My last column addressed the imperative of controlling State expenditure as an element in the national budgeting process. I made the point that a new Public Procurement system needs to come into effect to give us the tools to control these huge expenditures.

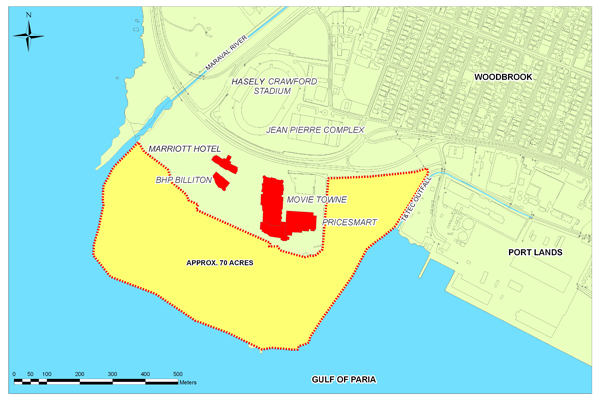

The Ministry of Planning & the Economy (MPE) published a Request for Proposals (RFP) at the end of August for the development of Invader’s Bay, a 70-acre parcel of State-owned reclaimed land – shown in this plan below:

The Invader’s Bay lands are absolutely prime property – flat, waterfront land with easy access to highways and all the urban infrastructure of water, electricity and sewers. These are valuable public lands, with an estimated value of at least $1.0Bn.

That RFP invited proposals with a closing-date of 4 October, which is an entirely inadequate 6 weeks. The Joint Consultative Council for the Construction Industry (JCC) has taken a strong position against that RFP process, including writing the MPE and meeting with the Minister, Sen. Dr. Bhoendradatt Tewarie and Minister of Trade and Industry Stephen Cadiz, MP.

The JCC wants work for its members, but that must be after a proper process, it is not our intention to stop any particular project

The JCC wants a proper participatory process.

The first “official” response to our publicity was an article in the Newsday of Monday 3 October – ‘Cadiz: JCC jumped the gun‘, the leading point being that the government was trying to open-up the procurement process so as to invite suitable proposals.

Cadiz is reported to have said

…What the Government has done is asked interested parties for proposals for concepts,” he said. “I don’t see that there is any issue at all. There were proposals made and the Government felt that this is public land and we should open it up and we gave people six weeks, we feel that is enough time…

Public Procurement can be described as the process which results in the spending or earning of ‘Public Money’. Public Money is money which is due to or payable by the State, or any debts for which the State is ultimately liable. Therefore Public Money must include the contracts entered into by the State as well as the disposal, by sale or otherwise, of State assets. The Invader’s Bay RFP is the start of a large-scale Public Procurement process, since its stated intention is to lease land to developers who make ‘suitable proposals’.

The publication of the RFP and those statements all give the impression that a proper procurement process is underway at Invader’s Bay.

Nothing could be further from the truth. Let me explain.

The first step in the Procurement cycle is the ‘Needs Identification’. The two main questions in the case of Invader’s Bay would be –

- What do we want to do with this property? That must also include ones assumptions as to what uses are not desirable there.

- Why do we want to do these things?

For example, the answer to the ‘What’ question could be that the property would be used for recreation or parkland. The answer to the ‘Why’ question could be either for private profit or to create new recreational facilities as a ‘public good’, those being free facilities which increase the amenity of a district or city. The Brian Lara Promenade and the San Fernando Hill facility are two examples of that.

Without a Needs Assessment it is impossible to objectively assess what is a ‘suitable project’. To carry out a Needs Assessment, it would have been necessary for the MPE to have consulted widely with the public and stakeholders. The Invader’s Bay lands are in our capital and are about one-third the size of the Queen’s Park Savannah. My point being that any proper Needs Assessment must involve substantial public and stakeholder consultation.

There has been no consultation whatsoever. None.

What is even more unacceptable is that the RFP, which was published by the Ministry of Planning & the Economy, is silent as to the 3 existing strategic plans for the Port-of-Spain area. The 3 plans are:

- Final Draft Development Plan: A Strategic Planning Framework for Metropolitan Port of Spain (Volume 2 Implementation Plan – The Port of Spain City Corporation) [Main Link] [Alternate Link]

- A Strategy for the Economic, Social and Physical Transformation of East Port of Spain: East Port of Spain Strategic Development Plan – September 2007

- Port of Spain Waterfront Project Strategic Development Plan for lands from Sea Lots to the Mucurapo Foreshore, still unpublished.

All of those plans paid for with Public Money. A straight case of – ‘nearer to Church, further from God’.

So, how are the proposals to be assessed? How will the decisions be made?

At para 3.5 of the RFP, at ‘Project Assessment’, we read –

“Proposals will be scored using the “Invader’s Bay Development Matrix and Criteria Description”.

We asked for that document when we met with the Ministers, but were told that it would be completed after the closing-date.

In the absence of these rules, how can developers know the ingredients of a winning proposal? Given that the evaluation rules are due to be completed after the closing-date, how can we be sure that this is a transparent process?

This could be an opportunity to demonstrate best-practice for public procurement, as promised by the People’s Partnership.

What is happening here is a recipe for accusations, blunders and confusion, just like in the previous decades of ‘old politics’. All the ingredients for corruption are present and that is why the JCC has made this call for the immediate withdrawal of this deeply-flawed RFP and its revision, after wide consultation.

We need to move away from the pattern of the biggest projects being set-up in secret , so that by the time the public gets to hear about it, all the vital details are fixed.

Expediency taking precedence over proper process has long been a costly constant in the governance of our society.

We must do better and it is not too late to do the right thing.

Expenditure of Public money – Accountability – Transparency = CORRUPTION

SIDEBAR: Criticisms by Cadiz

It is instructive to consider the criticisms of the JCC which were reportedly made by Cadiz.The headline accused the JCC of ‘jumping the gun’, implying undue haste and thoughtless speed. Cadiz is quoted as saying, “…I think the JCC jumped the gun,” he said. “If you cannot do it by six week then how long? Six months?”.

At another point in the same article, Cadiz is quoted as saying, “We need to get these things going,” he said. “The JCC only made representation of their disappointment four weeks into the RFP…” The implication being that the JCC were tardy and should have acted more swiftly.

If this Invader’s Bay situation were not so serious, it would be comical. The question in my mind is ‘Which of those explanations does Minister Cadiz believe?’

What seems clear is the hostility with which the Minister views the intervention of the JCC.

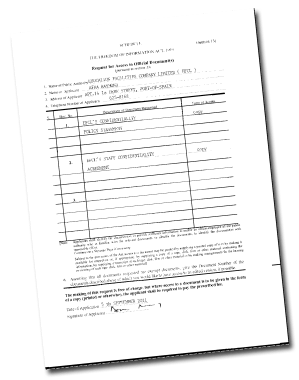

On Wednesday 21st September I received

On Wednesday 21st September I received  The Colman Commission into the failure of CLF Financial and the Hindu Credit Union is just about to move into its second round of Hearings and the public can expect to have further testimony on the losses suffered by people who deposited monies with CL Financial.

The Colman Commission into the failure of CLF Financial and the Hindu Credit Union is just about to move into its second round of Hearings and the public can expect to have further testimony on the losses suffered by people who deposited monies with CL Financial. On Friday 2 September, the EFCL’s attorneys delivered to my office

On Friday 2 September, the EFCL’s attorneys delivered to my office  Yes, Readers, I received

Yes, Readers, I received

Secondly, there were yet another species of large-scale investors who were the chiefs of the State-owned National Gas Company (NGC) and the nation’s largest pension plan, the National Insurance Board. Those two companies were reported to have invested the sums of $1.1Bn and $700M, respectively, in a Clico Investment Bank (CIB) product called the Investment Note Certificate (INC). This was another ‘gravity-defying’ product which offered attractive rates of interest along with the guarantee of being backed by good-quality investments. Like a close relative of the EFPA. In

Secondly, there were yet another species of large-scale investors who were the chiefs of the State-owned National Gas Company (NGC) and the nation’s largest pension plan, the National Insurance Board. Those two companies were reported to have invested the sums of $1.1Bn and $700M, respectively, in a Clico Investment Bank (CIB) product called the Investment Note Certificate (INC). This was another ‘gravity-defying’ product which offered attractive rates of interest along with the guarantee of being backed by good-quality investments. Like a close relative of the EFPA. In