Once again, controversial development proposals for Invaders’ Bay are back in the news. Those proposals of the Peoples Partnership government appeared to have stalled after the successful legal action taken by the JCC in 2012, but we are now hearing of substantial proposals from the PNM government. Some serious questions have to be answered so that the public can understand the situation.

Invaders’ Bay is a 70-acre parcel of State-owned reclaimed land south of the Movietowne/Pricesmart/Marriott complex near to the National Stadium in west POS. In August 2011, the Ministry of Planning and the Economy published a Request for Proposals (RFP) inviting offers to develop those lands by design, finance and construct proposals.

The entire RFP process was deeply flawed and strongly criticized by the JCC, the T&T Chamber of Commerce, the T&T Manufacturers’ Association and the T&T Transparency Institute, as well as the PNM, then in opposition. To make just one example, the RFP entries were judged in accordance with Assessment Criteria which were published a full month after the closing date. At the time, I labelled the entire scheme as possessing all the ingredients for corruption – see http://www.jcc.org.tt/invadersbay.htm – but most importantly, the RFP was issued in breach of the Central Tenders Board Act.

Continue reading “Property Matters – Invaders’ Bay Reboot”

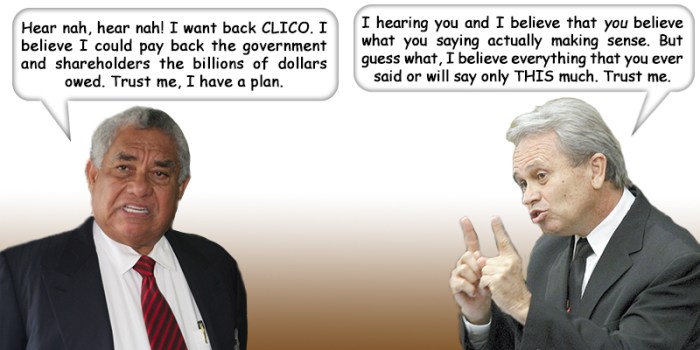

Afra Raymond is interviewed by Rennie Bishop on 107.7FM on Sunday 12, June 2016 to discuss the continuing CL Financial bailout after the intervention of Lawrence Duprey, and the Auditor General’s 2015 report.

Afra Raymond is interviewed by Rennie Bishop on 107.7FM on Sunday 12, June 2016 to discuss the continuing CL Financial bailout after the intervention of Lawrence Duprey, and the Auditor General’s 2015 report.

Afra Raymond is interviewed on the ‘The Power Breakfast‘ show on Power 102 FM by Rhoda Bharath and Richard Ragoobarsingh discussing the ongoing CL Financial bailout saga. 1 June 2016. Audio courtesy Power 102 FM

Afra Raymond is interviewed on the ‘The Power Breakfast‘ show on Power 102 FM by Rhoda Bharath and Richard Ragoobarsingh discussing the ongoing CL Financial bailout saga. 1 June 2016. Audio courtesy Power 102 FM