Scarborough Public Library in Tobago on 13 December 2018 to speak on his