Afra Raymond sits with hosts, Fazeer Mohammed and Felipe Nogueira on the Morning Edition television show to discuss the code of silence surrounding the CLICO bailout. Video courtesy TV6

- Programme Date: 07 December 2010

- Programme Length: 0:23:20

Afra Raymond sits with hosts, Fazeer Mohammed and Felipe Nogueira on the Morning Edition television show to discuss the code of silence surrounding the CLICO bailout. Video courtesy TV6

At this point in time, the nation’s budget is running at a deficit for the third successive year and the Minister of Finance is tasked with developing new sources of revenue. I think it is time to return to the question of property tax.

According to a recent statement by the Minister, if all the taxes due were paid, we would not have any budget deficit. The ‘tax gap’ is the difference between the total taxes owed and the actual taxes collected. While the notion of total compliance by taxpayers would be somewhat unrealistic, the goal of closing the ‘tax gap‘ is certainly one worth pursuing.

As I wrote on 19th September in this space –

…consider that rental income is also subject to income tax. Not many people who own rental property actually pay income tax on that rental income – if you don’t believe me, just ask a few friends or relatives who own rental property. This seems to me to be an area in which the Finance Minister can easily collect the data and increase the State’s revenue by staying within the ‘No New Taxes’ promise and implementing the laws which are already on the books…”

I am returning to the subject in this article.

When one considers how wealth accrues in our society, it is obvious that property forms a significant part of the nation’s assets. A great portion of the wealth of our successful citizens flows from rentals, buying blocks of land to sub-divide and sell-off lots, development or just flipping (buy low, sell high). There is no doubting that property dealings are a significant wealth-creating engine in our society.

The property sector is lightly taxed, with no real capital gains taxes, very little income tax collected on rentals and very low rates paid for Lands & Buildings Taxes/House Rates. Only in the case of Stamp Duty is there a somewhat modern system in place, but even that has been effectively neutralized by the real traders.

The widespread and varied protests against the PNM’s Property Tax proposals seemed to me to be divided into two types.

In saying so, it is striking to me that the position of the serious property dealers remained concealed in that campaign, which was effective in seeking after sympathy-support. Almost reminds me of the Clico Policyholders Group.

The first class of objection is practically dead, given the strong mandate given to the PP in the General Election. That said, it would be literally playing with fire for them, having achieved office by campaigning against the PNM proposals, to bring forward a new property tax in a similar mode.

The second class of objection is interesting in that it could be instantly invoked to play on our natural sympathy for the ‘underdog’.

I am proposing that the Minister of Finance consider targeting rental income for taxation.

So, what are the merits of this proposal?

Given the natural tension between landlords and tenants, it is difficult to imagine many tenants concealing or distorting facts for the benefit of their landlords. The simple fact is that there is plenty of information just waiting to be collected.

In terms of actual implementation, it would be advisable to get a high rate of participation by offering a tax amnesty to those who filed corrected tax returns within say 3 months. The waiver of penalties and interest charges on the 6-year tail of liability would be an attractive incentive to sensible investors.

Just to be clear, the payment of income tax on rental income does not set-off or reduce a property owners’ liability to pay property tax, as in the case of Land & Buildings Taxes or House Rates.

There is a substantial pool of untaxed income, together with an inescapable means of gathering the necessary information.

The only question is ‘What are we waiting for?’

The closing act of the last PNM regime was the vastly-unpopular property tax, which was assented-to by our President on 29th December 2009, after bruising months of public protest and many, many uninformed statements. The Property Tax Act 2009 was to be the basis of a complete revision of our country’s property tax system, insofar as the old Land & Building Taxes and House Rates were concerned.

The nationwide protest against the Property Tax proposals was a key factor in coalescing the opposition to the PNM and seemed to me to have paved the way to the electoral victory of the People’s Partnership government in May 2010. One of the PP’s most distinctive and popular manifesto promises was the repeal of that Property Tax Act.

I was in support of the proposed changes to the Property Tax system as being long-overdue.

As things stand, no Property Taxes have been paid for 2010 and the Minister of Finance has given property-owners a waiver for this year. That waiver amounted to over $140M and it remains unexplained.

There have recently been advertisements seeking details from property owners to update the database for Lands & Buildings Taxes, so it seems that some further revisions are to take place.

For me, the key point at which we lost our way in the UDeCOTT/HDC/NIDCO bobol, was the crossroads of the Investment Decision.

For me, the key point at which we lost our way in the UDeCOTT/HDC/NIDCO bobol, was the crossroads of the Investment Decision.

That Investment Decision is an indispensable part of any rational process of development, for families, businesses and countries alike. The national level is my concern and there must be broader considerations in making those decisions.

It is clear from the depth of the failure, that the last administration lost its way completely, insofar as elementary concepts such as opportunity cost, payback periods, cost-benefit analysis and so on. We have only now begun to scratch the surface in terms of understanding the extent of the losses and corruption – readers, please be reminded that as yet, we have no accounts for UDeCOTT or HDC for several years. In normal business thinking, the failure to publish accounts without even an attempt at an explanation is tantamount to an admission of the most serious problems. Only State-owned organisations can get away with that kind of irregular conduct, which is maybe why they do it.

My concern in this article, is that apart from the Investment Decision in the case of specific projects, the State has an obligation to consider the wider picture in terms of fine-tuning, timing and phasing those projects. Our last land-use plan in our country was approved by the Parliament in 1984 and we have had several fruitless attempts to revise that plan.

The focus here is on the need for a proper practice of integrated planning, in particular long-term land-use and town-planning. By integrated planning I am speaking to an approach which takes account of varying principalities, such as land-use, financial constraints and national targets. In addition, the approach allows a balance to be struck between the competing demands within various time-horizons, such as immediate demands, medium term demands (say, 10 to 20 years) and longer-term considerations.

Lack of an updated national Land-use plan

As I wrote in the Business Guardian of 9th October 2008 –

“The Minister of Planning, Housing and the Environment spoke at a breakfast meeting of the Couva/Point Lisas Chamber of Commerce on September 10, and some of her reported comments deserve our close attention.

The minister told her audience that the National Physical Development Plan was passed in 1984 and had been continually updated, but that “that plan has somehow never reached to Parliament.” Somehow. The mind boggles.

One report said, “Dick-Forde said the external and internal committees on national development were working towards the completion of the National Development Plan, which will be taken to Parliament in the next two years.”

When this tidal wave of development is at an ebb, we will then have a plan tabled in Parliament for discussion. To what end?” see http://www.newsday.co.tt/politics/0,85974.html

Given the last Minister’s stated timetable, we ought now to be having a draft plan published for consideration. Where is this, Minister King? When do the consultations start?

Transportation planning

This is a vital, related area and Minister of Works & Transport, Jack Warner, told us that the PNM government paid $21M for an incomplete Comprehensive National Transportation Study (CNTS) – see http://guardian.co.tt/news/general/2010/10/09/warner-pnm-paid-21m-non-study – and I agree. That fact only makes the situation more doubtful, since we seem to be making major transportation system decisions in the absence of a strategic plan.

Just consider –

…We all know how difficult it is to access Maracas Bay through the North Coast Road.

Currently, it takes approximately 45 minutes to get from Santa Cruz to Maracas Bay. Furthermore, landslips on the North Coast road are a major deterrent to persons wishing to access this scenic route for pleasure or business. As a result we will do a business plan for a new: ‘Connective Development Project’. This project would create an underground tunnel from Maracas Valley to Maracas Bay, to enable quicker access to the North Coast…

That strange project was then taken up by Warner at length – see http://guardian.co.tt/news/general/2010/09/26/warner-s-tunnel-take-next-year

Sewer Treatment plants and the threat of cholera

We recently had shocking stories about the leaking of significant amounts of untreated sewage into the Maraval reservoir – see http://guardian.co.tt/news/general/2010/11/19/wasa-boss-moka-residents-must-pay-repair-sewerage-plant. That is no surprise, given the widespread practice of property developers walking away with their profits in hand upon completing the sales of their properties, but with no proper plan for the maintenance of the sewer treatment plants.

Once again, this is an area which urgently needs to be addressed in terms of town planning, local health, WASA regulations and adequate financial mechanisms for ongoing maintenance of these facilities.

The Housing Development Corporation (HDC)

The HDC’s new target for 2011 is 6,500 new homes and that is still a huge number. Given our limited land resources and the absence of a national planning framework, how is this to proceed?

The HDC’s new target for 2011 is 6,500 new homes and that is still a huge number. Given our limited land resources and the absence of a national planning framework, how is this to proceed?

There remains the unanswered question as to what is the basis for these decisions?

The Limits of our financial resources

The Minister of Finance recently called for Ministries to not implement any new large projects, due to the financial limits constraining state expenditure – see http://www.newsday.co.tt/news/0,129148.html. That is a valid call, which shows that the time is ripe for us to plan our major strategies and projects so that they can conform to some sort of national context.

That context would have to include elements such as land-use, transportation implications, financial limits and the question of the capacity of the economy to meet the targets being set.

The question of fuel subsidies is an important part of this integrated planning discussion, since, at approximately $2.8Bn, they are a large part of our national expenditure. More to the point, the effect they have on our behaviour is largely unremarked, which is paradoxical – the gas price being so low that we do not really consider it in our daily choices.

It is a classic example of the sort of ‘policy silos’ which the integrated planning approach seeks to overcome.

The Minister of Works & Transport speaks out strongly against the heavy subsidies necessary for the operation of the Coastal Water Taxis – no statement from Warner on the larger sums spent on the fuel subsidy. The Minister of Energy, in the run-up to the budget, says that these fuel subsidies may need to be reduced. The Minister of Finance, in his budget address, said –

“…The largest Subsidy is on petroleum products, particularly gasoline which usually represents one to two percent of GDP per annum. All of our citizens benefit from this subsidy. It is often difficult to determine whether resources are being used wisely to achieve the intended objectives of subsidies. We are currently reviewing whether alternate options are more efficient…”

We need to develop a holistic view of the various subsidies being paid in our economy and transportation subsidies, including fuel, are important considerations.

The goal of promoting the wider use of public transportation has to be adopted with some vigour and creativity. The fuel subsidies enjoyed by small vehicles – say, less than 12 passengers – should be gradually reduced with a shift of those subsidies to larger-capacity vehicles. They make more efficient use of our limited roadways and would reduce the adverse effects of traffic and pollution.

The three Ministries concerned should join with the Ministry of Planning in mapping out these strategies and policies.

The strategic goal should be to decrease the convenience of individual car-journeys and increase the convenience of the mass-transit approach.

It is no easy shift to go from today’s congested reality to the medium-term goal of a much-improved transportation system with travelers having several choices. That journey would involve a virtual culture-shock for most of us, but it is one we should start, sooner than later, for our common good.

That is one of the examples of how an integrated planning approach can offer fresh solutions to serious problems.

The Code of Silence has formed the subject of several columns in this series.

I am referring to the unwritten agreement amongst the leadership group in our society to maintain silence in matters of white-collar crime. The guiding principle of the Code being that the members of that group must never be exposed to the same scrutiny and penalties as the common criminal.

That Code of Silence is poisonous to the progressive development of our society. Unless we can bury the notion that white-collar crime pays, our society is doomed to lurch from crisis to crisis. White-collar crime will never be truly challenged until the Code of Silence is tested to destruction. I welcome anything which would dismantle the Code of Silence. Literally anything.

The Commission of Enquiry into the various financial collapses which have beset us – Clico, British-American, Clico Investment Bank, Caribbean Money Market Brokers, the CL Financial group and the Hindu Credit Union – was announced by the Prime Minister in her 1st October address to Parliament.

On 17th November, Sir Anthony Colman QC was sworn in as the new sole Commissioner – he replaced the original choice – Sir Gavin Lightman QC, who had an apparent conflict of interest. The Secretary to the Colman Commission is Judith Gonsalves, who served the Uff Commission in that role. It is reported that Colman intends to hold open hearings and that those should start sometime in this month.

So, we are seeing three powerful channels emerging –

So, what is the likely effect of these lawsuits and the oncoming Colman Commission of Enquiry on the entrenched Code of Silence in our society?

To begin with, I expect a series of legal challenges to the very hearings of the Commission, with the likely grounds being the long-established principle that no person should suffer ‘double jeopardy’, in terms of two sets of charges to be answered. It will be an attempt to completely derail the entire Commission of Enquiry.

I would not be very surprised if certain state agencies also sought to shut the enquiry down. That would be a repeat of the unprecedented recent situation in which UDeCOTT went to court to challenge the Uff Commission.

The beneficiaries of the Code of Silence will make great efforts to avoid any deep examination of its members and the public needs to be alert to this point. There is absolutely no shame in that group and we should also prepare ourselves mentally for the ‘memory loss’ defence of the kind we saw from Hafeez Karamath in the recent Uff Commission.

After generations of operating unexamined, the very bowels of the society’s leaders are about to be opened up to a disgusted and skeptical public. The motivations, links and payoffs between these leaders are to be exposed to view. The exposure is going to be critical. Given the speed with which our legal system operates, the exposure is likely to be lengthy. Given the range of active media in our society, the details are going to be all over the place.

So, what is at stake here? What else can we expect, apart from legal challenges?

To begin with, I believe that the sums of money involved are several times more than in the Uff Commission. In addition, the slowing economy and the pattern of behaviour have set the public into a very critical mood.

In my view, these are some of the people we would see publicly cross-examined in the Commission of Enquiry and various lawsuits –

Most important of all, the Chief of Chiefs, Lawrence Duprey – Will he or won’t he show up for the many hearings? What can we expect to hear? Can Duprey offer an explanation for the shocking discrepancy between the $100BN+ asset valuation as at the end of 2007 and the $23.9Bn asset value he specified in his letter of 13th January 2009 to Ewart Williams? A mere 56 days separate the publication of those 2007 accounts – on 18th November 2008 – from Duprey’s letter, which has been hidden from view, despite my two Freedom of Information applications. The only reason we have some idea of this discrepancy – no…that is the wrong word, maybe staggering decline is better – is the anxiety of the then Minister of Finance to clear her name from allegations of Insider Dealing. That anxiety led the Minister to read this letter into Hansard on 4th February 2009.

Second most important of all, the Chair of Chairs, Andre Monteil – Monteil is now in retirement as a farmer and his testimony is surely one of the most awaited in recent times. As former PNM Treasurer, CL Financial Group Finance Director, Chairman of Education Facilities Company, National Housing Authority, then Housing Development Corporation and Clico Investment Bank, it is difficult to imagine a player who was more central. It is almost like a spy movie called ‘The Man who knew Too Much’.

Patrick Manning – When one considers the huge donations reportedly made by CL Financial to the PNM and the tangled web of this entire affair, it is difficult to see how Manning can escape serious, hard questions on many aspects. For instance, his 2002 decision to stop enquiries into HCU by then Minister in the Ministry of Finance, Conrad Enill, will surely be open to question. Manning’s recent bizarre behaviour might well be the beginnings of a defence. We will see.

Karen Nunez-Teshiera – The Minister of Finance who had to go to Parliament twice to attempt to clear her name in this matter. Firstly, from allegations that she withdrew her money from CIB early, having had inside information. Secondly, from allegations that as a CL Financial shareholder, she was biased in her dealings with the bailout, having failed to recuse herself from the discussions. Not one person I know, even blindly-loyal PNM-ites, is willing to openly defend the behaviour of Nunez-Teshiera. Not one. Imagine that. I think the phrase is “…A jury of one’s peers…” I wonder whether her Cabinet colleagues knew that the Minister was a shareholder? We won’t have to wait long.

The Regulators – from both the Supervisor of Insurance, and the Inspector of Financial Institutions, Carl Hiralal. Just imagine the Supervisor explaining how Clico kept its licence all those years its statutory fund in serious shortfall. Or the Inspector justifying how CIB can fail to file its tax return and yet keep its licence. Mr. Hiralal must be considering his position most carefully at this point.

Central Bank Governor – Imagine Ewart Williams reconciling his several statements on Clico being a problem case since 2004, with his having two fixed deposits at CIB. Williams must also be having a few reflective moments.

Robert Mayers – When he retired on 7th December 2008, did he or did he not know that Caribbean Money Market Brokers (CMMB) was heading for a financial collapse? Of course, we now know from the official statements that CMMB collapsed a mere 7 weeks after Mayers left office as its Managing Director. So, which is it to be? Is it that the collapse came like a bolt of lightening from a clear blue sky? Were there any warning signs? Do CMMB’s accounts give any clues?

Dr. Bhoendradatt Tewarie – He is former principal of UWI’s St. Augustine campus and now heads UWI’s Institute for Critical Thinking. Dr. Tewarie was a Board Director of the parent company, CL Financial, at the time of the collapse. Was he aware of Duprey’s letter to the Central Bank Governor, a mere 3 days before that Board authorized payment of a dividend to CL Financial’s shareholders?

The members of that Code of Silence are probably considering how best to escape the consequences of their actions and inactions. It will be a truly unique Christmas season for some of them. There are probably not enough lawyers in the country to handle this tidal-wave of legal actions.

The stakes are huge and the burning question for me is – Can this be the first time that prominent people go to jail? Serious sentencing? Will any stolen monies be recovered?

Can the Code of Silence survive this challenge?

The Code of Silence must be destroyed if we are to progress.

Take a read at his comprehensive website including his CV. http://www.siranthonycolman.com/

The new situation is charged with peril and one is reminded of Naipaul’s father, the intrepid journalist from A House for Mr. Biswas whose favourite tagline was “…amazing scenes were witnessed…”

The new situation is charged with peril and one is reminded of Naipaul’s father, the intrepid journalist from A House for Mr. Biswas whose favourite tagline was “…amazing scenes were witnessed…”

Finance Minister, Winston Dookeran, addressed Parliament on the Finance Bill (No. 2) 2010 on Wednesday 24th November. It was a lengthy and detailed statement, which put things into a necessary perspective. For me, it was important that Dookeran gave priority to the claims of the contractors and of course, the last item being the claims being made by the various groups representing Clico policyholders.

The Finance Minister held his position as set out in the 2011 budget, which was no surprise when one considers his statement that the various submissions received from the policyholders’ groups did not withstand scrutiny. I only had two significant concerns in terms of outstanding items which require proper attention.

…Clauses 2.3.3 and 2.3.4. of the SA, require the outgoing CL Financial chiefs to render all assistance to the incoming Board and Management in terms of all records and accounts etc. The question here is ‘Have the new Board and management been receiving the full assistance of the previous CLF chiefs?’ If not, what is being done about it?…

The immediate statements of the Clico Policyholders’ Group (CPG), which targeted Dookeran, are a perturbing sign. For whatever reason, the CPG is ignoring the settled principle of Cabinet’s collective responsibility. That stance seems to be detrimental to effective negotiation and I am beginning to wonder if some person or persons in the Cabinet is ‘giving them basket’.

The threatening statements from the CPG as to the damage their proposed lawsuit can do to our country’s economy are nothing less than scandalous. We are now witness to a grim game of brinksmanship.

We have all heard the arguments and rumours surrounding this bailout, so no point repeating those. It certainly seems that those are going to be ventilated in a high-profile series of lawsuits. I only hope that the hearings remain open and do not take place in a sealed Court. That is what happened in the very first lawsuit after the bailout, in which the Central Bank was attempting to get CL Financial to comply with the terms of the bailout. The stakes are too high now for any concept of privacy to prevail in this matter.

The Minister of Finance also announced that the conditions under which the financial relief would be offered were being considered and it is good to know that there is to be no unconditional relief at our collective expense.

My thoughts on that aspect are that the State must conduct itself in an exemplary fashion and not be placed at any further disadvantage, having already shouldered this enormous, exceptional payout.

There are now anti money-laundering (AML) laws which require depositors to make declarations as to the Source of Funds, all in an effort to prevent the proceeds of crime from entering the legitimate economy. In my view it is necessary for the government to be satisfied that the various sums being claimed by these policyholders were properly declared under the AML laws. We have had shocking reports about the elementary management controls which were either absent or awry in the CL Financial group, so it would not surprise me if their AML-compliance was lax. That needs to be thoroughly checked. It would not be acceptable for our taxpayers’ monies to be used to rinse ‘dirty money’.

Also, the claimants who owe on their taxes – VAT, PAYE, Corporation Tax, Income Tax and so on – should not be refunded. As Dookeran said in that address, if everyone paid the taxes due, our budget would not be in deficit. We cannot go deeper into deficit without these elementary precautions being taken.

Finally, there is the issue of the many borrowers from Clico, British-American, Clico Investment Bank (CIB). In the case of CIB alone, we are told that about $1.0Bn of those loans are ‘non-performing’ – which means that the borrowers are not repaying their loans. It would be perverse for some of those non-performing borrowers to receive refunds from the State. This is a live part of this situation, since in the case of CIB itself, the very Inspector of Financial Institutions swore in his affidavit filed in the winding-up action for that failed bank –

…With respect to the Creditors of the Petitioner, the Petitioner has met the statutory obligations for the Board of Inland Revenue (except for Corporation Tax Returns for 2007, 2008 and 2009 which are being prepared and remain outstanding)…

That is a glaring example of the kind of wanton wrongdoing at the heart of this mess. CIB fails to file its Corporation Tax returns for three years, yet keep their banking licence and arrange for the taxpayer to bail them out when it all goes sour.

Some claimants may try to invoke the ‘corporate veil’ to shield themselves from various breaches committed by their companies, but this is an exceptional situation in which the State is making an offer. In my view, the corporate veil ought properly to be ignored, so that the long-standing commercial principle of ‘set-off’ can be applied to the claimants.

The Colman Commission of Enquiry and its effects on the Code of Silence will be my next topic.

The recent series of changes at CNMG have sparked a series of evolving discussions. I was one of the three people ‘let go’ from CNMG and that was reported briefly on my blog.

The recent series of changes at CNMG have sparked a series of evolving discussions. I was one of the three people ‘let go’ from CNMG and that was reported briefly on my blog.

I am starting to reflect on some aspects of all this recent interest, but no, this not an anti-PP column or one about how wicked politicians are and so on.

What kind of talk is that?

The first thing that occurred to me is how the media conversation has blown up in sheer size and how that has had an effect on the quality of our national conversation.

In the so-called ‘good old days’, before the shift I am about to describe, the only people who really had a voice in our society were those who were approved, such as government ministers and their spokespersons, established journalists, the ‘great and good‘ and of course the brave and imaginative ones who were our activists. In fact, the last-named group were the voice of the voiceless, who fought to uplift our society. Of course in that group you would have to include the leading calypsonians and ‘troublemakers’ of their era.

From its beginnings about 20 years ago, we have moved far from the post-independence period in which the voices heard on the national media of Radio and TV were very limited. The NAR regime 1986-1991 decisively brought that to an end with the grant of more broadcast licences and the real birth of ‘talk radio’.  TV call-ins soon followed and of course, the internet/email broke onto the scene in the mid-1990s. The final stage in this progression is the growth of new-wave social media – such as Facebook, YouTube, Twitter etc. – to the point where they have now eclipsed the older formats like web-pages.

TV call-ins soon followed and of course, the internet/email broke onto the scene in the mid-1990s. The final stage in this progression is the growth of new-wave social media – such as Facebook, YouTube, Twitter etc. – to the point where they have now eclipsed the older formats like web-pages.

As a result of all that, we now have many people, who never had a voice as individuals, being able to project their ideas onto a huge stage. That is literally unprecedented. The new conversation has opened up serious new challenges and opportunities.

One of the most detrimental of our habits is mauvais langue – just plain bad-talking people behind their back, but not showing it when you meet those same people. As young people would say – Pure hate, just acting normal.

I hold the view that mauvais langue is the biggest cultural obstacle to our development as a nation. I say that because it is my view that without an open exchange of ideas, the possibility of change is very limited. In this new situation, someone can add a mischievous or irrelevant comment to the discussion, without ever identifying themselves or backing-up what they are saying. As a result of those possibilities and its combination with our habits, we now have most of our blog commentators and callers-in choosing to remain anonymous.

But what are we saying to each other? The essential message of a large number of the comments on these T&T blogs boil down to ‘Shut Up…I don’t agree with you and don’t want to hear what you have to say…Go away!‘ Our new national conversation is on a huge scale and on a range of issues which is extremely fertile, but the dominant habits of that conversation are perturbing.

To be fair, there is a solid body of research to show that anonymous conversations of this type are extremely effective at finding-out the views of the public, workers or customers. Indeed, this social media is now a very important part of how progressive states and corporations take their bearings as to where things stand.

One important difference I have seen is that the blogs for newspapers and news-sites in the advanced world have almost no anonymous content – people actually write as themselves.

More to the point, we have a situation where we have embraced the new situation and its possibilities, while our leaders and organisations lag far behind. Just as an example, the website for the Prime Minister is http://www.opm.gov.tt/ – the last officeholder had no publicly-available email address and that website is now temporarily offline, being under re-construction.

More to the point, we have a situation where we have embraced the new situation and its possibilities, while our leaders and organisations lag far behind. Just as an example, the website for the Prime Minister is http://www.opm.gov.tt/ – the last officeholder had no publicly-available email address and that website is now temporarily offline, being under re-construction.

There is also the secondary aspect of all this, the essence of our commitment to a free press. Of course, I am talking about the silence of Newsday – ‘The People’s Newspaper which offers daily news from Trinidad & Tobago’. There was a huge response to the news on Monday 8th November, that Fazeer Mohammed was removed from CNMG’s morning line-up. I think that article in the Express of the next day had over 825 comments – which must be some kind of local record. It is staggering to me that Newsday had nothing to say about this, until the Thursday after, even as a pure item of news. Just unbelievable.

It is easy to criticise the politicians and their mistakes, but this silence by Newsday is just another level of irresponsibility which would make any right-thinking person pause. Newsday have their own patchy track-record in that they forced-out Kevin Baldeosingh over his challenge to Fr. Henry Charles for plagiarism. The parliament discussions on Friday 12th and the news releases from both the Media Association of Trinidad & Tobago (MATT) and the Congress of the People (CoP) formed the basis of articles on the issue from Thursday 11th. Given that behaviour it is interesting to watch them, as The People’s Newspaper, minimizing a matter of such great concern to so many people. A matter concerning an apparent threat to freedom of the press.

It is easy to criticise the politicians and their mistakes, but this silence by Newsday is just another level of irresponsibility which would make any right-thinking person pause. Newsday have their own patchy track-record in that they forced-out Kevin Baldeosingh over his challenge to Fr. Henry Charles for plagiarism. The parliament discussions on Friday 12th and the news releases from both the Media Association of Trinidad & Tobago (MATT) and the Congress of the People (CoP) formed the basis of articles on the issue from Thursday 11th. Given that behaviour it is interesting to watch them, as The People’s Newspaper, minimizing a matter of such great concern to so many people. A matter concerning an apparent threat to freedom of the press.

We have to be honest and admit that a significant part of the national conversation is the impatient snarl to ‘shut-up’ the person we do not agree with. That tendency has borne some strange fruit in the case of Newsday and Fazeer.

Yes, I think Fazeer was forced-out too – given his popularity, it all seems very wrong-headed to me. At several levels, but the pregnant question here is how come the State owns companies which are in competition with private ones. The notion of the State Enterprise was originally one which performed some specialist task which the private sector did not provide, but the discussion is an involved one.

One of the criticisms of our State Enterprises is that in significant cases, they they are in competition with private business interests. For example, First Citizen’s Bank, Udecott, HDC, EFCL and so on. Of course the closest example of this is CNMG. Ironically enough, the Special Purpose Entities/State-owned sector were the topic of my last show on CNMG and we did discuss this issue of competition.

So, exactly why does the State own CNMG? How fair is it for the other media houses to have to compete with a State-funded entity? In my view, CNMG had established a solid reputation as a topical and fearless current affairs and news source. Of course, all of this is going to damage the brand, so its private sector rivals would be smiling to themselves.

Returning to one of my earlier discussions on the ‘Two Tendencies‘ – published in this space on 16th May 2010 – it seems clear that these are a big part of this story. The first tendency is to say that our State Enterprises are too important to be run by anyone but the best people. The second tendency says that, having won an election, all these bodies are ours to command and that is all. The second tendency can distort good sense and professional standards to the bizarre extent we saw in the Udecott case. This case of the Fazeer Mohammed ‘re-assignment’ is definitely one in which both tendencies have battled it out on the blogs and the airwaves.

It is unlikely to be settled anytime soon.

The big questions for me are –

This is the letter CNMG sent to discontinue the two programmes I was contracted to do with them – a weekly editorial on Friday mornings and a one-hour current affairs program on alternate Sundays . It was FAXed to me at 16:13pm on Thursday 4th November, but backdated to 1st November.

This is the letter CNMG sent to discontinue the two programmes I was contracted to do with them – a weekly editorial on Friday mornings and a one-hour current affairs program on alternate Sundays . It was FAXed to me at 16:13pm on Thursday 4th November, but backdated to 1st November.

So, let us see…

All to say that nobody was fired, is just that a number of people are no longer there, but no one was fired and more to the point, I see a report in this morning’s Express newspaper that Ken Ali said “I really have nothing more to say to the media on this matter.” I could scarcely believe what was on the page before me and hopefully there is a misprint.

Ken, please do confirm to us that you did not say that…

Afra Raymond sits with guests Martin Daly, SC; Conrad Enill, former Minister in the Min. of Finance; and Richard Joseph of Trinidad and Tobago Transparency Institute to discuss the topic, “State-Owned Entities: Taking Stock”. Video courtesy CNMG

We are now entering a bizarre endgame in this rounds of musical chairs. The children’s game has returned for us adults, but with a vengeance.

As I wrote on 10th September in this space, the real question is ‘When exactly did the CL Financial group collapse?’.

To understand this huge matter we need to put things in the correct order –

What did they know and when did they know it?

There now appear to be at least four groups representing these investors –

Some of the positions being taken by the various groups are indicative of the degree of desperation of the parties, hence the title of this article. The general view emerging from these groups seems to be that the CL Financial group is basically healthy and profitable, so there should be no issue about returning their investment.

I do not know what those views are based on and it is impractical to continue basing our discussions on the series of rumours and draft reports and suchlike. We need good quality information to make a quality decision and that is not negotiable. We need to insist on that as a minimum.

After the first round of organizing and attorneys’ letters, followed by the Prime Minister’s important address on 1st October, we are now into what appears to be an even stranger place.

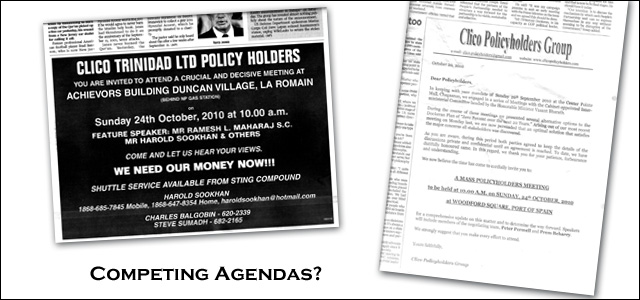

Two of the stranger proposals emerging from the CPG’s Port-of-Spain meeting on 24th October were –

It may all just be a series of negotiating positions, but it seems pretty clear that no one from these various investors’ groups intends to take a discount or ‘haircut’ on the monies owed to them. The unstated assumption is that if someone has to stand the bounce or take a haircut, that someone must be the taxpayer. That could never be the correct position. So, we need the facts.

The most startling development is the Central Bank’s full page adverts on Thursday 28th October, repudiating the claims that it had offered any guarantees in this situation. The reaction was immediate, with the CPPA publishing large adverts in opposition the next day and a new anti-bailout group emerging for the first time – at last! The CPG’s response was a nadir in their campaign, with the Trinidad Guardian reporting that – “…Permell went on to say that they do not care where the Central Bank gets the money from once they guarantee the policyholders’ contracts…” – I could scarcely believe what was on the page before me. Even the most militant Trade Unionists use more reasonable language.

Which brings us right to the meat of the matter, the order of things. What is the reason that the investors’ groups are now at the front of the line for assistance from this government? I could be wrong, but it is easy to get that impression when one hears of Cabinet discussing the matter twice in one week, certain groups giving threatening timetables and so on. I do not know if our Cabinet – PNM, UNC or PP – has ever given such a total priority to any matter in the past.

There are other claims on the limited monies available to the State. All of those claims existed before these investors groups. All.

Many people have poor water supply. Outstanding payments to contractors and suppliers are in excess of $7.0Bn, according to Central Bank estimates. Insufficient money for OPVs – the estimated cost of $3.0Bn is too much for the country to bear, so national security is falling behind. More guns and drugs entering our homeland. Public Servants claims are about $3Bn and that is also a strain on the Treasury. Not enough police cars. Sad situation in the public hospitals.

The CPG issued a 2 page advert in the Guardian on Thursday 4th November and it deserves careful reading. It was good to see their call for the publication of the correct financial information before making a decision. They set out their proposals for the relief of CPG members – those are the latter of the two above, with the added condition that they be given two seats on the boards of CL Financial and Clico.

The CPG claims that its proposals place no additional burden on the taxpayers, which is a good thing, if that is truly so. The CPG’s proposals are silent as to how the monies already spent are to be recovered.

The real test will be if the accounts and asset valuations reveal the group to be insolvent. Will the various investors’ groups accept that or are we in for a long, bitter fight?

The Attorney General recently announced that he had withdrawn Sir Gavin Lightman QC as the sole Commissioner, due to an apparent conflict of interest. Lightman had appeared for Clico in a 1991 court case and the PNM did well to have stopped this before it went too far.

Two important further points, though –

Last week I wrote about the Code of Silence observed by our ruling class. I gave examples to support my idea, but there was not enough space to mention everyone.

The Bankers Association of Trinidad & Tobago (BATT) and the Association of Trinidad & Tobago Insurance Companies (ATTIC) are also part of the situation.

The Bankers Association of Trinidad & Tobago (BATT) and the Association of Trinidad & Tobago Insurance Companies (ATTIC) are also part of the situation.

We have a long history of our rulers making huge, stupid, destructive decisions without any commitment to transparency or accountability. That lack of transparency is what allows corrupt to flourish. We can never eliminate corruption, but if we are serious about reducing it, we need to proceed differently.

Maybe, just maybe, this is the kind of colossal event which could force some of us to drastically change our ways, despite the positions we now assume. This is a moment of national peril and the continued observance of the Code of Silence is going to cost our country plenty money.

As it is, we already have been bound to a rotten bailout of the wealthiest individual in the Caribbean by our Treasury at ZERO interest. Anybody looking to set up a small business has to face the bank and pay interest. None of that for Lawrence Duprey and the CL Financial chiefs. They have been able to enrich themselves and when the entire thing went wrong, they were able to negotiate a handsome handshake for themselves and then leave the mess for our government to clean-up.

As it is, we already have been bound to a rotten bailout of the wealthiest individual in the Caribbean by our Treasury at ZERO interest. Anybody looking to set up a small business has to face the bank and pay interest. None of that for Lawrence Duprey and the CL Financial chiefs. They have been able to enrich themselves and when the entire thing went wrong, they were able to negotiate a handsome handshake for themselves and then leave the mess for our government to clean-up.

That is the plain meaning of the bailout. Is not policyholders we bailing-out, is the richest, smartest characters in the country. The bailout script is unfolding so well that almost the entire discussion is now about the fairness/unfairness of the government’s position with respect to retired policyholders etc.

Real Anansi antics.

The CLICO Policyholders Group (CPG)

There was an EFPA group and a CLICO Policyholders group formed just after the budget on 8th September, but they soon merged under the latter name. I am now seeing what appears to be a substantial split with 2 competing meetings being organised for 10am today – one in Port-of-Spain and the other in San Fernando.

There was an EFPA group and a CLICO Policyholders group formed just after the budget on 8th September, but they soon merged under the latter name. I am now seeing what appears to be a substantial split with 2 competing meetings being organised for 10am today – one in Port-of-Spain and the other in San Fernando.

The CPG group has been very successful at getting their views known and making the media circuit, with the eventual meetings with the advisory group set up by the PM.

The main concern being advanced by the CPG is for the recovery of the funds deposited with CLICO and there has been no reply whatsoever to the point that, despite its labelling, the EFPA was largely sold and understood as a deposit. The accounting rule of thumb as to ‘substance over form‘ in interpretation is an irrefutable part of the debate on this, but CPG have been silent on this point.

Almost all the many people with whom I have discussed this issue, have been very plain in their language – ‘I had my money deposit with CLICO‘ and so on. But the word Policyholder is more likely to attract sympathy, so the games continue.

We already spent $7.3Bn in cash since the bailout was announced. Please note that nobody is even talking about how the State is going to recover that loan. The only talk is about how are they, the depositors, going to recover their monies.

There is a real principle of financial equity being shredded to pieces in the conduct of this bailout and it was disappointing that Mr. Dookeran, as an Educator in the field, did not take the opportunity to expand on this.

The intent is plainly to deprive the Treasury of its limited funds so that the assets of 15,000 people can be preserved.

So, What about those negotiations?

When the Prime Minister spoke on 1st October, she created an advisory group (headed by Minister of Food Production, Vasant Bharath) to meet with the policyholders to seek other options.

The Prime Minister was to meet with concerned persons and activists on Wednesday 7th October in Chaguanas, but that meeting was cancelled at short notice, with no alternative dates given.

What we are left with is lengthy, secret meetings to discuss the review of the bailout terms, with no concrete information emerging. That secrecy is totally unsatisfactory. It smacks of secret deal-making and does nothing to inspire the confidence which is supposedly the very purpose of this exercise.

The last regime, with all of their noble intentions and devout Ministers, lost their way in a morass of muddled purposes, secret deals, mixed-up with misleading and false public statements from the highest office in the land. We all know how that ended. The question is whether we have learned anything from that bitter experience. The Peoples’ Partnership were the main beneficiaries of those PNM errors, have they learned from that?

Our money is being spent on this massive exercise and it is not good enough to emerge from these closed meetings with agreed phrases like ‘constructive or meaningful’. This emerging pattern speaks of disrespect for the acumen of our people.

To re-state my equation:

Imagine these bold-faced people declaring that when they are done and settled, the terms will be announced to us who paying for the whole thing. The first sign of a bad marriage is when the husband is the last to know – some say, the wife. But the main point is that the public cannot be the last to know.

The simple and painful fact is that public confidence in our leaders is at an all-time low. The time-honoured notion that a leader is someone wiser, more mature, less reckless and of overall higher ideals has been tested to destruction by events. In this particular case, it is easy to understand the charged atmosphere, hence the need for extra ventilation and transparency.

I was recently emailed by a well-meaning group asking that I start setting out some ideas of how CLICO might be rescued and I had to remind them that without basic information, all we can do is argue emptily with each other. All to the amusement of the masterminds of this, the greatest economic crime in our nation’s history.

I was even ‘phoned, while writing this, by an acquaintance who is a leading member of the CPG to join him and an un-named UK guest in a TV studio on Monday morning to discuss all this. Yes, I dismissed the request – too much secret-thing for my taste – and challenged the caller to name the person, supposedly a top UK expert.

What would be ‘constructive and meaningful’ would be to publish these long-outstanding reports so that we in the public can inform ourselves on the vital issues –

The Mottley Report – There was a team of three advisers – Wendell Mottley, Colin Soo Ping Chow and Steve Bideshi – appointed to examine the CL Financial group and we need to know what were the findings of this group.

The Mottley Report – There was a team of three advisers – Wendell Mottley, Colin Soo Ping Chow and Steve Bideshi – appointed to examine the CL Financial group and we need to know what were the findings of this group.We have seen reports in the press about the very long Cabinet meeting on Thursday 21st at which the CLICO issue was said to be part of that agenda.

It would be totally unacceptable for a deal to be sealed without properly informing us, the taxpaying public, as to the true background.

The People’s Partnership has already distinguished itself, positively, by announcing Commissions of Enquiry into the attempted coup in 1990 and the Financial collapse (CL Financial and HCU). This is no time to get diverted into back-room deals.

I am working for betterment and from you, our elected rulers, I expect better.