This article is about the Las Alturas Enquiry into the collapse of two new Morvant apartment buildings erected by China Jiangsu International Corporation (CJIC) for the Housing Development Corporation (HDC). This Enquiry seems a politically-motivated one into a serious failure of professional practice which could have cost human lives. It is only in its opening stages, but it is already clear to me that this episode is one which contains serious lessons for our country in terms of the role of Enquiries; the role of the Chinese contractors; the culture of non-enforcement which we practice and of course, the impact of targets and political objectives on proper process. In the case of Las Alturas this is a large-scale multiple-housing project constructed on a former quarry-site on the Lady Young Road, just south of the lookout. Two apartment buildings which were completed in late 2010 were eventually declared uninhabitable due to severe cracking and the proposed demolition of those structures was announced at the end of May 2012. Each building comprised 24 three-bedroom/two-bathroom apartments, with the total cost of those buildings stated by HDC to be in the $29M range. The buildings were erected by CJIC on the design/build basis which usually places all responsibility for soil investigation, design and construction onto the contractor.

The role of Enquiries

The JCC offered to work with HDC in determining the causes of this serious failure and that offer was accepted, but our joint exercise did not last very long. The Commission of Enquiry was announced in September 2014 by the Prime Minister and despite the serious nature of the failure at this project, it seemed to suggest an attempt to discredit the Leader of the Opposition, Dr Keith Rowley, who was Minister of Housing between 2003-2007. I still feel that it was a poor choice of issue to investigate, given the burning questions at Invader’s Bay, the Beetham Water Recycling Project, UWI Debe and EFCL, to name just a few. The Terms of Reference of the Enquiry were published in the Gazette of 3 December 2014 and a five-month period was stipulated for its Report to be made to the President.The Enquiry, which is chaired by retired Justice of Appeal Mustapha Ibrahim, is to examine the causes of the structural failure of two blocks of apartments built in 2008-2010 for the HDC by CJIC. The other two Commissioners are eminent Structural Engineers, Dr. Myron Chin and Anthony Farrell. We have also seen reports of the contractor, CJIC, declining to appear at the Enquiry. I consider that refusal to be deplorable and a real sign that serious penalties need to be attached to that course of action. As it is, the fines for non-attendance are nominal, so people can refuse on a whim, since there are few prosecutions for that.

The role of the Chinese contractors

The really stunning revelation here is that the State was aware, since 2011, that these two buildings at Las Alturas had to be demolished. Despite this, CJIC was able, from early 2012 onwards, to compete for and secure the $500M+ contract for UWI’s Debe campus. The JCC protested at the poor process used in procuring that large-scale project. UWI Principal Professor Clement Sankat was advised that in view of the poor performance by CJIC in local State projects – including UTT Tamana, ETeck Wallerfield and various EFCL – no proper evaluation could proceed to recommend that further contracts be granted to that firm. Given that the normal pre-qualification process requires prospective bidders to identify claims, litigations or disputed matters, one can only wonder how CJIC was able to prevail in that project.

Culture of non-enforcement

One of the seldom-discussed findings of the Uff Enquiry was as to the lack of any culture of enforcement of contracts in the State construction sector, as set out in the sidebar. So, I was both thrilled and intrigued by the headline in this newspaper on Friday 6 March 2015 ‘HDC to sue Chinese contractor‘. The role and reputation of Chinese contractors in the local market have long been a bone of contention for the JCC. That statement was made in opening remarks by Vincent Nelson QC, who is the lead Counsel for HDC at this Enquiry –

“…The Housing Development Corporation (HDC) is moving to pursue legal action against China Jiangsu International Corporation (CJIC), the company contracted to construct the two towers at Las Alturas, Morvant, which subsequently had to be demolished because of structural damage resulting from land slippage. Attorney for the HDC, Vincent Nelson, was adamant about this as he delivered his opening statement at the Commission of Enquiry into the housing project yesterday at the Caribbean Court of Justice in Port of Spain…”

The culture of non-enforcement, considered with the chiefs at HDC (who transferred there after abruptly departing Caribbean Airlines), together with the special influence seemingly enjoyed by the Chinese contractors, all make me very sceptical as to whether a real and forceful lawsuit will ever emerge against CJIC.

The role of targets

Finally, one needs to consider the detrimental role of politically-motivated overambitious targets. The 2002 National Housing Policy set an unforgettable target of 100,000 new homes to be built in 10 years, which translates to an annual average of 10,000, which means a literally impossible 200 homes per week. Those are the facts behind the bizarre ‘numbers game’ which in turn likely had a decisive influence on the decision-makers at UDECOTT, HDC and of course the Housing Ministry. It would be useful, in this season of 100 houses a week and a billion dollars in land each year being promised, to reconsider the role of over-ambitious targets in distorting proper process.

SIDEBAR: The Outline Timeline

This is only an outline, but it is instructive –

- December 2002 – UDECOTT acquires the Las Alturas site.

- 2003 – Initial layout prepared for a total of 120 apartments, which was revised later that year to 292 units given the Town & Country Planning Division’s advice on the allowable number of units.

- December 2003 – CJIC wins tender to design & build 297 apartments.

- November 2004 – Start on Site.

- 2005/2006 – Soil problems identified on part of the site.

- July 2005 – UDECOTT rejects project redesigns for lower units numbers of 142 and 167 apartments. Those redesigns were intended to avoid the unsuitable soils.

- July 2006 – the project is transferred from UDECOTT to HDC.

- 2008-2010 – Blocks H & I are built onto the areas reported to be unsuitable.

- 2011 – Blocks H & I are recommended to be demolished due to severe cracking.

We have also seen reports that both UDECOTT and the HDC were resistant to any reduction in unit numbers on the site.

SIDEBAR: Uff’s understanding

“Holding to account 29.21. …A recurrent feature of practice in the construction industry in Trinidad & Tobago is the extent to which rights and obligations prescribed by the Contract are or are not enforced. A simple example, discussed above, is the apparently mutual ignoring of contract provisions…”

At page 271 –

“…29.26. Underlying all the foregoing, however, is the question of enforcement of contractual rights and duties. What has been observed by the Commissioners is a culture of non-enforcement of rights, which appears to operate mutually, for example, by contractors not pressing for payment of outstanding sums while the employer does not enforce payment of liquidated damages. Whatever the explanation, the non-enforcement of contractual rights available to Government is a serious dereliction of duty on the part of those charged with protecting public funds. Equally, the non-pursuit of sums properly owed to commercial companies is a dereliction on the part of the directors of that company…”

The key point disclosed here is that contractual rights are seldom enforced in State contracts. A move to such a regular practice would require a major shift in our country’s governance culture.

This column sets out my reasons for seriously questioning the motivation and priorities of the Integrity Commission. Despite my doubts as to the way in which successive Commissions have operated the Integrity in Public Life Act (IPLA), I have continued to offer suggestions as to how their work could be made more effective.

This column sets out my reasons for seriously questioning the motivation and priorities of the Integrity Commission. Despite my doubts as to the way in which successive Commissions have operated the Integrity in Public Life Act (IPLA), I have continued to offer suggestions as to how their work could be made more effective.

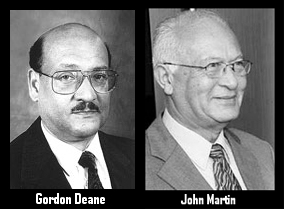

The Commission’s independence was fatally undermined by its decision to write to then Prime Minister, Patrick Manning, to seek his instructions on how the complaint against Dr Rowley was to be handled. At that time, the Commission was chaired by Gordon Deane, with John Martin serving as its Deputy Chairman.

The Commission’s independence was fatally undermined by its decision to write to then Prime Minister, Patrick Manning, to seek his instructions on how the complaint against Dr Rowley was to be handled. At that time, the Commission was chaired by Gordon Deane, with John Martin serving as its Deputy Chairman.

It has been reported that FCB is owed over $400M borrowed for the construction of this elegant hotel on the outskirts of the Queen’s Park Savannah. That hotel is now up for sale via the receivers, Deloitte, at an asking price in the region of $120M.

It has been reported that FCB is owed over $400M borrowed for the construction of this elegant hotel on the outskirts of the Queen’s Park Savannah. That hotel is now up for sale via the receivers, Deloitte, at an asking price in the region of $120M.

The Integrity Commission is continuing its efforts to revise the Integrity in Public Life Act (IPLA) to give greater effect to its anti-corruption work. I fully support those efforts.

The Integrity Commission is continuing its efforts to revise the Integrity in Public Life Act (IPLA) to give greater effect to its anti-corruption work. I fully support those efforts. The key challenge is to discern how Public Officials commit the corrupt acts the Commission is meant to reduce. It is therefore necessary to conduct a scrupulous examination of Commissions of Enquiry and other Inquiry (eg

The key challenge is to discern how Public Officials commit the corrupt acts the Commission is meant to reduce. It is therefore necessary to conduct a scrupulous examination of Commissions of Enquiry and other Inquiry (eg