These are the documents from my Request for Access to Official Document(s) Under the Freedom of Information Act, 1999 from the State and the agents acting on behalf of the State, in the referenced hotels.

These are the documents from my Request for Access to Official Document(s) Under the Freedom of Information Act, 1999 from the State and the agents acting on behalf of the State, in the referenced hotels.

This is my interview on the ‘Essential Public Interests at stake in the Invaders’ Bay development‘ Power 102.1FM’s ‘Power Breakfast‘ on Thursday, 15 December 2016 with Rhoda Bharath and Wendell Stephens.

This is my interview on the ‘Essential Public Interests at stake in the Invaders’ Bay development‘ Power 102.1FM’s ‘Power Breakfast‘ on Thursday, 15 December 2016 with Rhoda Bharath and Wendell Stephens.

In Privacy Pros and Cons, I considered the Parliamentary debate around the recent SSA Amendment Bill. Most of that debate seemed to be concerned with the limits on the rights of citizens to privacy, but my concern was that there was precious little comfort being offered in terms of the secret conduct of our public affairs.

If we are to evolve to developed nation status it is essential that the State seriously reform its culture of obscurity and secrecy, that is the contention I am advancing here. Continue reading “Private State?”

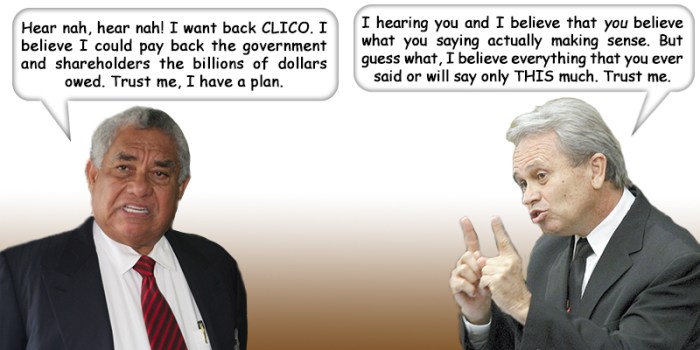

On Sunday 22nd May 2016, the front-page story in this newspaper was headlined ‘We will pay it back‘. That article featured very interesting quotes from former CL Financial Executive Chairman, Lawrence Duprey as well as the Minister of Finance & the Economy, Colm Imbert, on the prospects for repayment of the huge sums of Public Money spent on this CL Financial bailout.

Duprey claimed to have made a formal proposal to the State to repay taxpayers and all stakeholders who are owed money, while insisting that the amount owed was yet to be determined. The failure or refusal of the State to publish any audited statements in relation to this CL Financial bailout appears to be impeding the discussions as to a settlement of this massive debt. The sidebar contains a summary of how the Public Money spent on this bailout has grown from the initial 2009 estimates of $5 Billion to a 2016 figure now said to exceed $24 Billion. Continue reading “CL Financial bailout – Duprey’s Story: SIFI vs PIFI”

The recent high-level of public concern over the SSA Amendment Bill was of limited concern to me, until I started listening properly. In the event, the proposed law was passed by the Parliament and there is some threat from the Opposition of a lawsuit to test its constitutionality. We will see.

Two very interesting stances surfaced during the heated debates and it is at these kind of moments that I sometimes think of our so-called political divide. Those were the Right to Privacy stance disclosed by the AG and the private briefing of Parliamentarians as a legislative tool.

The AG, Faris Al Rawi, was emphatic on 2nd May 2016 that we have ‘…no enshrined right to privacy under the law…‘. He was almost immediately contradicted by former CJ, Michael de la Bastide QC, who relied on Section 4 (c) of the Constitution which specifies ‘the right of the individual to respect for his private and family life’. In ‘The creep of Tyranny‘ on Monday 9th May 2016 in this newspaper, my colleague Michael Harris also made strong objections to the AG’s stance. Of course we have rights to privacy and those are entrenched in our Constitution, but now those rights can be limited by the new law, intended to promote national security. Continue reading “Privacy Pros & Cons”

Last week we learned that Lawrence Duprey and his fellow CL Financial shareholders are victims of a badly-handled bailout. According to the Duprey version, the State must halt all asset disposals and he must regain control of the CL Financial group of companies. In what seemed to be an immediate response, Minister of Finance & the Economy, Colm Imbert, said he was so alarmed at the gross mismatch in the bailout figures that he decided to order a forensic audit on the entire process. These two contrasting stories are the latest big news on the CL Financial bailout.

I have always objected to the CL Financial bailout and it has become a strong example of how the Public Interest can be perverted under a series of disguises.

The Imbert Initiative looks like a welcome move to examine the details of this scandalous waste of Public Money. The proposed forensic audit seems to signal some official appetite for disclosure. However, if this is to properly protect the Public Interest, there are some ‘litmus tests’ which can show the official commitment to disclosure

This article will examine those two proposals so that some meaning might emerge from this utter, deliberate confusion.

Continue reading “CL Financial Bailout – Duprey’s Gambit”

“…The first responsibility that devolves upon you is the protection and promotion of your democracy. Democracy means more, much more, than the right to vote and one vote for every man and every woman of the prescribed age…”

—Dr Eric Williams, in his first Independence address, on 31st August 1962.

We are now at a place in which our political parties routinely subject us to misleading promises to win elections, followed by a sharp dose of reality as we realise which financiers are actually in charge of important public policy. This has been happening for a while now, but while we can criticise the various political parties, our gullibility is at the root of the problem. Many of us still believe in ‘Father Christmas’, so we remain stuck in a loop of high expectations leading to deep disappointment. Frustration and outrage appear to be key features of the ‘new normal’ we are all now living.

Obviously, we need a big shift in how the membership of the political parties hold their leaders accountable once office is attained, but there are other aspects of public affairs which need to change. Some say that once we choose not to vote, we have lost the right to criticise the actions of public officials, since we are effectively opting-out of the system. I believe it is important to remember that politics is not a single choice made by the voter at elections: politics is how we live our lives together and choose everyday.

Continue reading “Telling Truths”

On 10 August 2015, the then Minister of Finance and the Economy appealed the High Court’s 22 July 2015 judgment which ordered the release of the details on the CL Financial bailout. My protest at this action was published in this space as ‘Studied Disdain‘. Since then, the General Election of 7 September 2015 brought about a change of government – the People’s Partnership is now the official Opposition and the People’s National Movement is once again the government.

It is essential to now determine the areas in which we can expect changes in policy and the areas in which we can expect business as usual. Those perspectives informed my letter of 15 September 2015 to the new Minister of Finance & the Economy, Colm Imbert.

Imbert asked for more time to consider my request, so I consented to his application to the Appeal Court – the next hearing in this matter is therefore set for 25th January 2016.

My exchanges thus far with Imbert have been straightforward ones, but it is always important for us to be vigilant and aware.

The High Court ruled in my favour on 22 July 2015 and ordered the publication of the requested details, but on 10th August 2015 the Ministry of Finance appealed that ruling (P201 – 2015). Our next hearing is set for Monday 19th October 2015, to argue the State’s application for extension of the stay of execution. It is my intention to strongly oppose that application for any extension of the stay of execution.I am formally requesting that you take the necessary actions to restore the Public Interest in the Accountability, Transparency and Good Governance in relation to this vast, opaque expenditure of Public Money.In specific terms, I am requesting three actions from you –

In anticipation of objections to disclosing these details on the grounds of the right of private investors to confidentiality, my response would be to point out that all other recipients of Public Funds are liable to having detailed information disclosed, upon request and without notice. A request for information on the details of a Public contract would include the identities of the parties; the contract itself; the dates and amounts of payments. Such requests are routinely handled without resort to attorneys or even the Courts, even if administrative delay is also a reality. That is the common and accepted practice in relation to all Public contracts and payments, which is fortified by the provisions of the Freedom of Information Act, under which my litigation was successful. There is no case made for any special status of financial investors to enjoy rights of confidentiality which are not available to other recipients of Public Funds.

The only way for the required level of transparency and accountability to be achieved is by the responsible officials publishing all the details of all the payments of Public Money.

The equation for the reality check is –

Expenditure of Public Money Minus Transparency Minus Accountability Equals CORRUPTION

I can appreciate that the impending 2016 budget would likely demand your attention for the next three weeks. I would like to know the State’s position in this matter before the next Appeal Court hearing on Monday 19th October 2015, so I would appreciate your reply by Friday 9th October 2015.

This request was made in the Public Interest, so I trust that it will receive your positive attention.

Yours sincerely,

……………………………………………….

Afra Raymond

c.c. – Dr. Keith Rowley MP, Prime Minister,

Mr. Faris Al Rawi MP, Attorney General

How much has the CL Financial bailout cost?’

TIMELINE

|

DATE |

EVENT |

SOURCE with live hyperlinks |

|

30th January 2009 |

Bailout announced at an estimated cost of $5.0 Billion |

|

|

12th June 2009 |

CL Financial Shareholders’ Agreement signed, which for the first time made it a priority to protect shareholders’ rights. |

– see Para ‘A’ of the Preamble at page two. |

|

8th September 2010 |

Winston Dookeran’s first Budget Statement, in which he formally proposes to drastically reduce the rate of payout of Public Money in the bailout. |

pages eight through ten. |

|

1st October 2010 |

Then PM confirms that $7.3 Bn had been spent and that a further $7.0 Bn needed to be spent (pg 31). The burning need for an explanation of where the $7.3 Bn went…(pgs 25-26) |

Hansard for 1st October 2010 – pages 19 through 34. |

|

3rd April 2012 |

Then Finance Minister Winston Dookeran confirms that $12 Bn had been spent. |

Affidavit to High Court in Percy Farrell & Ors vs AG – para 21. |

|

1st October 2012 |

New Finance Minister Larry Howai confirms that $19.7 Bn had been spent, which is an additional $7.7 Bn in six months. |

page six. |

|

17th May 2013 |

Formal confirmation of bailout cost “…over $25 Bn…” |

Formal Press Release from Office of the AG – para eight. |

|

2nd April 2014 |

Then Finance Minister Howai confirms bailout cost as – “… the cost to the country of the CL Financial bailout—the actual cash that has been put out—is approximately$20.8 billion...” |

Hansard for Senate sitting of 2ndApril 2014 – page 35. |

|

7th August 2015 |

Then Finance Minister Howai confirms bailout cost as ‘not quite $20 Bn‘. |

CNMG interview |

These are the official statements as to the actual cost of the bailout since 2012. It really resembles the ‘carefully cultivated confusion‘ which I deplored recently in relation to the Invader’s Bay fiasco.

Para 21 (a) $5.0Bn already provided to CLICO;

(b) $7.0Bn paid to holders of the EFPA and

Para 22 $12.0Bn estimated as further funding to

be advanced.

Dookeran is saying in April 2012 that $12 Billion had been paid and an estimated $12 Billion remained to be paid, which is a total of $24Bn in public money to be spent to satisfy the creditors of the CLF group.

The first item, Dookeran’s April 2012 affidavit, is the one for which Howai is now being required by the Court to produce the details.

Some of my views on this, from last week –

“…Well, this is the usual practice, in which the public right to know is subordinated to private, undisclosed interests…it seems to me at these moments that the job of the State’s attorneys is to shroud the entire indecent affair in ‘something resembling an important principle’, but ultimately the effort is intended to wear me down and let the issue fade from collective memory…I am continuing to fight this very hard…what we have here is the ultimate collapse of our Republic by Public Officials who are sworn to uphold the Public Interest without fear or favour, but end up exposed as serving the toxic interests of the financial robber barons…I am reminded of Simon Johnson’s ‘The Quiet Coup‘ published in The Atlantic of May 2009…in T&T, we too, had a quiet coup…”

As the Season of Reflection and the impending election flow together, there is a bitter brew now being offered in relation to the CL Financial bailout.

Disdain is an attitude which denotes someone or something as being unworthy of proper consideration. I think that in relation to our collective interests in the CL Financial matter, we are now being subjected to Larry Howai’s ‘studied disdain’ in relation to our collective interests in the CL Financial matter.

On Tuesday 10 August 2015, the State announced its decision to appeal the recent High Court ruling that the details of the CL Financial bailout must be published. That appeal was also filed that day and the State applied to have the stay of execution extended to the end of the appeal process – the latter issue will be heard on 19 October 2015.

The Minister of Finance & the Economy is the main public official with responsibility to account for how Public Money is spent. The Public Money being used to bailout the CL Financial creditors is our money. The Minister of Finance therefore has a fundamental duty to publicly account for how our money has been spent.

Our collective interests in this matter, of exactly how $25 Billion of our dollars were spent, far outweigh the undisclosed interests on whose behalf the Minister is now appealing.

This appeal is against every one of the orders made in the High Court judgment of 22 July 2015 and therefore represents an utter abdication of the fundamental duties of the Minister of Finance and the Economy.

Our collective interests could benefit from the unintended juxtaposition of national elections, the apparent halt of USD sales by the country’s leading bank and the hostility of the Minister of Finance to the truth. These are rare moments in which we might gain insight and regain fundamental rights, but we have to be aware of what is at stake.

The Ministry’s Press Release deserves stern scrutiny, so these are my points. Continue reading “CL Financial Bailout – Studied Disdain”

![]() Afra Raymond sits with host, Larry Lumsden on the Good Morning T&T television show to discuss his recent High Court victory over the Minister of Finance to get accounting details on the CL Financial bailout. Video courtesy CNMG

Afra Raymond sits with host, Larry Lumsden on the Good Morning T&T television show to discuss his recent High Court victory over the Minister of Finance to get accounting details on the CL Financial bailout. Video courtesy CNMG