In the next few weeks, this column will cover some of the issues which are likely to have a bearing on the 2012 Budget.

In my view the State and its Agencies must perform in an exemplary fashion if we are to progress. A good example is worth a thousand words.

At page 22 of the 2010-2011 budget statement, the Minister of Finance said –

…Mr. Speaker, no coherent, co-ordinated planning or strategy for state enterprises exists. As a result we have begun to rationalise the state enterprises, including the special purpose companies, which will incorporate a new accountability system that goes beyond the presently operating company ordinances. It is these loopholes in public accountability that resulted in the UdeCOTT scandal. This must never again happen in Trinidad and Tobago…

The Ministry of Finance has now published a new State Enterprises Performance Monitoring Manual 2011, it is over three times longer than the previous edition, so it will be something to consider in weeks to come.

Certainly, there are stricter requirements in relation to the filing of accounts – at pg 30 of the 2011 guidelines –

3.2.5 AUDITED FINANCIAL STATEMENTS

State Enterprises are required to submit the following:

- Audited Financial Statements (2 originals and 120 copies) to the Minister of Finance within four (4) months of their financial year end. These reports are to be laid in Parliament and subsequently submitted to the Public Accounts and Enterprises Committee for consideration;

- Copies of their Management letters issued by Statutory Auditors…

At pg 16 of the 2008 edition –

1.3.10 Publishing of Financial Statements by State Enterprises

Government has agreed that State Enterprises be required to publish in at least one (1) major daily newspaper a summary of the audited financial statements within four (4) months to the end of their financial year and a summary of the unaudited half-yearly statements within two (2) months of the mid-year date.

Such summary statements must be in accordance with the requirements of the Securities Industry Act, 1995.

The new guidelines appear to be stricter, but the requirement to publish to the press seems to have been removed.

There are swirling issues on this –

- No accounts for years – As I have pointed out before, some of the largest State Enterprises have published no accounts for years. UDECOTT and NHA/HDC are just two examples of this flagrant breach of the shareholders’ instructions as set out above. In the case of HDC, there is a greater concern in my view, since sections 18, 19 and 20 of the HDC Act require the audited accounts to be produced and published. Anyhow you try to spin it, those are terrible signs. For a private company to have no accounts, for even a few months, is indicative of poor performance at the very least. No accounts for years is unacceptable. One can only wonder how clearly could anyone plan if basic information is being obscured in this fashion. We expect better from the chiefs of these State Enterprises and certainly we expect better from the Peoples’ Partnership. In his preamble to the 2010-2011 budget, Minister Dookeran said –

…We must at all times remember who we work for. We must make Government work for the people. As our Prime Minister always says: serve the people, serve the people, serve the people…

- Serious debts outstanding – There are continuing reports, despite some efforts, that contractors, consultants and suppliers are owed substantial monies by State Enterprises for extended periods. That has a disastrous effect on our local economy both on an immediate tangible level and in terms of the more subjective element of confidence.

- Ambitious new projects continue to be announced, even as the basic accounts are incomplete and substantial bills remain unpaid.

Apart from the evident confusion, at the very highest levels of the State and Government, the unacceptable part is that there is not even an attempt to explain what is the hold-up or what areas of the accounts remain unresolved. The few times anyone in authority has attempted to explain the delays in those accounts, it has been a model of vagueness and ambiguity. That uncommunicative behaviour does not augur well. These State Enterprises are not building a wartime bunker or a new spy satellite, only new homes and offices.

But there is more, according to S. 99 (1) of the Companies Act 1995

- every Director of a company shall in exercising his powers and discharging his duties act honestly and in good faith with a view to the best interests of the company; and

- exercise the care, diligence and skill that a reasonably prudent person would exercise in comparable circumstances.

Those provisions make mismanagement of a company an offence. It is literally impossible to manage or direct the affairs of a multi-billion dollar company in the absence of audited accounts. So there must be serious concerns as to how the Directors of those State Enterprises without accounts could have properly discharged their obligations under S. 99 (1).

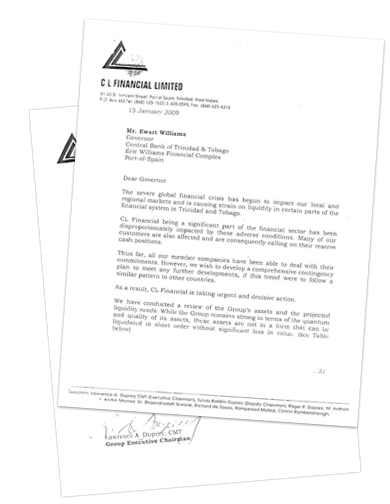

Apart from these points, there is now the fact that the SEC has made Orders in respect of Contraventions of the Securities Industry Act 1995 and the Securities Industry Bye-Laws 1997. Those Orders are in relation to the failure of these huge State-owned Enterprises to publish their accounts –

Apart from these points, there is now the fact that the SEC has made Orders in respect of Contraventions of the Securities Industry Act 1995 and the Securities Industry Bye-Laws 1997. Those Orders are in relation to the failure of these huge State-owned Enterprises to publish their accounts –

- 19th March 2010 against HDC, with fines totalling $121,000 – see http://www.ttsec.org.tt/content/pub100326.pdf.

- 15th June 2011 against UDECOTT, with fines totalling $120,000 – see http://www.ttsec.org.tt/content/Order-for-settlement-re-UDECOTT.pdf.

- 25th July 2011 against HDC, with fines totalling $400,000 – see http://www.ttsec.org.tt/content/Order-for-settlement-re-Trinidad-and-Tobago-Housing-Development-Corporation.pdf.

I was pleased to see the SEC taking this firm action against these offending State Enterprises, it is an important and necessary intervention. I am not at all sure what, if any, ongoing penalties are being applied. If there are no ongoing punishments or fines, this important regulator needs to take a tougher stand. It is simply not good enough in my view for the regulator to levy these fines and allow the companies to carry on with ‘business as usual‘. That would be like a dutiful policeman ticketing a motorist for smooth tires, no seatbelt and no headlights – issuing the ticket and then letting that motorist drive off. The SEC needs to consider heavy daily fines and banning orders against Directors of these companies in breach of the law, if such do not already exist.

The era of irresponsibility in high office needs to be brought to a close. The role of the Treasury in supporting this grossly irresponsible behaviour is questionable. The silence on the missing accounts is intolerable. The chapter of getting away with it needs to be ended.

Expenditure of Public money – Accountability – Transparency = CORRUPTION

Despite

Despite

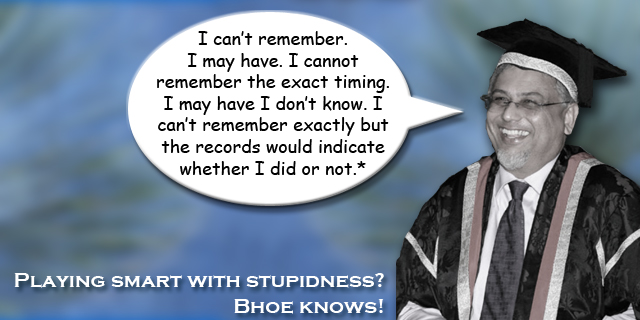

* In response to a question whether he took part in the reported decision to pay CLF dividends even after the approach to the State in 2009.

* In response to a question whether he took part in the reported decision to pay CLF dividends even after the approach to the State in 2009.

State Enterprises were created to enhance the pace and quality of Public Procurement, yet they are now the scene of the most bedeviling paradoxes in the entire system of public administration.

State Enterprises were created to enhance the pace and quality of Public Procurement, yet they are now the scene of the most bedeviling paradoxes in the entire system of public administration.