14th February 2011

Afra Raymond’s second submission to the Commission of Enquiry into the failure of CL Financial Limited, Colonial Life Insurance Company (Trinidad) Limited, Clico Investment Bank Limited, Caribbean Money Market Brokers Limited, and The Hindu Credit Union Credit Union Co-operative Society Limited

My name is Afra Martin Raymond and I am a Chartered Surveyor, being a Fellow of the Royal Institution of Chartered Surveyors. I am Managing Director of Raymond & Pierre Limited – Chartered Valuation Surveyors, Real Estate Agents and Property Consultants. I am also the President of the Joint Consultative Council for the Construction Industry (JCC), an umbrella organisation which represents the interests of Engineers, Surveyors, Architects, Town Planners and Contractors in this Republic.

This submission is being made in my personal capacity and does not represent the position of either Raymond & Pierre Limited or the JCC.

My work on this vital issue has all been based on the public record and can be seen at www.afraraymond.com.

I am willing to give oral evidence before the Commission.

My areas for focus in this submission are –

Fiduciary Duty of Directors and Officers

The burning question is – When did the Directors and Officers of CL Financial (CLF) know that the group was heading to collapse? When did the Directors and Officers of the failed subsidiaries know? What did they know and when did they know it? How much warning did their management controls give them?

The question is pertinent and the time-line is instructive –

- 31st March 2008 – Andre Monteil retires as CLF’s Group Finance Director.

- 6th August 2008 – Anthony Fifi retires as Managing Director of the Home Construction Limited group, which is wholly-owned by CLF.

- Mid-October 2008 – CLF purchases Jamaica Money Market Brokers’ 45% shareholding in CMMB. Please note that CLF owns 40% of JMMB.

- 7th November 2008 – Michael Carballo, CLF’s Group Finance Director gives an interview to the Business Guardian that the group had assets of $100Bn and could weather any storm.

- 18th November 2008 – CLF 2007 Annual Report is published – its Consolidated Balance Sheet disclosed a Total Asset Value of $100.666Bn.

- 8th December 2008 – Robert Mayers proceeds on pre-retirement leave from CMMB, pending his scheduled retirement, on 28th February 2009, as Managing Director.

- 13th January 2009 – Lawrence Duprey, CLF’s Executive Chairman writes, detailing an asset value of $23.9Bn, to the Governor of the Central Bank to seek urgent financial assistance. See ‘Finding the Assets‘ published on 23rd August 2009 for the text of that letter.

- 16th January 2009 – CLF pays a dividend of $3.00 per share.

- 23rd January 2009 – CLF has its Annual General Meeting at Trinidad Hilton.

- 30th January 2009 – The bailout is announced at a Press Conference at the Central Bank.

So, there is this contradictory financial manoeuvre in the dying stages of the group. I am speaking about the CMMB share purchase, in which CLF purchases Jamaica Money Market Brokers’ 45% shareholding in CMMB at a reported $41.37M USD. That price equates to 16.5 times earnings, given that CMMB’s profit as at March 2008 was $35M. It is impossible to reconcile that earnings multiple with CMMB’s exceedingly low profit rate and the rapidly-approaching collapse.

Was a professional, independent valuation of those shares obtained prior to the purchase? How can it have been a proper discharge of their fiduciary duty to shareholders for the CLF Directors to have agreed such a massive, questionable purchase without proper advice?

That transaction drew $262M out of CLF’s rapidly-depleting coffers on terms which are suspect. It demands close examination.

Another inescapable episode is the last CLF Annual General Meeting, the timing could hardly be better for an insight into the sensibilities of these chiefs. At the date of that AGM, Friday 23rd January 2009, the bailout letter was 10 days’ old, the dividend cheques were one week old and the bailout itself was a week ahead.

What was the atmosphere at that meeting? Were the shareholders told frankly of the major challenges and that the group had been forced to seek a State bailout? Did the Directors offer an explanation for the failure of the group?

It would be important to examine that AGM very carefully.

The Second issue is the treatment of departing Directors and Officers. Note that three of the most important and senior CLF chiefs departed in the 12 months prior to the collapse. It is most unlikely that those departures were mere good fortune or coincidence.

It is difficult to probe and verify such agreements when they are oral, much less when they are between parties who are actively collaborating. Memory can be notoriously unreliable.

I am submitting that those departures can be examined from the documents if one were to approach from the compensation aspect. What I mean is that these chiefs would have been paid upon departure and that would likely have been documented.

If that approach were taken, the suggested questions would be

- How much did Messrs. Monteil/Fifi/Mayers receive upon retirement?

- Was that sum reduced to reflect the impending crash?

- Were the amounts arrived at by a ‘set’ formula?

- Were the amounts arrived at by an interpretation of an employment contract which divorced pay from performance?

This would make it possible to have some insight into the way these chiefs treated with themselves, their shareholders and the other stakeholders of the group.

Executive Flexible Premium Annuity (EFPA)

I have written extensively on the EFPA, its growth and the effect of that size upon the entire CL Financial group.

I have no further points to make on those aspects. My submission here is on the point of set-off and the burden to the taxpayer.

My submission is that in relation to the intended payments from the State to EFPA claimants is that the State must conduct itself in an exemplary fashion. The State must not be placed at any further disadvantage, having already shouldered this enormous, exceptional payout.

There are now anti money-laundering (AML) laws which require depositors to make declarations as to the Source of Funds, all in an effort to prevent the proceeds of crime from entering the legitimate economy. In my view it is necessary for the government to be satisfied that the various sums being claimed were properly declared under the AML laws. We have had shocking reports about the elementary management controls which were either absent or awry in the CL Financial group, so it would not surprise me if their AML-compliance was lax. That needs to be thoroughly checked. It would not be at all acceptable for our taxpayers’ monies to be used to rinse ‘dirty money’.

Also, the claimants who owe on their taxes – VAT, PAYE, Corporation Tax, Income Tax and so on – should not be refunded.

Finally, there is the issue of the many borrowers from Clico, British-American, Clico Investment Bank (CIB). In the case of CIB alone, we are told that about $1.0Bn of those loans are ‘non-performing’ – which means that the borrowers are not repaying their loans. It would be perverse for some of those non-performing borrowers to receive refunds from the State. This is a live part of this situation, since in the case of CIB itself, the very Inspector of Financial Institutions swore in his affidavit filed in the winding-up action for that failed bank –

…With respect to the Creditors of the Petitioner, the Petitioner has met the statutory obligations for the Board of Inland Revenue (except for Corporation Tax Returns for 2007, 2008 and 2009 which are being prepared and remain outstanding)…

That is a glaring example of the kind of wanton wrongdoing at the heart of this mess. CIB fails to file its Corporation Tax returns for three years, yet keep their banking licence and arrange for the taxpayer to bail them out when it all goes sour.

Some claimants may try to invoke the ‘corporate veil’ to shield themselves from various breaches committed by their companies, but this is an exceptional situation in which the State is making an offer. In my view, the corporate veil ought properly to be ignored, so that the long-standing commercial principle of ‘set-off’ can be applied to the claimants.

I am submitting to the Commission that everyone over seeking bailout funds exceeding $75,000 be subject to a BIR audit for themselves and any business interests that they may have earned revenues from and they should be denied a taxpayer-funded bailout if they were found to have not paid their taxes.

Political Party Financing

It is my submission that the means by our political parties are financed is at the very heart of this affair.

Governance models, regulatory frameworks and accounting conventions are all important parts of the interlocked issues, but those pale into insignificance beside the influence of this major party financier.

There can be no doubt that CLF was one of the leading contributors to political parties in this country.

In the case of the United National Congress (UNC), which is the leading element of the existing coalition government, their last leader was convicted and imprisoned for failing to declare substantial donations received from Lawrence Duprey – see here and here.

In the case of the People’s National Movement (PNM), there have been published reports as to the payment of sums of the order of $20M to that party by CLF in the 2007 general election – see here and here.

In the case of the former political party, the entire CLICO issue was raised by the respected economist Trevor Sudama MP in the 2002 budget debate. Sudama was a UNC Cabinet member and posed the question as to whether CLICO, having been found to be insolvent by the Supervisor of Insurance, should be allowed to continue in business. Sudama was strongly opposed in the debate and eventually removed from the Cabinet. This can be corroborated from Hansard (p. 757 and 800) and the reports of the Supervisor of Insurance.

In the case of the PNM, the link was even deeper, with the same individual being that party’s Treasurer, CLF’s Group Finance Director and Chairman of two banks – Home Mortgage Bank and CLICO Investment Bank as well as two major State enterprises in the construction sector – Housing Development Corporation and the Education Facilities Company Limited. That individual is Louis Andre Monteil.

It is clear from the many statements of the Governor of the Central Bank that they were very limited in what they could do as regulators and it is difficult to escape the impression that an undue influence was brought to bear in the case of CLF.

The last Minister of Finance, Karen Nunez-Tesheira – a former law lecturer – was found to have withdrawn her own and her family’s monies from the CLF group just before the crash, was a shareholder of CLF and accepted dividends after the bailout was requested by the beleaguered group.

Only when Nunez-Tesheira was confronted by an informed and relentless media did she admit any of those transactions. We have never had an account of those dividends.

There is a long-standing and widely-accepted doctrine of Cabinet secrecy. It is my submission that this is one of those exceptional cases in which the very purpose of the Enquiry will be frustrated unless the Terms of Reference are robustly interpreted. In this case the situation demands an examination of the conduct of these matters at the political level.

For a proper understanding of this issue, it is essential that Karen Nunez-Tesheira, Trevor Sudama and Louis Andre Monteil be cross-examined on this political aspect. It is my view that former Prime Ministers Basdeo Panday and Patrick Manning must be questioned if we are to properly apprehend the extent of the financiers’ influence.

I am basing that submission on part (i) of this Enquiry’s Terms of Reference -To enquire into “…the circumstances, factors, causes and reasons leading to the January 2009 intervention…”. There is no way to satisfy the first part of your mandate, to understand the root causes of the crisis, without getting into this fundamental issue. Political Party financing is at the centre of the fiasco. The learning from the Wall Street crisis on this question is unequivocal as to the pernicious influence of these political financiers and lobbyists.

For this Enquiry to achieve the required level of interrogation, information and insight, it must pierce the conventional veil of Cabinet secrecy. To do that, you need to take a robust view of your Terms of Reference.

I do believe all the items in this submission to be true and correct.

……………………………………………..

Afra M. Raymond B.Sc. FRICS

www.afraraymond.com

I have been preparing my submissions for the Colman Commission and took some time-out to start reading the Report into the USA’s financial crisis. Of course I am referring to the

I have been preparing my submissions for the Colman Commission and took some time-out to start reading the Report into the USA’s financial crisis. Of course I am referring to the

The audited accounts for CMMB for

The audited accounts for CMMB for  The JMMB (Jamaica Money Market Brokers) element. But then also we need to consider the sidebar item on the acquisition by CL Financial of the JMMB block of shares in October 2008. What could have been the rationale for CL Financial to spend $262M on securing its ownership of a company that was about to fail? No doubt that would have been a period of considerable cash-flow pressure within CL Financial itself, so it does seem to be a bizarre decision. Given all of those elements, why would CLF pay such high multiples to buy the remaining shares in a failing subsidiary? This is one of those intrigues which makes me wonder whether there was more in the mortar than the pestle, so to speak. Given that the purchase of the JMMB shareholding was only 3 months before Duprey wrote that fateful letter requesting financial assistance,what was CLF’s rationale? Could there have been a prior agreement as to the price to be paid for those shares? Was a valuation of those shares ever done? If so, by whom, on what assumptions and with what result?It seems that a huge sum of money (over $260M, by my calculations) was drawn out of the collapsing parent company, on what was virtually the brink of the meltdown, to buy the remaining shares in yet another collapsing company. It is staggering to conceive of a situation in which a financial company could spend over $260M without such elementary due diligence, which is why this aspect is an important one. At the very least, the quality of judgment of the CL Financial chiefs seems suspect. Could it be that the reporting systems of the group were so poor as to be unable to foresee the impending collapse at either the group or CMMB level?

The JMMB (Jamaica Money Market Brokers) element. But then also we need to consider the sidebar item on the acquisition by CL Financial of the JMMB block of shares in October 2008. What could have been the rationale for CL Financial to spend $262M on securing its ownership of a company that was about to fail? No doubt that would have been a period of considerable cash-flow pressure within CL Financial itself, so it does seem to be a bizarre decision. Given all of those elements, why would CLF pay such high multiples to buy the remaining shares in a failing subsidiary? This is one of those intrigues which makes me wonder whether there was more in the mortar than the pestle, so to speak. Given that the purchase of the JMMB shareholding was only 3 months before Duprey wrote that fateful letter requesting financial assistance,what was CLF’s rationale? Could there have been a prior agreement as to the price to be paid for those shares? Was a valuation of those shares ever done? If so, by whom, on what assumptions and with what result?It seems that a huge sum of money (over $260M, by my calculations) was drawn out of the collapsing parent company, on what was virtually the brink of the meltdown, to buy the remaining shares in yet another collapsing company. It is staggering to conceive of a situation in which a financial company could spend over $260M without such elementary due diligence, which is why this aspect is an important one. At the very least, the quality of judgment of the CL Financial chiefs seems suspect. Could it be that the reporting systems of the group were so poor as to be unable to foresee the impending collapse at either the group or CMMB level?

The other huge event of the year was the budget speech on 8th September 2010, in which Finance Minister, Winston Dookeran, disclosed publicly that he was revising the terms of the CL Financial bailout. That bailout was a hugely suspect act, the largest financial commitment ever undertaken in this country, without proper due diligence or even any proper ventilation in the Parliament. Our Republic had never been so financially violated and in broad daylight. It was encouraging to see the Finance Minister take the point to its logical conclusion and of course that brought about the large-scale organisation of various aggrieved groups to put their point.

The other huge event of the year was the budget speech on 8th September 2010, in which Finance Minister, Winston Dookeran, disclosed publicly that he was revising the terms of the CL Financial bailout. That bailout was a hugely suspect act, the largest financial commitment ever undertaken in this country, without proper due diligence or even any proper ventilation in the Parliament. Our Republic had never been so financially violated and in broad daylight. It was encouraging to see the Finance Minister take the point to its logical conclusion and of course that brought about the large-scale organisation of various aggrieved groups to put their point.

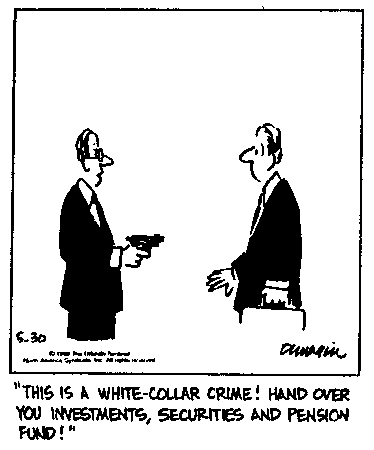

The obvious connection between these various events is the fact that White Collar Crime – which is sometimes, mistakenly, called victim-less crime – is afflicting our country in a big way.

The obvious connection between these various events is the fact that White Collar Crime – which is sometimes, mistakenly, called victim-less crime – is afflicting our country in a big way.

…The CMMB Group comprises CMMB Limited, CMMB Trincity and CMMB Barbados…Effective 2 February, 2009, the Bank assumed control of CMMB Securities and Asset Management Limited (CSAM)…

…The CMMB Group comprises CMMB Limited, CMMB Trincity and CMMB Barbados…Effective 2 February, 2009, the Bank assumed control of CMMB Securities and Asset Management Limited (CSAM)…