I wonder if is Bobol?

What dey doing with Taxpayer’s Money at all!?

I wonder if is Bobol?

What dey doing with Taxpayer’s Money at all!?

—Opening stanza of ‘The Treasury Scandal’ by Atilla the Hun (1937)

I took this title from the late 1930’s kaiso by the great Atilla the Hun (Raymond Quevado) on the scandal of some $200,000 missing from T&T’s Treasury. His outrage was rooted in the fact that the story came-out in bits and pieces and of course, none of the ‘Big-Boys’ was ever jailed, or even charged for that theft. That was a massive amount of money in the 1930s – at that time a good Woodbrook house cost about $6,000 – so that could give you an idea. Atilla was lamenting the lack of accountability and transparency in how Public Money was being managed. The ‘Treasury Scandal’ was a true episode from the bad-old-colonial-days of the 1930s, but of course we have progressed a great deal since then, having achieved Independence, Republican status and universal education.

The problem is that despite the obvious movement forward, we are witness to yet another ‘Treasury Scandal’. I am referring to the CL Financial bailout, announced in January 2009 and still ongoing at an anticipated cost of $24Bn – according to paras 21 and 22 of the 3 April 2012 affidavit of then Finance Minister, Winston Dookeran.

It is vital to look back before we go forward. In 2008 and 2009, the Indo-Trinbago Equality Council (ITEC) campaigned strongly on the issue of the Secret Scholarship Scandal’. The suspicion was that there was a secret scholarship fund operated by the State without any transparency and ITEC used its Parliamentary representatives and the Freedom of Information Act to force the Patrick Manning-led PNM administration to publish the details they had been trying to conceal.

The published details included the names of those who benefited from the funds as well as the amounts, dates of payments and details of the courses of study to be pursued. Some of the more controversial issues to emerge from the publication of those scholarship details were –

- From the names given, it seemed that less than 10% of the recipients were citizens of East Indian descent;

- The PNM administration was never able to demonstrate how those scholarships had been advertised, or for that matter, any objective process used to choose from the applicants;

- Unlike other Scholarship arrangements, there was no requirement for these scholarship winners to do any kind of national service;

- A number of people who were reported to have received money, went public to say they had never even applied for, far less received, scholarships. The question arising was ‘Where did that money really go?’;

A total of $46M of Public Money was paid during the 5 year period under examination. The President of ITEC at that time was Devant Maharaj and its leading attorney was Anand Ramlogan, both of whom now serve in the Cabinet.

I fully supported ITEC in that use of the Freedom of Information Act to force publication of important information on the use of Public Money, which is the property of every citizen.

In my view the failure and or refusal to account for the colossal and unprecedented expense of the CL Financial bailout is indicative of a ‘Quiet Coup‘ against our Republic. I am deliberately borrowing Simon Johnson’s potent phrase, used to describe the coup of Financial Capital against the USA published in a fascinating and essential article from The Atlantic. The fact that two successive administrations have remained bound to these arrangements and the low priority given to transparency and accountability in this matter all speak to the potency of the plotters.

“Emerging-market governments and their private-sector allies commonly form a tight-knit—and, most of the time, genteel—oligarchy, running the country rather like a profit-seeking company in which they are the controlling shareholders… As masters of their mini-universe, these people make some investments that clearly benefit the broader economy, but they also start making bigger and riskier bets. They reckon—correctly, in most cases—that their political connections will allow them to push onto the government any substantial problems that arise.”

—Simon Johnson. “The Quiet Coup” in The Atlantic. 2009.

The CL Financial group was able to use its considerable political clout and financial footprint to achieve a binding agreement that our Treasury would be used to pay its debts. Absolutely unprecedented and all negotiated in less than three weeks, we are told. That is the official version of this astonishing story.

Given the likely existence of a ‘Code of Silence’ in this tangled affair, I have been making use of the Freedom of Information Act in my campaign for transparency and accountability in the CL Financial bailout.

If we are ever to start to untangle this web of deceit and betrayal, we must get details of who got their money out, how much, on what terms and when. On 8 May 2012, I applied to the Ministry of Finance via the FoIA – from which the Central Bank is exempt – to request this information –

SIDEBAR: “Cabinet approves Clico plan” courtesy Newsday

- Accounts – The audited accounts for the CLF group or whatever figures the Minister is relying on;

- The briefing given to the Independent Senators in September 2011 before debate of the two supplementary bailout Bills;

- Details of the creditors, especially EFPA holders, to see who got what money;

- Whether the Minister required CLF’s Directors to comply with the Integrity in Public Life Act.

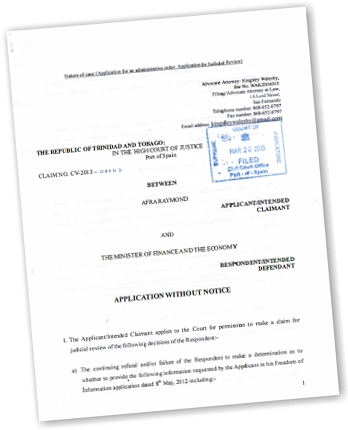

The Ministry replied on 14 August to say that the information requested is likely to be exempt and I am now challenging them in Court.

If it is right and proper to use the FoIA to force publication of the details of a Secret Scholarship Scheme of some $46M over 5 years, why is it acceptable to conceal the details of some $24Bn in Public Money? That is over 521 times more Public Money being spent in secret…yes, $24Bn is over 521 times more money than $46M.

For all we know, some of the people on the Ministry’s list of persons who have been paid could be the same ones protesting via the various Policyholders’ Groups.

To quote Cabinet Minister Devant Maharaj in October 2011, as part of the ongoing campaign on the Secret Scholarship Scandal:

Maharaj said yesterday that he rejected Williams’ claim thatthen prime minister Patrick Manning’s handwritten note on one of the applications for the matter to be handled quietly was ministry protocol, as was claimed by Yuille-Williams. “It seems as if this was the overriding motto for the disbursement of these funds,” Maharaj added. “This was a blatant attempt to hide the facts from the glare of public scrutiny.”

At this time the Ministry of Finance is publicising the end of the CL Financial bailout so that all the Public Money spent on this can be repaid and there are various official reports of how this is to be achieved. At the very same moment, the said Finance Ministry has engaged a high-powered and expensive legal team, headed by Russell Martineau SC, to oppose my attempts to have the basic information published.

That is today’s Treasury Scandal.