SIDEBAR: How much Public Money has been spent on this CL Financial bailout?

These are the official statements as to the actual cost of the bailout since 2012. It really resembles the ‘carefully cultivated confusion‘ which I deplored recently in relation to the Invader’s Bay fiasco.

- 3 April 2012 – Affidavit of then Finance Minister, Winston Dookeran, which specifies the Public Money committed to this colossal bailout as –

Para 21 (a) $5.0Bn already provided to CLICO; (b) $7.0Bn paid to holders of the EFPA and Para 22 $12.0Bn estimated as further funding to be advanced.Dookeran is saying in April 2012 that $12 Billion had been paid and an estimated $12 Billion remained to be paid, which is a total of $24Bn in public money to be spent to satisfy the creditors of the CLF group.

- 1 October 2012 – Senator Larry Howai, delivering his first Budget Statement, stated the cost of the CL Financial bailout at page six –

“…The cost to the national community has been substantial—an amount of $19.7 billion or 13.0 per cent of our current GDP; yet this expenditure was necessary and decisive for containing an economic and financial crisis…”

Howai is telling the Senate in October 2012, a mere six months after Dookeran’s Affidavit, that $19.7 Billion has been spent. If we follow this official account, which fixed the total spent in April 2012 at $12 Billion, an additional $7.7 Billion of Public Money was spent in six months. I continue to contest whether this bailout was at all necessary, but it was certainly an incredible rate of expenditure, that cannot be contested. - 4 May 2013 – In this newspaper, under the headline ‘$25b and counting – Cost to taxpayers of CLICO bailout and enquiry‘ –

“…However, Government’s intervention into the CLICO fiasco has cost taxpayers more than $25 billion…” - 17 May 2013 – UNCTT’s website contains a formal Press Release from the office of the then Attorney General, Anand Ramlogan SC –

“…It should be noted that efforts to stabilize and resuscitate CLICO have thus far cost taxpayers over $25 billion dollars…” - 2 April 2014 – At the Senate sitting , Minister Howai stated at page 35 of Hansard –

“…Mr. President, as you would perhaps be aware, the cost to the country of the CL Financial bailout—the actual cash that has been put out—is approximately $20.8 billion. This was done in an effort to preserve the stability of the economy of Trinidad and Tobago…” - 7 August 2015 – I was therefore astonished to hear the Minister of Finance, Larry Howai, stating on CNMG TV, that the cost of this bailout is ‘not quite $20 Billion‘.

The first item, Dookeran’s April 2012 affidavit, is the one for which Howai is now being required by the Court to produce the details.

Some of my views on this, from last week –

“…Well, this is the usual practice, in which the public right to know is subordinated to private, undisclosed interests…it seems to me at these moments that the job of the State’s attorneys is to shroud the entire indecent affair in ‘something resembling an important principle’, but ultimately the effort is intended to wear me down and let the issue fade from collective memory…I am continuing to fight this very hard…what we have here is the ultimate collapse of our Republic by Public Officials who are sworn to uphold the Public Interest without fear or favour, but end up exposed as serving the toxic interests of the financial robber barons…I am reminded of Simon Johnson’s ‘The Quiet Coup‘ published in The Atlantic of May 2009…in T&T, we too, had a quiet coup…”

As the Season of Reflection and the impending election flow together, there is a bitter brew now being offered in relation to the CL Financial bailout.

Disdain is an attitude which denotes someone or something as being unworthy of proper consideration. I think that in relation to our collective interests in the CL Financial matter, we are now being subjected to Larry Howai’s ‘studied disdain’ in relation to our collective interests in the CL Financial matter.

On Tuesday 10 August 2015, the State announced its decision to appeal the recent High Court ruling that the details of the CL Financial bailout must be published. That appeal was also filed that day and the State applied to have the stay of execution extended to the end of the appeal process – the latter issue will be heard on 19 October 2015.

The Minister of Finance & the Economy is the main public official with responsibility to account for how Public Money is spent. The Public Money being used to bailout the CL Financial creditors is our money. The Minister of Finance therefore has a fundamental duty to publicly account for how our money has been spent.

Our collective interests in this matter, of exactly how $25 Billion of our dollars were spent, far outweigh the undisclosed interests on whose behalf the Minister is now appealing.

This appeal is against every one of the orders made in the High Court judgment of 22 July 2015 and therefore represents an utter abdication of the fundamental duties of the Minister of Finance and the Economy.

Our collective interests could benefit from the unintended juxtaposition of national elections, the apparent halt of USD sales by the country’s leading bank and the hostility of the Minister of Finance to the truth. These are rare moments in which we might gain insight and regain fundamental rights, but we have to be aware of what is at stake.

The Ministry’s Press Release deserves stern scrutiny, so these are my points. Continue reading “CL Financial Bailout – Studied Disdain”

Afra Raymond is interviewed on the ‘Cruise Control‘ show on Isaac 98.1 FM by Tessa Sampson about the recent judgement in favour of Mr Raymond ordering the publication of the accounts and other material in the CL Financial bailout. 10 August 2015. Audio courtesy Isaac 98.1 FM

Afra Raymond is interviewed on the ‘Cruise Control‘ show on Isaac 98.1 FM by Tessa Sampson about the recent judgement in favour of Mr Raymond ordering the publication of the accounts and other material in the CL Financial bailout. 10 August 2015. Audio courtesy Isaac 98.1 FM

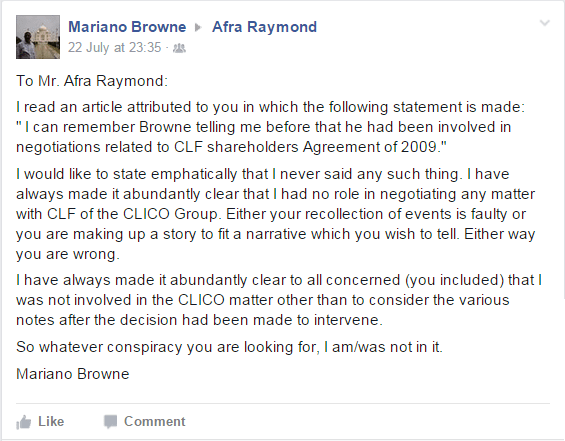

I am pleased that Mariano Browne has replied on the record, so this column will deal with those valuable points. For starters, it is even clearer than before that former Minister of Finance, Karen Nunez-Tesheira, has serious questions to answer in relation to her central role in this bailout. Given that financial training and experience formed a weak part of her profile, one can only wonder at what prompted Manning to appoint Nunez-Tesheira to that position. We will see. In addition, the terms which were negotiated between the State and CLF are essential to understand today’s dilemma with respect to Duprey’s ambitions. A related issue which needs clarity is the role of the powerful, unelected ‘bigger heads’ who are seemingly in control of our country.

I am pleased that Mariano Browne has replied on the record, so this column will deal with those valuable points. For starters, it is even clearer than before that former Minister of Finance, Karen Nunez-Tesheira, has serious questions to answer in relation to her central role in this bailout. Given that financial training and experience formed a weak part of her profile, one can only wonder at what prompted Manning to appoint Nunez-Tesheira to that position. We will see. In addition, the terms which were negotiated between the State and CLF are essential to understand today’s dilemma with respect to Duprey’s ambitions. A related issue which needs clarity is the role of the powerful, unelected ‘bigger heads’ who are seemingly in control of our country.

Afra Raymond and Peter Permell are interviewed on the ‘Election Hardtalk‘ show on Power 102FMFM by Tony Fraser about the continuing impact of the CL Financial bailout on the economy and the request to get back the company by Lawrence Duprey. 16 July 2015. Audio courtesy Power 102FM

Afra Raymond and Peter Permell are interviewed on the ‘Election Hardtalk‘ show on Power 102FMFM by Tony Fraser about the continuing impact of the CL Financial bailout on the economy and the request to get back the company by Lawrence Duprey. 16 July 2015. Audio courtesy Power 102FM

It has been reported that FCB is owed over $400M borrowed for the construction of this elegant hotel on the outskirts of the Queen’s Park Savannah. That hotel is now up for sale via the receivers, Deloitte, at an asking price in the region of $120M.

It has been reported that FCB is owed over $400M borrowed for the construction of this elegant hotel on the outskirts of the Queen’s Park Savannah. That hotel is now up for sale via the receivers, Deloitte, at an asking price in the region of $120M.