On Thursday, 5 September 2019, the PM announced at the post-Cabinet media briefing that the large-scale HDC contract with China Gezhouba Group Company (CGGC) for 5,000 new apartments was now ‘cancelled’-

…That contract was reviewed extensively by the Cabinet and it has been stopped. HDC has been instructed to go back out to tender because there were some parts of that contract that did not meet Cabinet’s acceptance and approval, both structurally and legalistically. That contract has been stopped.

So, Cabinet has reviewed this contract (after its execution!) and has now cancelled it so as to re-tender and proceed in accordance with proper standards. Sad to say, a straight reading does not count for much in these matters. This is where we are, that is all.

The previous article explained the several serious aspects which were wrong with that HDC contract. In my view the entire contract was wrong, even if no laws were broken and all the necessary protocols were observed. ‘rong like a Crix Biscuit and this article will explain exactly how.

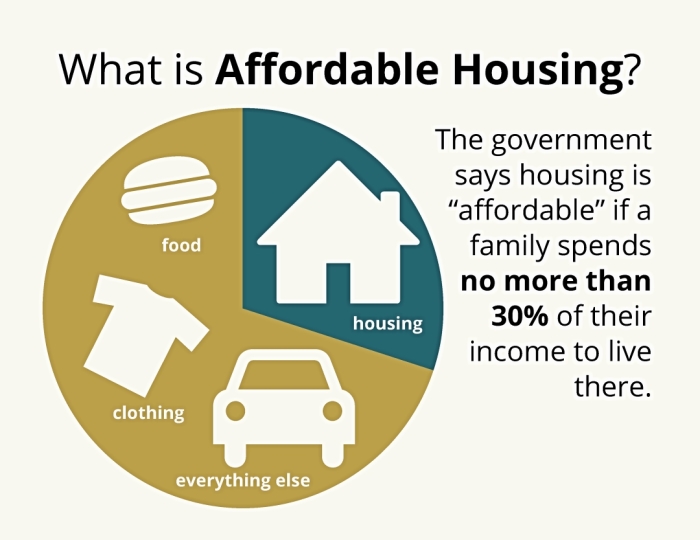

Affordability

A contract sum of $71.7M USD ($485M TTD) for 439 new apartments, is an average cost of $1.1M TTD per unit, not counting the land. Given that the qualifying income to buy a $1.1M TTD home is twice the national average household income, there is no way anyone can call those new homes ‘affordable’. It is no use claiming that some people could afford that price and that those people are on HDC’s waiting list. That would be a blatant betrayal of the hopes of the tens of thousands of poor people who are on that waiting list.

The new homes produced for HDC have to be affordable to applicants earning less than the national average. For your information, the national average monthly household income is between $9,000 to $10,000, according to the basis of figures used.

I projected that the 5,000 new apartments in this HDC/CGGC arrangement would cost at least $5.5 Billion TTD, using the rates applied to the first phase. If indeed the HDC has access to that level of funding, at the very least all those new homes must be affordable to poor applicants. Any talk about $1.0M + new homes ought to be rejected in favour of far more affordable ones. The bulk of the new homes must be strictly for rent, upward of 75%, given the facts shown by that tragic waiting list.

If the HDC were to shift its output to new homes under $400,000, the State could get far more new homes for the same $5.5 Billion – 13,750 by my estimation.

Even aside from the irrefutable points about the unaffordability of these new $1.1M homes, there is a troubling issue in relation to the value proposition. By that, I am referring to location and the question as to whether one can actually sell new apartments for $1.1M at South Quay or Lady Hailes Avenue. That kind of issue is likely why CGGC did not accept those risks. I would have advised clients of mine to do the same.

Moving from the affordability issues, one also needs to scrutinise the actual arrangement.

PPP arrangement

The HDC launched the first Housing Development to be constructed by the current PNM Administration using the Public Private Partnership Model (PPP) in 2016 to encourage investment from contractors who would design, finance, and build new homes on public lands. The fundamental principles being that the private sector deploys its capital to provide new homes, so no Public Money is required for the design and construction. An underlying aspect is that the design, construction, market and financial risks are carried by the private sector. On that basis, suitable contractors could be selected without the need for tenders which would arise in a conventional contract.

In May 2019, Housing and Urban Development Minister Major-General (Ret’d) Edmund Dillon speaking at the signing ceremony for this PPP, which he referred to as Project 5000, said:

The official HDC Press Release of 17 May 2019 notes the following:

“…CGGC will be responsible for the financing, design, procurement and construction of the housing blocks and the associated infrastructure for these developments…”

Yet, when one examines the HDC/CGGC contract, as disclosed after the JCC’s Freedom of Information request, it is plain that no private capital is at risk. This is a straightforward Engineering, Procurement and Construction (EPC) FIDIC contract in which the State is financing the entire project, up to and including the provision of full financial guarantees.

The PM’s statement that the contract is to ‘go back out to tender’ is literally incredible, since it was never tendered. Those high costs were negotiated rates and of course sobering questions arise.

How does a contractor qualify for the PPP, which is intended to put private capital at risk in providing these new homes, yet get a contract which places all the financial risks with the State?

Are we to believe that the Cabinet was unaware of the terms of this massive housing contract? Are we to believe that Cabinet only reviewed this contract after pointed questions were raised by colleagues and myself in the media? Even if one accepts the necessity of having State Agencies under arms-length control of those Boards of Directors, how can such a swerve have happened?

Finally, consider the official photo issued by HDC of the contract signing and the presence of Foreign Affairs Minister, Sen. Dennis Moses. In that light, it is a natural question as to whether this entire arrangement is in fact emerging from a Government to Government Arrangement (G2G). If that were the case, we could well be seeing that Chinese contractors are awarded contracts to compensate for the ‘loss of profit’ in cancelling the HDC/CGGC contract. After all, it was a legal contract, right?

Can you get a copy of the Request for Proposals? It will basically outline the terms; I believe the country is being misled as to what they are getting as opposed to what they are asking for. The included proposal by the Chinese clarifies this.

Politicians and businessmen only smile when huge profits are guaranteed.

Afra,

While I share your concerns expressed here, I wonder whether we’re missing another, deeper point. It is that the nature of this contract and its hard won exposure that has allowed us to know the true cost of HDC units. I have previously speculated as to the true cost of construction down the years. I have long suspected that there was massive subsidy on the scale suggested here which went unnoticed and certainly unconfirmed.

A key takeaway for me therefore is that we must continue to demand to know the true cost of HDC units so that we can compare same with the sale or rental prices. I some times ponder whether our authorities themselves know those unit costs under “normal” contract arrangements.

Normal is a metaphor that translates words into deeds. It is normal for suppliers to triple the cost prices of goods and services to Ministries because of the normal lapses that occur before remittances are received. Financial transactions are as porous as fish nets, so are policies and contracts.

I shall paste a response from Cadiz on Afra’s blogged interview dated 9th Sept. 2019

“Stephen Cadiz

September 9, 2019 at 9:50 pm

During my term as the MP for Chaguanas East we constructed 10 houses for persons who had rights to the land they were living on at a cost of $125K. This was a concrete foundation, concrete block construction, 2 bd rm, indoor plumbing, kitchen, living rm.

agreed there was no land acquisition nor infrastructure to be built.”

This principle is excellent if intelligently managed and with the supervised checks and balances possible. On Friday 13th Sept. 2019 on Gayelle a pre-recorded interview of David Muhammad and a past president of Eastern Credit Union (2000 to about 2007, I think) explained the destruction of these principles in the Credit Union group by both bankers who become administrators and by banks corrupt manipulation of the principles, similar to the commercialisation of Way Way and Sou Sou principles by NLCB. It is normal for us to ignore good for a variety of reasons. True costs vary much more frequently than the weather and that is as Destra sings, ‘normal normal’.

I should have referenced this telling report of Ewart Williams on credit unions.

This is the link: https://www.central-bank.org.tt/sites/default/files/2017-09/31st%20AGM%20Eastern%20Credit%20Union%20March%202005.pdf

Harvey Borris is the past director of the Eastern Credit Union who served several terms from 2000 and the last one ended in 2016.

Why did you mention Harvey Borris?

He is the past president of the ECU mentioned above.