The new bailout formula was approved, as two new Acts, by our Parliament on 14 September –

The first one prevents any lawsuits against the Central Bank by claimants, while the second gives the Minister of Finance the right to borrow up to $10.7Bn and places the Republic Bank Ltd. (RBL) shares formerly held by CLICO into a new investment vehicle, NEL 2.

These seem to represent what I am calling the Final Solution, in that the clamour and protest which had marked the last year seems to have been fading away. There have been queries from the various ‘Policyholders’ groups’, but those have been limited.

Whatever one thinks of the actual bailout, which I maintain is a perversion of our Treasury, there are valuable lessons to be learned from all this. The main lesson for me is the Power of the Few. In that although only about 16,000 investors were affected, they were able to mount a successful campaign to improve their position. We need to note that lobbying and campaigning can be effective in gaining benefits for limited groups. To all the weak-hearts who say nothing ever changes, please take note.

We also saw the position set out by the PM in her important speech on 1 October 2010 being reversed, in that the claimants’ rights to sue the Central Bank have been extinguished. There are rumblings about a challenge to the constitutionality of that restriction, but we will have to wait on that one to play out. The fact that the right to challenge the Central Bank’s actions in respect of the bailout has been removed opens fresh dangers in terms of the payout process.

We have all had bad experiences of what usually happens when serious unrestricted power is held by someone who does not have to answer for their actions. My concern is that there does not seem to be any avenue for oversight of or appeal/redress against the Central Bank, in the event that claimants feel they are receiving unfair treatment. That concern will have to be addressed at some stage.

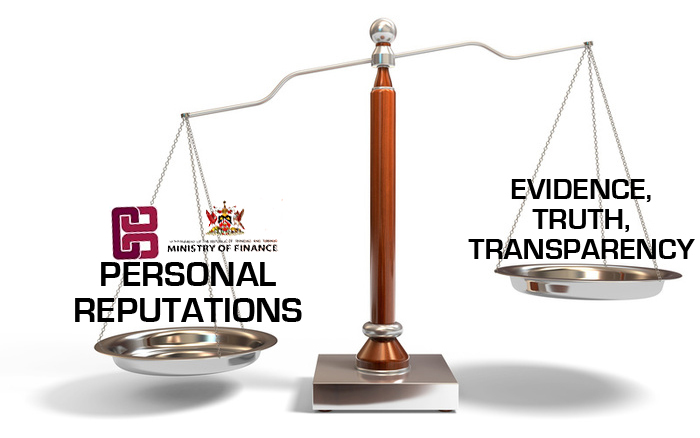

Even as an account of the payout, we have deficient reporting with no true profile of the wealth being returned having been presented for public consideration. The Central Bank and Ministry of Finance is in possession of this critical information as to the amounts of money to be returned to claimants, but that is being suppressed, for whatever reason. This episode has been a real stain on our stated ambitions towards accountability, transparency and the ever-distant ‘Good Governance’.

A related point is that the PM gave a clear commitment to revealing who benefited from the first wave of bailout funds, said at the time to be of the order of $7.3Bn. The PM’s speech is at pages 19 to 34 of Hansard – at pg 24 –

…The previous administration injected $5 billion into Clico and they spent $2.3 billion to bail out the other distressed entities such as CIB in particular, so coming to a total of $7.3 billion has gone into that hole and yet today the Government and, therefore, the taxpayers of this country have been called upon to come up with another $16 billion to $19 billion. So what happened to that $7.3 billion? Where did it go? Who are the people that were paid? How was it utilized? What happened to that $7.3 billion?…

The concern here is that we are not at all sure that this new arrangement will in fact yield the required information as to who are the real beneficiaries of this bailout. In view of the fact that the entire deal is a burden on our Treasury, this opaque arrangement is unacceptable.

After all –

Expenditure of Public money – Accountability – Transparency = CORRUPTION

Quite apart from those concerns, the fact is that provisions should have been made for Anti-Money Laundering and Tax Evasion screening. The Treasury must not be used for Money-Laundering and the proper safeguards need to be put in place to prevent this.

The lack of accounts for the CL Financial group, after 31 months under State management, is also unacceptable. The essential terms of the bailout are being sidelined, since the original agreement was for the State injections of cash to be repaid via asset sales. Both 2009 agreements – the January MoU and the June CL Financial Shareholders’ Agreement – also spoke to the preparation of accounts and provision of information.

The perturbing aspect is that there continues to be a uniform silence as to the preparation of these overdue accounts, so the taxpayer must wonder just how, or if ever, these vast sums of bailout money are to be recovered. This is the burning question which is at the root of my outrage.

The new arrangement is also silent as to the position with respect to other creditors of the CL Financial group, so there is no certainty as to how those claims would be treated. On 31 October, Trinidad and Tobago Newday reported on ‘CLICO Bahamas seeks $365M from CL Financial’. There are substantial regional and local claims outstanding, so the entire cost appears is an unknown quantity at this time, given the lack of accounts.

As I pointed out previously, the Directors and Officers of the CL Financial group and its subsidiaries ought to be subject to the provisions of the Integrity in Public Life Act, by reason of its being a State-controlled company. The Integrity Commission needs to demand the required declarations from those persons, if we are to secure the required level of transparency.

The continuing failure of the Central Bank to make rulings as to the extent to which CL Financial’s Directors and Officers at the time of the collapse are ‘fit and proper persons’ is the final piece of the sorry picture.

The State’s period controlling the CL Financial group, ends on 11 June 2012 – a mere 7 months away – at which time the group will return to its owners. Given the fact that the Central Bank has not made an adverse ‘Fit & Proper’ finding against Lawrence Duprey, in the absence of accounts and with a significant part of the RBL shares divested in this fashion, what will be the out-come? Is the stage now set for Lawrence Duprey to return?

I spent last Wednesday afternoon in New York’s Zucotti Park, with so many points to share on that experience. For now, I leave this striking slogan of the Occupy Wall Street movement –

If you are not outraged, you haven’t been paying attention…

The

The  Continuing from last week’s critique of the revised bailout and its implications, I have further concerns as to the process by which the legislation was passed.

Continuing from last week’s critique of the revised bailout and its implications, I have further concerns as to the process by which the legislation was passed.

Last week Wednesday and Thursday I appeared before the Colman Commission to give my testimony in this matter. On Wednesday afternoon there was a very negative reaction to my attempts to introduce a Power-Point presentation as a way to better illustrate some of the points I have been making. It was a frustrating and comical experience for me to hear supposedly learned men asking ‘What is this?’ and one of them even saying that he had no idea what it was…Here, in Port-of-Spain in 2011, we have learned men saying that they don’t know what a Power Point presentation is for. Of course, I am all for transparency, so their patently transparent ‘blocking tactics’ were most welcome, because they showed the viewers on TV just ‘Who is Who and What is What’. Thank you, colleagues, for doing a better job than I ever could have. The public is not stupid and your behaviour has had a clear impact on those who were viewing. That said, the Commissioner ruled that my evidence would be taken the next morning and so it was.

Last week Wednesday and Thursday I appeared before the Colman Commission to give my testimony in this matter. On Wednesday afternoon there was a very negative reaction to my attempts to introduce a Power-Point presentation as a way to better illustrate some of the points I have been making. It was a frustrating and comical experience for me to hear supposedly learned men asking ‘What is this?’ and one of them even saying that he had no idea what it was…Here, in Port-of-Spain in 2011, we have learned men saying that they don’t know what a Power Point presentation is for. Of course, I am all for transparency, so their patently transparent ‘blocking tactics’ were most welcome, because they showed the viewers on TV just ‘Who is Who and What is What’. Thank you, colleagues, for doing a better job than I ever could have. The public is not stupid and your behaviour has had a clear impact on those who were viewing. That said, the Commissioner ruled that my evidence would be taken the next morning and so it was.

The Colman Commission into the failure of CLF Financial and the Hindu Credit Union is just about to move into its second round of Hearings and the public can expect to have further testimony on the losses suffered by people who deposited monies with CL Financial.

The Colman Commission into the failure of CLF Financial and the Hindu Credit Union is just about to move into its second round of Hearings and the public can expect to have further testimony on the losses suffered by people who deposited monies with CL Financial.