Tag: transparency

Media Integrity Too

A timeline of events within the People’s partnership period…

-

4 November 2010

Afra Raymond’s Agreement for Freelance Services with CNMG was discontinued. My agreement with CNMG was as a Commentator with a one-hour current affairs program to be aired alternative Sundays and weekly editorial slots on Friday mornings as part of the ‘First Up’ program.

“Termination of Services”

“Caribbean New Media Group fires journalist Afra Raymond, stops his CL Financial, CLICO fraud coverage”

“Afra Raymond let go from CNMG” -

6 November 2010

Fazeer Mohammed re-assigned at CNMG. Fazeer was the popular co-Host of the leading breakfast TV show ‘First Up’. He subsequently resigns.

Fazeer Mohammed re-assigned at CNMG. Fazeer was the popular co-Host of the leading breakfast TV show ‘First Up’. He subsequently resigns.

“FIRED: On the heels of argument about Kamla, CNMG cuts journalist Fazeer Mohammed.” -

September 2011

Marcia Henville suspended from 102.1FM. Marcia was the outspoken livewire who led a highly-popular drivetime talk-show examining current affairs

Marcia Henville suspended from 102.1FM. Marcia was the outspoken livewire who led a highly-popular drivetime talk-show examining current affairs

“Powerless 102” -

October 2011

TnT Mirror and I95.5FM are reportedly the subjects of an embargo in respect of State advertisement – both these outlets have been identified as being strongly critical of the present Peoples Partnership government. MATT issues a statement condemning “advertising boycott.” Minister of Foreign Affairs and Communications denies the existence of the advertising embargo in January 2012.

“State firms using ads to punish.”

“Press Release: MATT condemns advertising boycott (October 29, 2011)”

“No boycott on media houses: Suruj denies claims of discrimination.” -

8 December 2011

O’Brien Haynes resigns as CEO of Radio Vision Limited (which includes Power 102.1FM)

-

29 December 2011

Ian Alleyne is the subject of Police Search on TV6/CCN/Express offices. Ian is the controversial host of ‘CrimeWatch’, the country’s most popular TV show, a hard-hitting and interactive outlet for the #1 public concern – the relentless rise of violent crime. ‘CrimeWatch’ is deeply critical of certain elements in the Police Service. MATT issued a statement on the “TV6 raid”

Ian Alleyne is the subject of Police Search on TV6/CCN/Express offices. Ian is the controversial host of ‘CrimeWatch’, the country’s most popular TV show, a hard-hitting and interactive outlet for the #1 public concern – the relentless rise of violent crime. ‘CrimeWatch’ is deeply critical of certain elements in the Police Service. MATT issued a statement on the “TV6 raid”

“Police seize Crime Watch video from TV6 premises.”

“Statement on TV6 raid (December 30, 2011)” -

31 December 2011

Afra Raymond’s column on Karen Nunez-Tesheira sent to her by Trinidad and Tobago Guardian’s Ag Editor-in-Chief. My Business Guardian columns had been a critical analysis of a range of issues from ‘Property Matters’ to the ongoing scandal of the ‘CL Financial bailout’. I resigned as a columnist at the Guardian on 4 January 2012

“Media Integrity” -

31 January 2012

David Mohammed suspended indefinitely from 102.1FM. David was the originator of ‘The Black Agenda’ programme, which rose to become T&T’s most popular radio program. ‘The Black Agenda’ programme can be followed on Twitter, on Youtube or on Facebook. The only report I have seen in the print media on David’s virtual dismissal was in the T&T Mirror. Also, there were statements of support from the National Workers’ Union, and the OWTU.

David Mohammed suspended indefinitely from 102.1FM. David was the originator of ‘The Black Agenda’ programme, which rose to become T&T’s most popular radio program. ‘The Black Agenda’ programme can be followed on Twitter, on Youtube or on Facebook. The only report I have seen in the print media on David’s virtual dismissal was in the T&T Mirror. Also, there were statements of support from the National Workers’ Union, and the OWTU.

“Muhammad gets his Power cut.” -

9 February 2012

CCN Directors are requested to present themselves for Police interview, which seems to have arisen out of the same episode with Ian Alleyne and the broadcast of the so-called ‘rape tape’.

Cops want interviews with CCN directors -

9 February 2012

The Newsday office and reporter Andre Bagoo’s home is the subject of Police search. Andre is the lead investigative reporter for the Newsday, with emphasis on politics and corruption in public administration.

The Newsday office and reporter Andre Bagoo’s home is the subject of Police search. Andre is the lead investigative reporter for the Newsday, with emphasis on politics and corruption in public administration.

“Media Association statement on Newsday raid (10 February 2012)” -

14 February 2012

Open Police surveillance of Andre Bagoo’s home is reported.

“Police car outside reporter’s home: lawyer wants answer.”

“Police tactics toward Newsday ‘intimidatory’”

ABUSE OF POWER

This is a sinister pattern, which we need to recognise now.

To seed this discussion, I have three threads…

- The use of Police resources to target journalists is questionable in light of the apparent, unexplained delays in dealing with the CL Financial chiefs, the UDECOTT chiefs and of course, the HCU chiefs. The Police anti-media operations were apparently executed in exemplary fashion with warrants being obtained and searches done using the element of surprise – no reasonable person could find fault with the execution of those operations. The burning question for me, given the apparent delays in prosecuting or even searching the ‘White Collar robbers’ – even during the recent SoE – is ‘What are the priorities of our Police Service? Are our limited Police resources being effectively allocated in the fight against ‘White Collar crime’?

- The second issue is the agenda of the Media practitioners. Despite the strong and clear statements from the Media Association of T&T (MATT) on these issues – the embargo of State advertising for the Mirror and I95.5FM, the Police search of TV6/CCN on the Ian Alleyne issue and the Police search of Newsday and Andre Bagoo – there is still no MATT comment on the Power 102.1FM dismissals and the issue of the Guardian’s Acting Editor-in-Chief sending my column on Karen Nunez-Tesheira to her for comment. We need to be mindful of self-censorship in a world in which most of the media is in private ownership. Which shifts into my next point…

- Lastly, there are the issues emerging from the world we live in now. It is a truly New World, with the commonly-held conviction that ours is a ‘free society’. Our Constitution guarantees freedom of speech, freedom of expression and freedom of association. It also guarantees the rights of property owners and that takes me straight to the vexatious juxtaposition of those rights. You see, if we do live in a society with all those rights, the question arises ‘What is wrong with the owner of a media outlet deciding to let-go/fire/suspend indefinitely/re-assign a particular commentator?’ Even more to the point – “Are we saying that the privately-owned media can pick-and-choose their commentators, but the State-owned outlets have a different set of rules to follow?” Despite the provisions of T&T’s international anti-corruption and media treaty obligations in favour of whistle-blowers, there are still those who want to know what is wrong with the government deciding how to place its advertisements.

I am closing this off now; to let the discussion flow…the battle-lines are clear to me…our sentiments on the free nature of our society come into conflict with the impulse for self-protection once we achieve Public Office. In this rounds, given the boundless nature of the new technology, we are going to see a sharper, more wily, battle to reduce the strength and clarity of our media. I greet it.

As always, the struggle is against the enemy without and the enemy within…

- Please view my iPad oPinion video Podcast on this topic here

VIDEO: Caribbean Economic Forum – The CLICO Debacle

This is the video of the segment from the show Making A Difference with Felipe Noguera called Caribbean Economic Forum. Appearing with guest Afra Raymond was David Walker, another prominent analyst on the CLICO debacle. Video courtesy Making a Difference

- Programme Air Date: January 2012

- Programme Length: 0:20:14

VIDEO: Afra Raymond testimony in the Colman Commission, Day 1

This shows the attempts by various parties to object to my showing the PowerPoint presentation…some of those parties and their attorneys include –

- Central Bank – represented by London-based Bankim Thanki QC

- Lawrence Duprey – represented by London-based Andrew Mitchell QC

- PriceWaterhouseCoopers – represented by Russell Martineau SC, former Attorney General and former President of the Law Association

- Andre Monteil – represented by Martin Daly SC, Sunday Express columnist and former President of the Law Association

It is really instructive to consider the various arguments put forward by these parties in an attempt to limit my testimony and ultimately to deny it the benefit of clear illustration via PowerPoint.

There is going to be a real struggle to show the information on this series of financial and economic crimes. That information needs to be shown in as digestible a form as possible, which was the point of my presentation.

Between the strong opposition of the parties who were at the centre of the crisis and the refusal of the government to fund multi-media facilities, we have a fight on our hands to get at the facts.

VIDEO: 4th Biennial Business Banking and Finance Conference (BBF4)

This is the video of my address to the 4th Biennial Business Banking and Finance Conference (BBF4) held at the Trinidad Hilton from 22 to 24 June, 2011. The session I participated in was devoted to ‘Lessons from the Financial Crisis: The Resolution of Failed Entities.’ [See the acknowledgement letter from the conference convenor here.]Video courtesy UWI

- Programme Air Date: 24 June 2011

- Programme Length: 0:15:21

The Colman Commission – The Importance of Money

The Colman Commission was established about a year ago as a Public Enquiry into the failure of the CL Financial group, some of its subsidiaries, and the Hindu Credit Union. The Commission is also mandated to report on the causes of these costly failures, so that it can make recommendations for possible prosecutions and the regulatory or systemic changes needed to avoid further collapses.

The Colman Commission was established about a year ago as a Public Enquiry into the failure of the CL Financial group, some of its subsidiaries, and the Hindu Credit Union. The Commission is also mandated to report on the causes of these costly failures, so that it can make recommendations for possible prosecutions and the regulatory or systemic changes needed to avoid further collapses.

There has been a lot of fresh information revealed at the Commission and that is good, since the public now has a much better view of the various episodes behind the scenes. The sole Commissioner, Sir Anthony Colman, has now made a statement which outlines his progress in this huge and complex matter. Colman expects to take at least one more year and will be continuing his examination of the HCU matter when the CL Financial stage is completed.

Despite all the evidence about staggering sums of money and the heated public discussion that has sparked, I am perturbed by the way the essential information is being handled.

Since it is a Public Enquiry into a huge financial collapse, the financial information has to be front and centre if we are to get at the facts.

It is common knowledge that the link between performance and pay is essential in obtaining quality results in any competitive situation. That basic fact, with which most people would agree, is now seriously challenged by some of the key events in the global financial meltdown. It is beyond the scope of this article to delve into the new learning emerging from this global crisis, suffice to say that the old learning has literally been ‘tested to destruction’.

An unhealthy relationship between pay and performance would be a problem for any company, but in a financial company the issue is worse. That is because the investors expect those companies to endure and prosper, so that they can collect the expected returns.

The Colman Commission will be unable to fulfill its mandate if it does not uncover the relationship between pay and performance in the failed companies. Colman will also need to consider the motives and behaviour of the investors, who must also form a significant part of the story. Without their participation and investments, the failed companies would have had no money to lose.

There is a strong interest in keeping the real figures and circumstances out of the news and some of the main items are –

- The Accounts

- The true levels of salaries, fees, dividends and bonuses

- The identities and sums of money returned to those who have benefited from the bailout

- The delinquent borrowers who owe the failed companies huge sums of money

- The extent to which the failed companies and their chiefs complied with our tax laws

In ‘The Colman Commission – Cloudy Concessions’, published here on 1 September, 2011, I pointed out the danger of allowing the HCU claimants to testify without stating the amounts invested for the public record. It was my view that those concessions represented the ‘thin edge of the wedge’ in terms of the entire exercise being a Public Enquiry into a series of financial collapses.

In this recent, third session of evidence Hearings, we have had three examples of the ‘widening wedge’ in respect of financial information.

- The first example is the recent imbroglio on the testimony of the CEO of Methanol Holdings (MHTL), in which significant financial information was excluded, apparently by agreement between the various parties and the Commission. This is exactly the kind of danger I had been warning about, since MHTL is a significant, supposedly healthy, part of the failed CL Financial group and there is bound to be considerable public interest in its financial performance. Yet, the Colman Commission agreed to exclude that financial information, so the public is none the wiser as to the overall health of the CLF group, despite paying for a public Enquiry. This issue was highlighted in the Guardian editorial of Tuesday 15 November, 2011, which ended by emphasizing the public’s right to know.

- The second example was the decision on Directors’ monies – as reported in the Business page of this newspaper on 16 November, 2011 “…Commission Colman has ruled that the means of remuneration for CL Financial officials should be disclosed to the Commission but not the actual quantification of them…”. That bizarre concession removed any possibility of reporting on the real state of affairs at these failed companies. If the Commission continued with that arrangement, it would have been impossible for any real understanding of the crisis and its causes to be derived from their work.

- The third, most notable, example was even more noteworthy, being the reversal of that decision and the grounds for that reversal, as reported in the Express of 16 November, 2011

…The board appearance fee was revealed yesterday on the same day that Sir Anthony Colman, the lone commissioner in the Commission of Enquiry, ruled that the remuneration packages of those involved with the conglomerates collapse could be made public….

Colman yesterday reversed a decision he made on Tuesday…

“My attention has been drawn to the fact that in fact some evidence has already been circulated in regard to Mr (Michael) Carballo’s remuneration package and also Mr (Lawrence) Duprey’s remuneration,” Colman said.

“I have come to the conclusion that it would be grossly unfair if there were a general bar on further evidence as to remuneration of participants so I reverse the ruling which I made yesterday and the result would be that the remuneration of participants can be put into evidence,” he said.

“I do not accept that if the remuneration emanated from any of the companies involved there could be any question of confidentiality,” Colman said”

It is remarkable to me that an appeal restricted to the principle of fair-play seemed to have caused this reversal, in a situation where the initial concession was toxic to the fundamental enquiry which is being conducted at public expense, supposedly for our benefit.

This is an Enquiry into a colossal financial collapse, so therefore the money must be front and centre at all times. We must have scrutiny as to its origin, rationale/contract for payment and its disposition for tax purposes.

Sir Anthony Colman needs to be watchful of the wily attorneys, who may seek again to tempt him to agree to conceal some more financial information which might be awkward for their clients. The fact is that all those companies are now being funded by the Treasury and we have a right to know what caused this huge mess.

It is not a concession, we now own the mess, so we must be allowed to see all of its parts. No sacred cows.

Sidebar: Colman’s Challenge

Colman’s statement as to the difficulty of running the Enquiry was most instructive, with a total of 49 lawyers appearing for various parties and a further 5 for the Commission.

Colman has had to maneuvre between 18 parties to the Enquiry, three non-parties and over 800,000 documents.

Which only makes it all the more important that the Colman Commission be given the necessary administrative/legal support and multi-media resources so that it can better serve the purposes for which it was established.

We have the resources in this country to give each SEA student a new laptop, so it should be no challenge to provide those resources to the Colman Commission.

CL Financial bailout – The Truth about the Truth

Continuing from last week’s critique of the revised bailout and its implications, I have further concerns as to the process by which the legislation was passed.

Continuing from last week’s critique of the revised bailout and its implications, I have further concerns as to the process by which the legislation was passed.

I am aware that the Members of Parliament were given a briefing, so that they would be better informed on this complex matter. That briefing was conducted personally by the Minister of Finance and the Governor of the Central Bank, together with their advisers and certain CLICO officials.

The briefing provided background information on these areas –

- The status of the various outstanding audited accounts;

- A ‘profile’ of the monies owed in terms of amounts owed to certain classes of policyholders. I am told that quite a small number of these claimants held a large proportion of the monies being claimed;

- The various lawsuits/judgments against the Central Bank;

- The rationale given for extinguishing the right to sue the Central Bank in this matter was that public rights and stability were being given preference over the exercise of private rights.

I am also told that the Members of Parliament were not given copies of the presentations, which seems to have effectively limited them to gaining certain impressions or the limited notes they would have been able to take during the briefing.

That account of events, given to me by more than one Parliamentarian, seems to suggest that the very rationale of the exercise, said to be the elevation of public rights over private ones, could have been subverted.

The reality is that, despite the extensive debate on the matter, this is the position –

- Accounts – There has still been no proper, clear statement on the status of these CL Financial and CLICO accounts, which is unsatisfactory. An emerging view is that this is a calculated silence, since the companies are insolvent, which would make the Directors liable for the criminal offence of ‘trading while insolvent’. That is a considerable issue, which could only be overcome by the State issuing a guarantee to the group’s creditors, which would have exposed the Treasury to the full extent of the huge claims. The silence is a shabby ‘third way’, which gives a further insight into why the bailout remains untenable to so many of us.

- There is no publicly-available profile of the monies owed in terms of amounts owed to certain classes of policyholders. That is a major omission and one can only wonder why the information is being effectively suppressed. In addition, there were statements that the claims of Credit Unions and Trade Unions will be fully-paid, which seems to be a favourable treatment in comparison to the individual claimants.

- In respect of the lawsuits and judgments, I do not see how the block on lawsuits against the Central Bank can stop claims in foreign Courts.

- The rationale of public rights being preferred over private rights is a solid one in a matter of this type, but upon reflection one is left with a different impression. How can public rights be said to prevail in a situation where the public is denied the essential parts of the picture?

The Parliament benefits from briefings on complex and important matters, but it is unacceptable that those briefings should be somehow shrouded in secrecy. The Minister of Finance and Governor of the Central Bank need to publish their full Parliamentary briefing, without delay, to remove any lingering doubts. Good governance, transparency and accountability demand no less.

Another aspect of the emerging situation is the recent reports that the Board of Inland Revenue is investigating the three top CL Financial executives for alleged non-payment of taxes. The report in the Sunday Express of 13 November stated that the tax filings of Lawrence Duprey, Andre Monteil and Gita Sakal were under official scrutiny, incredibly enough, it was also stated that Duprey’s chauffeur was in receipt of up to $3.9M in a particular year.

I had always wondered at whether people who enjoyed favour at the highest level really paid all their taxes. I have pointed out that in the case of Clico Investment Bank (CIB) there are serious and unanswered questions on that point arising from the affidavits of the Inspector of Financial Institutions in the CIB winding-up action. It seems that fresh and serious doubts are now arising on the tax compliance of some of the top CL Financial officials, so we will see. In view of the relaxed stance taken in relation to Anti-Money Laundering and Tax Evasion in the revised bailout process, we should not be surprised if these BIR cases slip into obscurity.

We need to be alert to the costs and other consequences of this crisis. Huge sums of taxpayers’ money are being spent to rescue companies who do not appear to have complied with our tax laws and there are no accounts being discussed.

Last week Wednesday and Thursday I appeared before the Colman Commission to give my testimony in this matter. On Wednesday afternoon there was a very negative reaction to my attempts to introduce a Power-Point presentation as a way to better illustrate some of the points I have been making. It was a frustrating and comical experience for me to hear supposedly learned men asking ‘What is this?’ and one of them even saying that he had no idea what it was…Here, in Port-of-Spain in 2011, we have learned men saying that they don’t know what a Power Point presentation is for. Of course, I am all for transparency, so their patently transparent ‘blocking tactics’ were most welcome, because they showed the viewers on TV just ‘Who is Who and What is What’. Thank you, colleagues, for doing a better job than I ever could have. The public is not stupid and your behaviour has had a clear impact on those who were viewing. That said, the Commissioner ruled that my evidence would be taken the next morning and so it was.

Last week Wednesday and Thursday I appeared before the Colman Commission to give my testimony in this matter. On Wednesday afternoon there was a very negative reaction to my attempts to introduce a Power-Point presentation as a way to better illustrate some of the points I have been making. It was a frustrating and comical experience for me to hear supposedly learned men asking ‘What is this?’ and one of them even saying that he had no idea what it was…Here, in Port-of-Spain in 2011, we have learned men saying that they don’t know what a Power Point presentation is for. Of course, I am all for transparency, so their patently transparent ‘blocking tactics’ were most welcome, because they showed the viewers on TV just ‘Who is Who and What is What’. Thank you, colleagues, for doing a better job than I ever could have. The public is not stupid and your behaviour has had a clear impact on those who were viewing. That said, the Commissioner ruled that my evidence would be taken the next morning and so it was.

For those who are interested and want to know what all the fuss was about, stay tuned to www.afraraymond.com for a full article on this situation, including the so-called ‘offensive’ slides.

With respect to the method of presenting the evidence in the Colman Commission, I have some serious concerns as to the effect of relying only on written or oral testimony. The volume and complexity of the material and the fact that a wide audience, beyond the attorneys, is watching this Public Enquiry, means that there needs to be an upgrade in the way in which the information is presented. I have written to the Commission on this already and was shocked to learn that a request for further funding for multi-media was apparently rejected at the highest level.

There have been two Power Point presentations to the Colman Commission – my own and Ms. Maria Daniel of Ernst & Young, who was just before me – and in both cases the witnesses had to rent their own equipment.

The purpose of this Public Enquiry is to bring some light and justice to this very shadowy and crooked episode. I am here asking the Prime Minister, Minister of Finance and the Attorney General to take proper leadership on this issue. The people need to see the evidence if they are to understand.

I can well remember the Prime Minister’s campaigning words, echoing in my mind “Serve the People! Serve the People! Serve the People!”.

Finally, I am writing to the Integrity Commission this week to request, again, that they obtain declarations from the Directors of CL Financial, as required under the Integrity in Public Life Act.

If you are not outraged, you haven’t been paying attention…

CL Financial bailout – The Final Solution?

The new bailout formula was approved, as two new Acts, by our Parliament on 14 September –

The first one prevents any lawsuits against the Central Bank by claimants, while the second gives the Minister of Finance the right to borrow up to $10.7Bn and places the Republic Bank Ltd. (RBL) shares formerly held by CLICO into a new investment vehicle, NEL 2.

These seem to represent what I am calling the Final Solution, in that the clamour and protest which had marked the last year seems to have been fading away. There have been queries from the various ‘Policyholders’ groups’, but those have been limited.

Whatever one thinks of the actual bailout, which I maintain is a perversion of our Treasury, there are valuable lessons to be learned from all this. The main lesson for me is the Power of the Few. In that although only about 16,000 investors were affected, they were able to mount a successful campaign to improve their position. We need to note that lobbying and campaigning can be effective in gaining benefits for limited groups. To all the weak-hearts who say nothing ever changes, please take note.

We also saw the position set out by the PM in her important speech on 1 October 2010 being reversed, in that the claimants’ rights to sue the Central Bank have been extinguished. There are rumblings about a challenge to the constitutionality of that restriction, but we will have to wait on that one to play out. The fact that the right to challenge the Central Bank’s actions in respect of the bailout has been removed opens fresh dangers in terms of the payout process.

We have all had bad experiences of what usually happens when serious unrestricted power is held by someone who does not have to answer for their actions. My concern is that there does not seem to be any avenue for oversight of or appeal/redress against the Central Bank, in the event that claimants feel they are receiving unfair treatment. That concern will have to be addressed at some stage.

Even as an account of the payout, we have deficient reporting with no true profile of the wealth being returned having been presented for public consideration. The Central Bank and Ministry of Finance is in possession of this critical information as to the amounts of money to be returned to claimants, but that is being suppressed, for whatever reason. This episode has been a real stain on our stated ambitions towards accountability, transparency and the ever-distant ‘Good Governance’.

A related point is that the PM gave a clear commitment to revealing who benefited from the first wave of bailout funds, said at the time to be of the order of $7.3Bn. The PM’s speech is at pages 19 to 34 of Hansard – at pg 24 –

…The previous administration injected $5 billion into Clico and they spent $2.3 billion to bail out the other distressed entities such as CIB in particular, so coming to a total of $7.3 billion has gone into that hole and yet today the Government and, therefore, the taxpayers of this country have been called upon to come up with another $16 billion to $19 billion. So what happened to that $7.3 billion? Where did it go? Who are the people that were paid? How was it utilized? What happened to that $7.3 billion?…

The concern here is that we are not at all sure that this new arrangement will in fact yield the required information as to who are the real beneficiaries of this bailout. In view of the fact that the entire deal is a burden on our Treasury, this opaque arrangement is unacceptable.

After all –

Expenditure of Public money – Accountability – Transparency = CORRUPTION

Quite apart from those concerns, the fact is that provisions should have been made for Anti-Money Laundering and Tax Evasion screening. The Treasury must not be used for Money-Laundering and the proper safeguards need to be put in place to prevent this.

The lack of accounts for the CL Financial group, after 31 months under State management, is also unacceptable. The essential terms of the bailout are being sidelined, since the original agreement was for the State injections of cash to be repaid via asset sales. Both 2009 agreements – the January MoU and the June CL Financial Shareholders’ Agreement – also spoke to the preparation of accounts and provision of information.

The perturbing aspect is that there continues to be a uniform silence as to the preparation of these overdue accounts, so the taxpayer must wonder just how, or if ever, these vast sums of bailout money are to be recovered. This is the burning question which is at the root of my outrage.

The new arrangement is also silent as to the position with respect to other creditors of the CL Financial group, so there is no certainty as to how those claims would be treated. On 31 October, Trinidad and Tobago Newday reported on ‘CLICO Bahamas seeks $365M from CL Financial’. There are substantial regional and local claims outstanding, so the entire cost appears is an unknown quantity at this time, given the lack of accounts.

As I pointed out previously, the Directors and Officers of the CL Financial group and its subsidiaries ought to be subject to the provisions of the Integrity in Public Life Act, by reason of its being a State-controlled company. The Integrity Commission needs to demand the required declarations from those persons, if we are to secure the required level of transparency.

The continuing failure of the Central Bank to make rulings as to the extent to which CL Financial’s Directors and Officers at the time of the collapse are ‘fit and proper persons’ is the final piece of the sorry picture.

The State’s period controlling the CL Financial group, ends on 11 June 2012 – a mere 7 months away – at which time the group will return to its owners. Given the fact that the Central Bank has not made an adverse ‘Fit & Proper’ finding against Lawrence Duprey, in the absence of accounts and with a significant part of the RBL shares divested in this fashion, what will be the out-come? Is the stage now set for Lawrence Duprey to return?

I spent last Wednesday afternoon in New York’s Zucotti Park, with so many points to share on that experience. For now, I leave this striking slogan of the Occupy Wall Street movement –

If you are not outraged, you haven’t been paying attention…

Property Matters – Only a matter of time

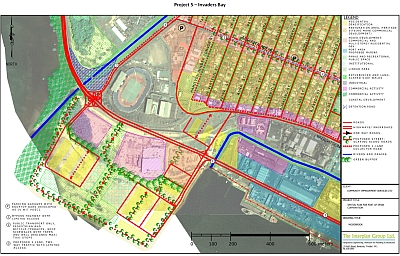

The way the Ministry of Planning & the Economy (MPE) is persisting in their course of action on the Invader’s Bay development is perturbing in terms of the long term consequences of short-term decision-making.

The way the Ministry of Planning & the Economy (MPE) is persisting in their course of action on the Invader’s Bay development is perturbing in terms of the long term consequences of short-term decision-making.

At Section 2.0 of the Request for Proposals (RFP) for Invader’s Bay we read

…For Trinidad and Tobago this is a “major waterfront transformation” along the line of other signature waterfront developments such as Darling Habour (sic) in Sydney, Baltimore Inner Habour (sic), the Habour-front (sic) in Toronto, London Docklands and Teleport City in Tokyo. Although the genesis of the projects may vary, the result has generally been bold and dramatic. With the change in the manner in which ports operate and cargo is transported, waterfront property is now more valuable for its residential, retail and recreational function than simply for port activity with heavy industry, docks and fenced off warehouses, as is the case currently in Port of Spain…

We are being asked to consider the Invader’s Bay initiative ‘along the line’ of other leading international examples, which in itself is a good place to proceed from. The reality is that those developments cited by the MPE all took decades to conceive and what is more, the authors of the RFP know that. Yet we are also being asked to believe that a workable concept/s could be devised for Invader’s Bay in an RFP which is silent on the current strategic plans for the capital and only gives proposers 6 weeks to prepare.

Of course the lack of consultation will severely limit the participation of many important developers, not to mention the public.

The point is that in all those cities cited by the RFP, there is a serious commitment to consultation, which means that those large-scale transformations took considerable time to conceptualise.

In the city of New York, for example, there has been a long-standing commitment to community-based development. Check this 6 October webcast from The New School – the introduction is instructive –

For decades, deliberations over land use in New York City have included developers, community boards, elected officials, the Department of City Planning and other city agencies. Do the people who live and work in city neighborhoods have a sufficient voice? Do residents improve the process, or impede progress? Who is best positioned to determine a neighborhood’s needs, and what are the best structures for public participation? New York has long been a leader in community-based development but as the city recovers from the Great Recession, what does the future hold?

And that is just one reference, readers can ‘Google’ to find the many other supportive examples. In the very RFP, as well as in the recent budget, there is a clear commitment to consultation in national development. Except in this case.

But there is more.

As I wrote in the opening of ‘Reflections on Republic Day’, on the Raymond & Pierre website on 27 September 2007 –

The best example I can think of for the kind of broad commitment to consultation is, of course, the site of the World Trade Centre in Lower Manhattan: Ground Zero. This is a very interesting example since the site is privately owned and the City of New York is controlled by the Democrats while the Republicans control the national government of the USA. Against this background of different players we have the fact that the destruction of the WTC was a most severe blow to US prestige and power. The entire defense apparatus was rendered useless by that attack. Arguably, there could be no site in the world with a more urgent claim to large-scale redevelopment.

Yet, the fact is that a sort of compact has been arrived at between the parties to the effect that no redevelopment will take place unless and until everyone has had their say. For example, there was a recently concluded international competition for the design of the 911 Memorial. There were over 5,000 entries from more than 60 countries and a winner was just selected.

As expected, the consultations have been controversial and emotional but the fact is that an environment existed in which such an understanding could work. Whatever one’s view of the American imperium, there is a potency to the existence of that huge crater at the heart of their main city while the necessary conversations go on. Time for us to think again.

At that time I was protesting the haste and waste of the then PNM regime, a consequence of their pattern of proceeding with huge developments without any consultation.

At Section 3.1 of the RFP –

TENURE ARRANGEMENT

The proposed Developer will be chosen via this RFP process and shall then enter into a Memorandum of Understanding (MOU) with the Government of Trinidad and Tobago (Ministry of Planning and the Economy) for an agreed lease rate. It is expected that this activity would be finalized within one (1) month of the submission of the said RFP.

Which means that we can expect the choice of the proposed Developer will be made and the lease agreements completed in one month from the closing date. Yes, Friday 4 November.

Sad to say, there is even more. The RFP also specifies –

“…If financing has to be sourced from an external source, the Developer MUST submit a letter of guarantee from the financier as well as a profile of the financier. Failure to comply with this requirement will result in disqualification…”

When we raised the point that this is an impossible condition for new bidders to satisfy, given the sheer scale of the proposed development, both Ministers – Tewarie and Cadiz – attempted to indicate that this mandatory condition was flexible. Unbelievable, but true.

As leaders, whether in government or non-governmental organisations, we have an obligation to learn from the past. This is an effort to document the events in this episode, so that there will be a record, when the Invader’s Bay matter comes to be critically examined in the future.

The clear inconsistency of the position taken in the budget on urban planning was highlighted in last week’s column. With respect to this project, we noted the attempt to cast this development in the same light as other examples which all involved long-term consultation, the silence on the existing plans, the impossibly-short timetable to elicit fresh proposals, the even-shorter timetable for selection and agreement of lease terms, the wobbling on the financial requirements and incredibly, that the scoring criteria were to be finalized after the proposals were submitted.

It is literally impossible to determine which of these is worse than the others and it is beyond the imagination of any fiction writer I know to take a plot this far. But this is what is happening in our country today.

In my mind, all of these, taken together, show that the publication of the RFP is a form of sham dialogue and openness. If this is the genuine attempt by the MPE, to properly seek the public interest, then I am giving them an ‘F’ for effort.

What we are seeing here is a recipe for disaster, we already have all the ingredients of corruption, so what is next?

It really does make me wonder who runs this country and when, if ever, can we achieve consistent and equitable government. Who is the real power?

Property Matters – The Needs Assessment

The Ministry of Planning & the Economy (MPE) announced last week that 10 proposals had been received in response to its RFP for Invader’s Bay.

Given that MPE has not carried out a Needs Assessment for this prime property, for whatever reason, I will continue to outline the relevant elements for the Invader’s Bay property. This is not intended to be complete, just a list of what I consider to be the critical items a proper Needs Assessment would include –

Given that MPE has not carried out a Needs Assessment for this prime property, for whatever reason, I will continue to outline the relevant elements for the Invader’s Bay property. This is not intended to be complete, just a list of what I consider to be the critical items a proper Needs Assessment would include –

- Investment – This is a parcel of land estimated to be worth at least $1.0Bn, so any attempt to describe this process as ‘not being an investment’ would be completely wrong. In the literal sense, it might not involve any expenditure of State money, but, in every other sense, the disposal of this $1.0Bn asset would constitute a major State investment in Invader’s Bay.

- The National Interest – At this moment the imperative is to diversify our economy so as to find sustainable replacements for our declining energy revenues, so this is an apt point. Following on last week’s column, it seems reckless that such an attractive State-owned property would be developed without consideration of the strategic issue. Even on the conventional basis of announcements of construction jobs and permanent jobs etc., it is difficult on purely financial grounds to justify most types of development on that site, especially given the generally depressed market. The decisive factor, given the level of interest such a unique offering is likely to attract, would be to have as an identified ‘Need’ that only projects which were net earners of foreign exchange would be considered. Such a condition would eliminate any offices, apartments, foreign franchise restaurants or shopping malls and set the stage for a different development discussion. A necessary discussion at this point in our country. Please note that the RFP does state that the project should generate foreign exchange, but that is only expressed as an ‘expectation’, which is far too flexible, given the influence of the traditional property developers. If the intention is genuinely to break with the past and set off in a new direction, the conditions need to be strong enough to break the grip of the past.

- Balanced Development and Lagging areas – The RFP speaks to these concerns as follows – “…The Government recognizes the value of long term planning as well as problems created when long term planning is ignored. In order to ensure balanced development and restore lagging areas, care must be taken in the development of new areas…” Those are real concerns, but they seem at odds with the intention of the RFP, since the execution of that plan gives us yet another major development in our capital. We should consider if this is an area we want to develop at this time – bearing in mind that scarce private-sector resources may be required in other part of the country – for instance, the San Fernando Waterfront and other areas – so that development can be balanced instead of continuing the last administration’s emphasis on POS. The sidebar contains a comparison of three large-scale ‘urban development’ districts which formed part of the budget.

There is always the question of who controls the terms of these public debates. The intention from this side is to have that flawed RFP withdrawn. To proceed as things stand is to continue on a path which lacks the necessary transparency and public participation. The quantities of money involved and the absence of those critical elements means that we would be proceeding with all the ingredients for corruption.

This RFP amounts to an invitation to tender, so the bogus idea that this is just a discussion or consideration of proposals must be discredited. It is nothing of the sort. This RFP is a tender process to put these valuable public lands into private hands, which is quite different from a consultation. We have to stop any attempt to mix-up the two processes.

The State and its agencies have an over-riding obligation to be exemplary in their conduct.

SIDEBAR – A budget comparison

The 2012 budget sets out three urban development projects, at pages 31 and 32 –

- Invader’s Bay – “…significant interest has been expressed in the transformation of the waterfront along Invader’s Bay. This development has great potential for promoting commercial activities in the services sector and will benefit the country significantly. Such projects are meant to be private sector initiatives utilizing green building technologies and will assist in making Trinidad and Tobago an attractive destination for new investments…”

- Sustainable City Project – East Port of Spain – “…This initiative, is part of a wider “Emerging and Sustainable Cities Initiative” supported by the Inter-American Development Bank of which Port of Spain has been chosen as one of the five pilot cities from170 eligible cities in the hemisphere…This project is being developed in partnership with the East Port of Spain Council of Community Organizations, the Caribbean Network for Urban and Land Management at UWI, the East Port of Spain Development Company, and other key stakeholders. This exercise has also engaged the Making Life Important Initiative of the Ministry of National Security…”

- Chaguaramas – “…the Chaguaramus Development Authority is spearheading development in the North-Western region and a master plan detailing land use proposals for that region will soon be subject to public discussion…”

Of course those three proposals are favouring Trinidad’s north-west peninsula, which returns to the theme of balanced development, but a further description of their relative merits is beyond the scope of this article. I am inviting readers to consider the varying approaches to an important long-term large-scale issue such as urban development.

In the cases of east POS and Chaguaramas, the commitment to widespread consultation is manifest, yet there is no such commitment evident in the case of Invader’s Bay, which seems to me to be ‘the jewel in the crown’. The three current strategic plans for POS, all paid for by Public Money, are being ignored by the very Ministry responsible for Planning.

Good Public Administration requires actions which foster the confidence and trust of the public, that is indisputable. Those policies and actions must be transparent, reasonable and, above all, consistent, if the public is to place real trust in the hands of the administration.

For all those reasons, it is unwise for any administration to operate in an inconsistent fashion.

In the case of Invader’s Bay, with the stakes so very high, it would be reckless to continue in this manner.