Next Monday, 8 September 2014, is carded for the Finance Minister to deliver his 2015 Budget Statement to the country and of course speculation is great as to whether this will be an ‘election budget‘ or if a more restrained approach might be taken.

In preparing to write this column, I took a look at our budgets since 2005 and it was really striking that many of the key issues identified a full decade ago are still at the fore of the more recent budgets. Some of those issues were the imperative to reduce our dependence on the energy sector; the constant push to upgrade our infrastructure; the demand for more resources dedicated to national security and of course, the repeated statements about this or that program to reduce white-collar crime.

These expenditure and revenue figures were drawn from the Budget Statements, so no account has been taken of either actual outcomes or supplemental appropriations – this is the process used by the Government to obtain authorisation from the Parliament to exceed the approved spending limits in the national budget.

Clearly, we are seeing a trend as to the constant increases in expenditure, with only one decline, in 2010. Given that background, it also appears that surpluses are rare, occurring only twice, in 2006 and 2009.

The reality that we are on the verge of a national election which is sure to be strongly-contested, leaves me in little doubt that the 2015 budget is also likely to be a deficit budget, with the State spending more than it earns.

The recent scandals at LifeSport, Eden Gardens, THA/BOLT, CAL, CL Financial and of course, the Beetham Water Recycling Project, all show the extent to which the Treasury is being targeted by well-connected parties.

There is a constant stream of allegations of ‘Grand Corruption’, which is little surprise in our society in which an unsupported allegation is so often used to discredit an opponent. There is no comfort to be had in that observation, since the other reality is that thorough investigations and prosecutions are only done against ones political enemies, inside or outside the ruling party. That is the sobering reality in our Republic, in which we should all enjoy equal rights and be held to common standards. Different strokes for different folks, just like back in the ‘bad-old-days‘.

It seems to me that the defining question, in terms of whether the various financial crimes are taken seriously, is whether the accused persons are ‘members in good standing‘, so to speak.

The extent to which our Treasury is protected from being plundered by criminal elements is a serious question which should concern every citizen, given that the Public Money in the Treasury belongs to us as citizens and taxpayers. The frequency with which these financial crimes are overlooked is nothing less than scandalous, as any of the Auditor General’s Reports in the previous decade would attest. Permanent Secretaries approving payments in breach of financial regulations; payments made with no documents (leases, contracts or agreements) on file; failure or refusal to produce documents as required by law upon the Auditor General’s request and so many other types of lawbreaking. The same types of conduct is also rife in State Enterprises, which is why so many of the larger ones are unable to produce accounts as required by the very Ministry of Finance which sets those rules and continues to fund them.

The wicked part is that these Public Officials are virtually never charged with breaking the law or made to face any other serious consequences for their misbehaviour in Public Office. We need a new beginning in terms of how we handle the reality of our country’s wealth and its intentionally-degraded laws for controlling how our Public Money is used. A big part of that would be a political dispensation in which full investigations and prosecutions were the norm, especially when key members of the ruling party are the target of allegations.

Our budgeting process now shows all the signs that our system of Public Financial Management is ineffective in dealing with the seasoned criminals who are hard at work helping themselves to our money, whatever the political party in power. At that level, at least, there is little evidence of discrimination.

The growing complexity of the budget is of no comfort. For example, the 2014 documents totalled some 2,997 pages, yet the Billion-Dollar-Plus Beetham Water Recycling Project (BWRP) was omitted. Despite questions as to what did he know and when did he know it, the Minister of Finance continues to ignore the fundamental requirement to provide for this huge project within our national accounts. There has been no attempt to give the public the necessary explanation as to how the BWRP is to be paid for, since the underlying commercial arrangements which are driving this project remain obscured. The BWRP also shows a strong theme as to the privatisation of our nation’s water supplies, which is a growing area of concern globally. Not the first one, it is true, since we had DESALCOTT before, but this second, huge project implies a trend, in my mind.

The inescapable question is ‘To what extent can we rely on our national accounts, if huge projects like BWRP are omitted?‘

All of which brings us to the continuing and unexplained delay in passing the Public Procurement & Disposal of Public Property Bill. That new law would play an important part in greatly reducing the scope for waste and theft of Public Money. The JCC and its Kindred Associations in the Private Sector Civil Society group continue to call for this law to be passed without any further delay.

Of course all of this is driven by the political parties’ imperative to raise money from various financiers to fund election campaigns, so Political Party Financing laws are essential to control those influences. The Parliament recently unanimously approved a Private Members’ Motion laid by Independent Senator, Helen Drayton, to appoint a Joint Select Committee (JSC) to start the long-overdue process of agreeing just what are the new laws we need to deal with this influence, described by President Carmona, in his inaugural address as a ‘veritable juggernaut‘. The JCC continues to call for the JSC to be appointed so that this critical work can be started to control Political Party Financing.

Having observed the two-week spectacle of prolonged debate in the Parliament on the recently-approved Constitutional Amendment Bill, one can only wonder as to the priorities which are being displayed.

Hence my title – ‘For a Few Dollars More‘.

The recent statements of both the Minister of Finance, Larry Howai, and the Governor of the Central Bank, Jwala Rambarran, could give the public an impression that this financial disaster has now been mostly resolved and we are on some kind of smooth track to a complete solution.

The recent statements of both the Minister of Finance, Larry Howai, and the Governor of the Central Bank, Jwala Rambarran, could give the public an impression that this financial disaster has now been mostly resolved and we are on some kind of smooth track to a complete solution. Today is the 30th of January 2014: five years since the State bailout of CL Financial was announced to a shocked nation and region. It is necessary to mark this moment in time with solid facts and stern meditation.

Today is the 30th of January 2014: five years since the State bailout of CL Financial was announced to a shocked nation and region. It is necessary to mark this moment in time with solid facts and stern meditation.

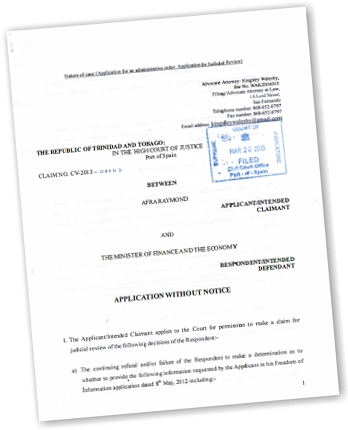

I am responding to the points made by Central Bank Governor, Jwala Rambarran, in his

I am responding to the points made by Central Bank Governor, Jwala Rambarran, in his  Afra Raymond chats on the show ’Forward Thinkers‘ with David Walker on 104.7FM, dealing with the CL Financial bailout and my lawsuit against the Minister of Finance to get at the detailed information as to how the $24B in Public Money was spent. 24 October 2013. Audio courtesy More 104.7 FM

Afra Raymond chats on the show ’Forward Thinkers‘ with David Walker on 104.7FM, dealing with the CL Financial bailout and my lawsuit against the Minister of Finance to get at the detailed information as to how the $24B in Public Money was spent. 24 October 2013. Audio courtesy More 104.7 FM