This is the time to reflect on the changes we have witnessed in the last year and the several challenges arising from those. This column will attempt to combine the ‘Property Matters’ concerns with the ongoing examination of the CL Financial fiasco.

The Uff Report

For me, the largest single event this year was the completion of the work of the Uff Commission of Enquiry into the Public Sector Construction Industry, with particular reference to UDeCOTT and the HDC. The controversial Commission of Enquiry was at the centre of widespread public concerns as to the level of corruption in the State construction sector. To his credit, the Enquiry Chairman, Professor John Uff QC, PhD, insisted that the proceedings be televised and the results of each day’s hearings were also posted to its website.

The Uff Report made history in this country, since it is the first time that a government has published the Report of a Commission of Enquiry. That is no small accomplishment and despite the fact that these massive wrongdoings took place under the last PNM administration, the act of publication has to be welcomed.

But there are still challenges, because, for whatever reason, the Uff Commission’s website, www.constructionenquiry.gov.tt has now been shut down, which is a real pity, since it contains the important testimony of many witnesses on the issues in this area. That website needs to be re-opened and I am calling on the Attorney General, under whose Ministry the Enquiry was operated, to ensure that takes place. It is no large expense to have these important documents made available to the public. In light of their educative content, I would suggest that the actual documents be housed at UWI, as they have a direct bearing on the deliberations of the Engineering and Social Sciences Faculties.

Of course we had the sight of a fleeing Calder Hart and a defeated Patrick Manning, his PNM cohorts drinking bitter tea for his fever, all attributable in my view to the groundbreaking Uff Commission.

Looking forward, we have the fact that the 91 recommendations of the Uff Report were adopted by the Peoples Partnership in the run-up to the 24th May General Election. We have now been promised that those are to be implemented by Minister of Justice, Herbert Volney. We await Volney’s early report as to the implementation.

In that connection and taking from the PNM example, I am, once again, calling for the publication of the report of the Commission of Enquiry into the Piarco Airport project. The Bernard Report must be published now.

CL Financial bailout

The other huge event of the year was the budget speech on 8th September 2010, in which Finance Minister, Winston Dookeran, disclosed publicly that he was revising the terms of the CL Financial bailout. That bailout was a hugely suspect act, the largest financial commitment ever undertaken in this country, without proper due diligence or even any proper ventilation in the Parliament. Our Republic had never been so financially violated and in broad daylight. It was encouraging to see the Finance Minister take the point to its logical conclusion and of course that brought about the large-scale organisation of various aggrieved groups to put their point.

The other huge event of the year was the budget speech on 8th September 2010, in which Finance Minister, Winston Dookeran, disclosed publicly that he was revising the terms of the CL Financial bailout. That bailout was a hugely suspect act, the largest financial commitment ever undertaken in this country, without proper due diligence or even any proper ventilation in the Parliament. Our Republic had never been so financially violated and in broad daylight. It was encouraging to see the Finance Minister take the point to its logical conclusion and of course that brought about the large-scale organisation of various aggrieved groups to put their point.

That series of organisations, committed to the doubtful mantra of the guaranteed investment – whatever that is – took on a series of bizarre and increasingly combative stances. The signature theme being that ‘We are not responsible for our decision’. We were being treated to a spectacle worthy of any of the ‘Ole Mas’ presentations of yore, in which successful investors – on average at least $700,000 was invested by each of these ‘protestors’ – having benefited from the operation of the capitalist system were seeking 100% redemption from the State.

The entry of the Prime Minister into this debate on 1st October was in my view a turning-point in our development. For the first time in my memory a politician, who had the majority, to achieve the significant changes which had been tabled, stepped back from that act of sheer power to attempt an act of persuasion. It was a signal lesson in the reality of possibility in our lifetime. Even if one is amongst the Clico Policyholders’ Group (CPG) and feeling aggrieved, the calm audacity of the Prime Minister’s decision must be respected.

Most importantly, we now have a one-man Commission of Enquiry established with the eminent UK jurist, Sir John Colman QC sworn in. That Commission is to examine the causes of the CL Financial and Hindu Credit Union collapses. The Colman Commission is expected to start sittings in January 2011 and the Attorney General has directed that its report be delivered in 6 months’ time.

The Manning Factor

The most comical event of the year is the bold-faced attempt by the former Prime Minister, Patrick Manning, to shift attention away from the PP’s revelations as to the illegal spying activities of various State agencies. Manning, the original PM, attempted to show-up the Prime Minister, Kamla Persad-Bissessar, with a series of allegations on the status of a house being built with private funds on private lands for a private purpose. The Prime Minister effectively dismissed Manning’s concocted concerns with the telling observation that all the refutations she quoted were available from the public record, if the accuser had ever been interested in examining that open source.

Having stirred to life and found his voice, it is important to note the several matters on which Manning maintains a stony silence –

- Calder Hart – Where is Calder Hart? The nation was told solemnly by Manning that he knewCalder Hart’s whereabouts and further, that Hart was not a fugitive. We are now told that Calder Hart cannot be located and Manning needs to speak on this. Is it true that Hart gave Manning his location? Has Hart changed locations? Or is it that Manning has not shared that information with the correct authorities?

- Election rationale – What, if any, was his rationale for calling the general election at mid-term? I am not sure that anyone knows the answer to this one, but it is surely of continuing interest.

- Guanapo Church – What is the truth behind the ill-fated Guanapo Church? It is not my habit to wax scriptural, but that was a ‘house built on sand’ if ever we saw one. The reason for the State Grant of this land and the rapid grant of full planning permission – a record of only one month between the date of application and the grant – remains unexplained. As for the architect’s plans for this huge church in the grounds of the PM’s residence, the mind boggles. Where is Pastor Pena? We need to insist that Manning tells us more about this miraculous church.

- Cleaver Heights – Another area is the wild allegation Manning made, at the close of the 2008 budget debate, as to a ‘missing’ $10M at an HDC project at Cleaver Heights in Arima. Or was it $20M? After inserting that case into the ongoing Uff Commission and having the embarrassment of having the allegation evaporate under cross-examination, Manning needs to tell us just how he came to learn of this allegedly missing money.

- CL Financial bailout – Manning’s conduct in this matter has been the crowning-point of his administration, in my view. The then Minister of Finance, Karen Nunez-Teshiera, was accused of using ‘inside information’ to make early withdrawals of her own funds from the CL Financial Group and to compound the mischief, being a shareholder of the CL Financial group in the sum of over $10M. Manning’s steadfast defense of his beleaguered Minister of Finance was a display of loyalty which is seldom seen in higher political circles. We need to know if the Minister told her colleagues that she was indeed a shareholder of the troubled group. Did she or did she not recuse herself from the Cabinet’s deliberations? My reading of the events, as told by the very Minister, is that she did not.

For Manning to fail to come clean on these questions, he would run the risk of damaging his hard-won reputation for upstanding values and leadership.

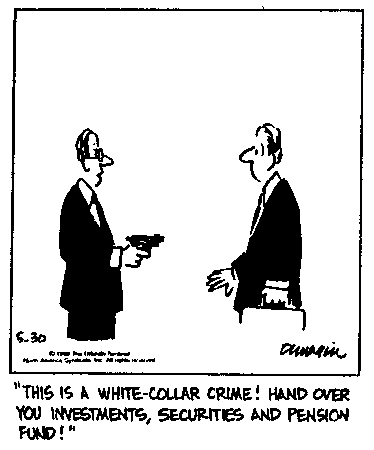

White Collar Crime

The obvious connection between these various events is the fact that White Collar Crime – which is sometimes, mistakenly, called victim-less crime – is afflicting our country in a big way.

The obvious connection between these various events is the fact that White Collar Crime – which is sometimes, mistakenly, called victim-less crime – is afflicting our country in a big way.

The year ahead holds significant challenges as we try to go forward in this morass, to escape the conspiracy which I have titled The Code of Silence.

The only way political rulers can carry on as they do, wasting the country’s money for the benefit of their friends and family, is because they are sure of each other’s silence. The people in the private sector who were responsible for the financial collapse are no different. The financial collapse is not, as some have falsely claimed, in any way connected with the Wall Street crisis. That is only a handy coincidence. If our regulators and politicians were doing their jobs we would not be in this position.

Please remember that the alarm bells on CL Financial were sounded by Trevor Sudama, since the 1999 budget debate. More to the point, many of the people who still inhabit the Parliament were there at the time. Again, I give this administration credit for appointing a Commission of Enquiry into this sordid affair.

Also, please remember that both UDeCOTT and the HDC failed to file accounts for years, in breach of the law and State guidelines. That failure was not remarked upon by members of the then Opposition. More to the point, we have now had a change in administration, with no word on the UDeCOTT accounts. I do acknowledge that certain HDC accounts have now been published and that is to be the subject of upcoming commentary.

The Code of Silence must be broken if we are to progress.

…The CMMB Group comprises CMMB Limited, CMMB Trincity and CMMB Barbados…Effective 2 February, 2009, the Bank assumed control of CMMB Securities and Asset Management Limited (CSAM)…

…The CMMB Group comprises CMMB Limited, CMMB Trincity and CMMB Barbados…Effective 2 February, 2009, the Bank assumed control of CMMB Securities and Asset Management Limited (CSAM)…

The new situation is charged with peril and one is reminded of Naipaul’s father, the intrepid journalist from A House for Mr. Biswas whose favourite tagline was “…amazing scenes were witnessed…”

The new situation is charged with peril and one is reminded of Naipaul’s father, the intrepid journalist from A House for Mr. Biswas whose favourite tagline was “…amazing scenes were witnessed…”

The Bankers Association of Trinidad & Tobago (BATT) and the Association of Trinidad & Tobago Insurance Companies (ATTIC) are also part of the situation.

The Bankers Association of Trinidad & Tobago (BATT) and the Association of Trinidad & Tobago Insurance Companies (ATTIC) are also part of the situation. As it is, we already have been bound to a rotten bailout of the wealthiest individual in the Caribbean by our Treasury at

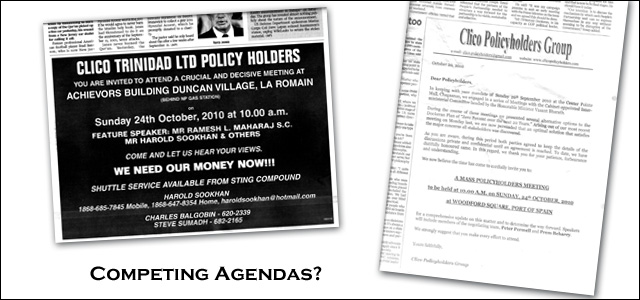

As it is, we already have been bound to a rotten bailout of the wealthiest individual in the Caribbean by our Treasury at  There was an EFPA group and a CLICO Policyholders group formed just after the budget on 8th September, but they soon merged under the latter name. I am now seeing what appears to be a substantial split with 2 competing meetings being organised for 10am today – one in Port-of-Spain and the other in San Fernando.

There was an EFPA group and a CLICO Policyholders group formed just after the budget on 8th September, but they soon merged under the latter name. I am now seeing what appears to be a substantial split with 2 competing meetings being organised for 10am today – one in Port-of-Spain and the other in San Fernando.

The Mottley Report – There was a team of three advisers – Wendell Mottley, Colin Soo Ping Chow and Steve Bideshi – appointed to examine the CL Financial group and we need to know what were the findings of this group.

The Mottley Report – There was a team of three advisers – Wendell Mottley, Colin Soo Ping Chow and Steve Bideshi – appointed to examine the CL Financial group and we need to know what were the findings of this group.

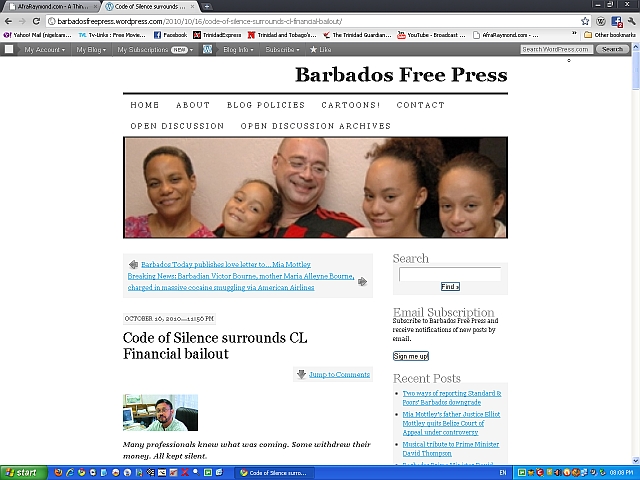

Throughout this series of articles on the CL Financial bailout I have touched on the existence and effect of a Code of Silence amongst our ruling elite.

Throughout this series of articles on the CL Financial bailout I have touched on the existence and effect of a Code of Silence amongst our ruling elite. This is one of the leading Professional Bodies and their silence has been deafening. The President of the Law Association is former Independent Senator, Sunday Express columnist and eminent Senior Counsel, Martin Daly. Daly is widely regarded as a fearless and irreproachable voice on many matters.

This is one of the leading Professional Bodies and their silence has been deafening. The President of the Law Association is former Independent Senator, Sunday Express columnist and eminent Senior Counsel, Martin Daly. Daly is widely regarded as a fearless and irreproachable voice on many matters.

The entire collapse is shot through with a failure of accountants at several levels and yet this professional body has been silent on all this. After ignoring my open letter and other attempts to start some dialogue on this, Anthony Pierre, ICATT’s President, agreed to appear on a TV interview with me on CNMG. That interview was broadcast on Sunday 26th September 2010 – it can be viewed at

The entire collapse is shot through with a failure of accountants at several levels and yet this professional body has been silent on all this. After ignoring my open letter and other attempts to start some dialogue on this, Anthony Pierre, ICATT’s President, agreed to appear on a TV interview with me on CNMG. That interview was broadcast on Sunday 26th September 2010 – it can be viewed at  There has been very limited engagement from UWI on this matter, which is a pity when one considers that the areas of study there include economics, finance, law, business management and accounting.

There has been very limited engagement from UWI on this matter, which is a pity when one considers that the areas of study there include economics, finance, law, business management and accounting.

Yes, the TTTI did make a strong statement calling for improved accountability in the bailout process. That is a Civic Society body doing its job.

Yes, the TTTI did make a strong statement calling for improved accountability in the bailout process. That is a Civic Society body doing its job. Robert Mayers was the former Managing Director of CMMB, who retired on 8th December 2008 – see

Robert Mayers was the former Managing Director of CMMB, who retired on 8th December 2008 – see  CIB was chaired by Mervyn Assam, recently appointed as a Special Ambassador with responsibility for Trade and Industry. Faris Al-Rawi, attorney-at-law, was a Director on that Board and he is now a PNM Senator.

CIB was chaired by Mervyn Assam, recently appointed as a Special Ambassador with responsibility for Trade and Industry. Faris Al-Rawi, attorney-at-law, was a Director on that Board and he is now a PNM Senator. Ian Narine, writing in the Business Guardian on Thursday 14th October –

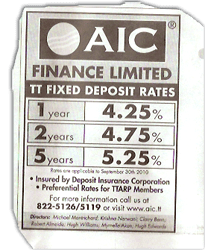

Ian Narine, writing in the Business Guardian on Thursday 14th October –  In the last part of September, AIC Finance has been advertising surprisingly high rates of interest in daily newspaper adverts which also offer ‘Preferential rates to Trinidad & Tobago Association of Responsible Persons (TTARP) members’.

In the last part of September, AIC Finance has been advertising surprisingly high rates of interest in daily newspaper adverts which also offer ‘Preferential rates to Trinidad & Tobago Association of Responsible Persons (TTARP) members’.

A version of this commentary appeared in print on October 17, 2010, on page A31 of the Sunday Guardian.

A version of this commentary appeared in print on October 17, 2010, on page A31 of the Sunday Guardian.

Amidst the raging debate on the rights of the disappointed depositors versus those of the anxious taxpayer, I am continuing to examine some more of the fundamental issues. Yes, I accept that there are depositors amongst the taxpayers, but those interests are not in alignment, hence the discussion.

Amidst the raging debate on the rights of the disappointed depositors versus those of the anxious taxpayer, I am continuing to examine some more of the fundamental issues. Yes, I accept that there are depositors amongst the taxpayers, but those interests are not in alignment, hence the discussion. That is the burning question at this time and a large part of the blame for the CL Financial collapse must lay with the regulators. In this case it seems that the Governor of the Central Bank and Inspector of Financial Institutions both have serious questions to answer. The situation is really too much to even imagine, but a few examples –

That is the burning question at this time and a large part of the blame for the CL Financial collapse must lay with the regulators. In this case it seems that the Governor of the Central Bank and Inspector of Financial Institutions both have serious questions to answer. The situation is really too much to even imagine, but a few examples –