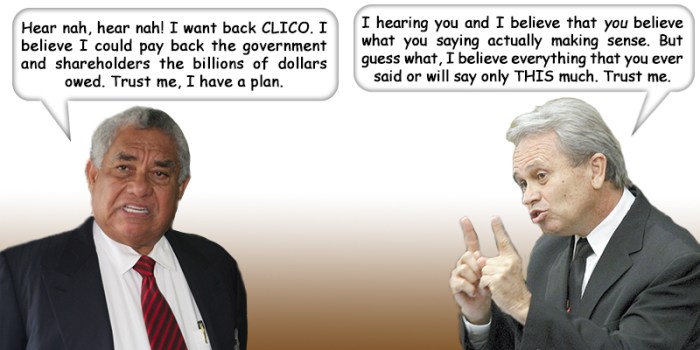

On Sunday 22nd May 2016, the front-page story in this newspaper was headlined ‘We will pay it back‘. That article featured very interesting quotes from former CL Financial Executive Chairman, Lawrence Duprey as well as the Minister of Finance & the Economy, Colm Imbert, on the prospects for repayment of the huge sums of Public Money spent on this CL Financial bailout.

Duprey claimed to have made a formal proposal to the State to repay taxpayers and all stakeholders who are owed money, while insisting that the amount owed was yet to be determined. The failure or refusal of the State to publish any audited statements in relation to this CL Financial bailout appears to be impeding the discussions as to a settlement of this massive debt. The sidebar contains a summary of how the Public Money spent on this bailout has grown from the initial 2009 estimates of $5 Billion to a 2016 figure now said to exceed $24 Billion.

That continuing lack of detailed figures for the cost of the bailout is one of the things which Minister Imbert promised to resolve with a final number to come from auditors Ernst & Young in the next two weeks or so. One can only wonder how these vast sums of Public Money could have been spent with no proper accounts. In terms of Public Financial Management, this CL Financial bailout is an object lesson in how the Public Interest can be completely compromised without any real prospect of punishment, prosecution or even loss of pride.

In the lead-up to the collapse of CL Financial, there were many questionable decisions taken by the chiefs of that huge conglomerate. In ‘Colman Report by end of May‘, in the Newsday of 7th May 2016, Minister Imbert stated that the Commission of Enquiry Report into the CL Financial collapse is expected to be delivered by the end of this month. That Report is expected to contain findings as to the causes of this epic collapse and one would expect that it will be published upon receipt, given the huge sums of Public Money which have been spent.

The Colman Report ought to address issues such as the role of the Central Bank as the regulator; the role of the Cabinet; the responsibilities of PWC as the auditors and of course the actions of the CL Financial chiefs such as Lawrence Duprey and Andre Monteil. Neither of those men testified at the Enquiry, citing their right to avoid self-incrimination, but their respective positions were represented by attorneys who raised many points throughout the Enquiry. Lawrence Duprey was represented by UK-based Andrew Mitchell QC, while Andre Monteil was represented by Martin Daly SC.

SIDEBAR: How much has the CL Financial bailout cost? A timeline

| DATE | EVENT | SOURCE with live hyperlinks |

|---|---|---|

| 30 January 2009 | Bailout announced at an estimated cost of $5.0 Billion | CBTT Statement of 13 February 2009 |

| 12 June 2009 | CL Financial Shareholders’ Agreement signed, which for the first time made it a priority to protect shareholders’ rights. | CL Financial Shareholders’ Agreement – see Para ‘A’ of the Preamble at p 2. |

| 8 September 2010 | Winston Dookeran’s first Budget Statement, in which he formally proposes to drastically reduce the rate of payout of Public Money in the bailout. | 2011 Budget Statement – pp 8-10. |

| 1 October 2010 | Then PM confirms that $7.3 Bn had been spent and that a further $7.0 Bn needed to be spent (p 31). The burning need for an explanation of where the $7.3 Bn went…(pp 25-26) | Hansard for 1 October 2010 – pp 19-34. |

| 3 April 2012 | Then Finance Minister Winston Dookeran confirms that $12 Bn had been spent. | Affidavit to High Court in Percy Farrell & Ors vs AG – para 21. |

| 1 October 2012 | New Finance Minister Larry Howai confirms that $19.7 Bn had been spent, which is an additional $7.7 Bn in six months. | 2013 Budget Statement – p 6. |

| 17 May 2013 | Formal confirmation of bailout cost “…over $25 Bn…” | Formal Press Release from Office of the AG – para eight. |

| 2 April 2014 | Then Finance Minister Howai confirms bailout cost as – “… the cost to the country of the CL Financial bailout—the actual cash that has been put out—is approximately$20.8 billion...” | Hansard for Senate sitting of 2 April 2014 – p 35. |

| 7 August 2015 | Then Finance Minister Howai confirms bailout cost as “not quite $20 Bn.” | CNMG interview |

| 22 May 2016 | Finance Minister Colm Imbert states cost as ‘…Our books show $24 Billion…‘ | Sunday Express. “We will pay it back” |

It also seems to me that the bailout period over the last seven years (2009-2016) has been a veritable carnival with just about every element of good governance and accountability discarded. Here are a few items to consider –

- $24 Billion in Public Money spent – no audited accounts.

- Freedom of Information Act – High Court ruling to publish bailout details appealed by the State.

- Interest – The entire loan of this huge sum of Public Money was made on a zero-interest basis.

- No ‘Haircut’ – Creditors were not required to accept less money, unlike other places in which the bailout terms required that the sacrifice be shared, but more on that later.

- Integrity in Public Life Act – The Integrity Commission continues to ignore the fact that CL Financial is a State-controlled entity whose Directors are obliged by law to file declarations of assets, liabilities and income. Wilful blindness.

- Criminal Prosecutions – As yet, none of the CL Financial chiefs have been charged for fraud or any such acts.

- Asset disposals – Significant asset disposals have been reported without corresponding details as to the prior independent valuations required by law.

When the figures and details of this episode are eventually published, the misconduct of the bailout may readily exceed our fears.

Another interesting detail to emerge from these statements by Duprey was his repeated insistence that, apart from the State, there were substantial existing debts to other stakeholders which he also promised to repay. Now that made me wonder, once again, just what was the total cost of the bailout. After all, the stated cost had escalated from $5 Bn to $24 Bn between 2009 and 2016, yet there are still various groups clamouring for settlement. So just who had been paid and who had been left unsatisfied? It seems that certain groups and institutions were able to swiftly recover their monies, while others were made to wait up until now. So, how much money is Duprey really promising to repay?

We need to insist that all the details of all the payments be published so that the true beneficiaries of this fiasco can be known. That is not negotiable, given the vast, unexpected and secretive expenditure of Public Money. Our Money.

In Duprey’s Gambit, I explained that the comparisons between this CL Financial bailout and the events on Wall Street are highly misleading. For one thing, Duprey has been able to obtain seemingly-limitless access to our Treasury for an interest-free loan, while keeping majority shareholding. On Wall Street, the financial institutions accessing Public Money were made to pay a punitive rate of interest and give up the majority of their shareholdings to the State. In the case of AIG, then the world’s largest insurer, the interest rate charged was almost four times more than the base rate and they relinquished 85% of their shares.

For whatever reason, Duprey did not cite the Wall Street example in his latest sally. He took us on another trip, intended to portray this bailout as some normal operation, this time to Europe –

That’s no problem. Whatever the amount is, we will work (out) a resolution plan, as has been done in many countries with other companies. The most recent one was Austria.

He cited a European newspaper article, which said a resolution was found in Austria ‘to the satisfaction of everybody. It has just been done in Austria, with a bank in the south of Austria. Read that and see. That’s all we’re doing…’

Well, after reading that I smiled at Duprey’s sheer nerve, since his Austrian bank comparison is as bizarre as it is bogus. One presumes he was speaking about the ‘Hypo’ bank, which was a highly-controversial state bailout of a politically-supported bank. The latest on that bailout seems to be that all creditors are taking a ‘haircut’ – i.e. 54% less than they are owed – and the bank is to be liquidated. Here in T&T, however, all creditors are being fully satisfied, the State has agreed to a ZERO-INTEREST loan to the wealthiest man in the Caribbean and the way this situation looks, the CL Financial Chiefs will soon be back in charge. Are we clear now? Naipaul really did speak about the role of the picaroon in our society. I tell you.

I was bemused by one of Duprey’s closing statements –

…Had it been left alone, everything would have been satisfied and we would have gone along our merry way, as we have done in the past…

One can only wonder what lies beneath such an enigmatic statement.

It seems clear to me that this CL Financial bailout represents a massive transfer of wealth from the public to the wealthiest minority…that is what this is all about.

In closing, I reflect on a fascinating essay of March 11th 2015 on the blog of the Hertie School of Governance in Berlin – ‘Not SIFIs but PIFIs – a bank bailout lesson from Austria’ in which the authors discuss the political and financial background to the HYPO bank bailout. This is a piece of essential reading on the difference between a ‘Systemically Important Financial Institution’ (SIFI) and the designation they proposed for HYPO, that of ‘Politically Important Financial Institution’ (PIFI). The parallels are compelling, so perhaps Duprey’s comparison was not so very far adrift.

Afra, sometimes I suffer such trepidation before I read you, then have to take deep breaths and

psyche myself to so do.

Keep up the pressure brother, and watch your back.

Peter Anthony Gales 1-868-389-0331 1-347-867-8432 http://www.PeterAnthonyGales.com

>

Sunlight is the best disinfectant

The EFPA was a real problem for the banking sector in terms of the interest rate offered..and it was sold…AND ALLOWED (by the SOI) with the guarantee of principal and interest backed explicitly by the Stat Fund and implicitly by the CBTT/GORTT.

As I was made to understand, the CIB depositors and the CL Mutual Fund holders were made whole while the EFPA holders were left to hang.

This was back to front in the pecking order…but I guess when you have a CBTT governor,a sitting Minister of Finance and a Senator among your depositors …its good to be CIB.

The EFPA product being the only real casualty here-shareholders still in the game,CIB depositors made whole…entities that BORROWED from CIB given a reprieve, the insurance products (life and traditional annuities) still in force.

Is it that this one product (that worked for 20 years) is the cause of all this???

REALLY(channel Ace Ventura here)

it is my impression that this is EXACTLY like the Wall Street bail outs.

Except here Goldman Sachs is represented by the banking Sector ….

The successive placement of ex bankers at the helm of the CL entity post 2008 is just shortsighted, or brilliant depending on your POV.

We are now stuck with little alternatives to the banks for deposits and the banks are cashed up and unwilling/unable to deploy capital.

Our financial services

As always Mr Raymond thank you for the effort and work it takes to bring sunlight to these dark spots.

Sooner than later the threads of this corrupt fabric will start to unravel. I admire your un-daunting efforts and continued updates! Permanence, perseverance and persistence in spite of all obstacles, discouragements, and impossibilities: It is this, that in all things distinguishes the strong soul from the weak. Thomas Carlyle

Ingrid

Thank you for your supportive remarks, Ingrid…

Quite frankly, this has been going on for over seven years now and it does sometimes seem to me that the truth will emerge later, rather than sooner!

Afra