This is an edited version of my address to the 4th Biennial Business Banking and Finance Conference (BBF4) held at the Trinidad Hilton from 22 to 24 June, 2011. The session I participated in was devoted to ‘Lessons from the Financial Crisis: The Resolution of Failed Entities.’ [See the acknowledgement letter from the conference convenor here.]

Thanks for the invitation to speak at this forum, it was last-minute, but welcome, since our local Institutions of Higher Learning have not spent the necessary time to explain and analyse this financial fiasco. I have been very critical of the Institute of Business, the Institute of Social and Economic Research, the Faculties of Economics and Management and the Caribbean Centre for Money & Finance, so it is great to see you making a start on this overdue work. It is my pleasure to participate in these proceedings.

I want to start by shifting focus to the arena of the mind and the existence of elements such as moral and ethical values, as well as social standards. In 1971 there was a famous series of psychological experiments in which selected students entered a two-week role-play as prison-guards in control of other people who were playing the role of prisoners.

That experiment was conducted at Stanford University in California and the results were that most of the prison guards adopted cruel behaviour with most of them being upset when the experiment was stopped after only six days. The entire experiment was filmed and the prisoners suffered from regular acts of wickedness, abuse and sheer perversity – one-third of the guards acted sadistically.

The Stanford Prison Experiment as it is now known, was heavily criticised as being unethical and unprofessional. Of course the other aspect is that it re-opened the perennial discussion into the nature of things. The nature of our nature, as it were – ‘Are we humans naturally evil and cruel?‘ The learning seems to be that well-adjusted and reasonable people can very quickly lose their moral compass in a situation with a lack of the conventional controls such as disapproval and laws.

No surprise to those familiar with history and politics, but the lesson for us in T&T is that if you let people get the idea that they can never be punished, there is virtually no limit to the rules they will break. Asset-stripping, Bribery and Corruption can become the new norms of a governing class and that is what has happened in our country.

We have never had a strong tradition of detecting and punishing White-Collar Criminals, so if we are to make a start in terms of the resolution of failed entities, that has to be the starting-point. We cannot reconstruct or resolve the failed entities if we do not change that aspect of our culture – the absence of consequence has to be abolished.

The absence of consequence is inimical to any development – personal, national or regional. It is no point bringing new regulations or ‘approaches’ to this huge problem, until and unless the basic culture changes.

So that is the challenge for us – we have to change the way we think and behave around these issues of White-Collar Crime. It is a very damaging type of crime which can affect the lives of many, many people – as we have seen in the CL Financial fiasco. But we have to make that choice to change our culture around these issues.

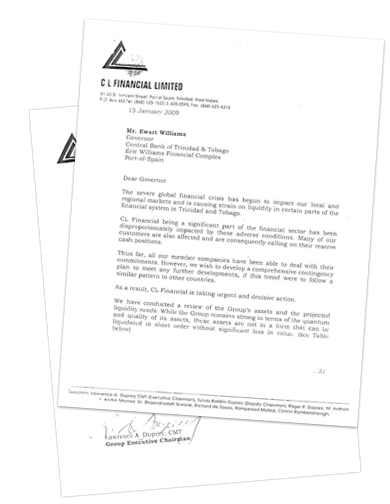

The current financial disaster amounts to the greatest ever destruction of capital in peacetime – these are literally epochal events, but we do need to be careful as there is yet another big lie out there. It suits the CL Financial chiefs to promote a version of events that has the blame attached to the Wall Street events of 2007/2008. The people promoting that version are buffoons, whose story is unable to withstand serious examination. I call it the Wall Street hoax and it is useful since it allows the CL Financial chiefs to escape the reality of their failure, to put it charitably, by blaming events way beyond their control.

Nothing could be further from the truth. We need to be very clear on the scale of this particular lie and the public mischief it represents. Even close examination of CL Financial’s 2007 audited accounts shows only tiny exposures to Wall Street But what is worse is that the entire CL Financial pattern of behaviour and the burning question of the extent to which the CLF chiefs were ‘fit and proper’ are not new issues. If we consider the 15 July 1996 ‘Circular Letter to Shareholders‘ issued by Republic Bank Limited under the hand of then Chairman, the late Frank Barsotti, it is all there. Fifteen years ago we knew the threat to which we were exposing this country by letting CLICO take over Republic Bank…it is 66-pages long, but very important to read – it is on my blog.

We don’t have a Wall Street problem, what we have here is a St. Vincent Street problem. Yes, from the Central Bank (at the foot of the Street) to the Treasury (paying for the whole entire wretched bailout) to the Red House (where the real discussion has never taken place), right up to #29 – the CL Financial headquarters. Yes, is a real St. Vincent Street problem we suffering from. This is we own creation we fighting with.

The CL Financial fiasco is estimated to be costing at least ten times as much, as a proportion of GDP, as the Wall St. crisis. Yet we still have mischief-makers who want to make misleading comparisons between the two, to justify the bailout.

A powerful parallel with the Wall Street crisis is the fact that the CL Financial fiasco was also characterized by ‘Shadow Banking’, meaning vast sums of money solicited from investors and being traded outside of the conventional regulatory umbrella.

Here are some extracts from the Financial Crisis Inquiry Commission’s Final Report (the FCIC is the US government’s official Commission of Inquiry into the Wall St crisis) –

From pg. XX (20) of the ‘Conclusions’ section –

“…Within the financial system, the dangers of this debt were magnified because transparency was not required or desired. Massive, short-term borrowing, combined with obligations unseen by others in the market, heightened the chances the system could rapidly unravel. In the early part of the 20th century, we erected a series of protections—the Federal Reserve as a lender of last resort, federal deposit insurance, ample regulations—to provide a bulwark against the panics that had regularly plagued America’s banking system in the 19th century. Yet, over the past 30-plus years, we permitted the growth of a shadow banking system—opaque and laden with short-term debt—that rivaled the size of the traditional banking system. Key components of the market—for example, the multitrillion-dollar repo lending market, off-balance-sheet entities, and the use of over-the-counter derivatives—were hidden from view, without the protections we had constructed to prevent financial meltdowns. We had a 21st-century financial system with 19th-century safeguards…”

Every line of that paragraph rings true to our local situation. We are grappling with a shadow banking threat to the savings of the nation. Our national wealth has been pledged to rescue adventurers at the very edge of the financial universe and that is what is wrong with the bailout.

I am no supporter of the Peoples’ Partnership, but what is right is right and the fact is that our Minister of Finance, Dookeran, is spot-on with this part of his analysis and action. When Dookeran spoke in his inaugural budget speech on 8 September 2010, he took the approach of combining the assets and liabilities of both CLICO and British-American Insurance, which showed an insolvency in the order of $7.3Bn.

More to the point, the approach showed ‘traditional insurance‘ liabilities – i.e. Health, Pension and Life – of the order of $6Bn and ‘non-traditional/investment’ liabilities – i.e. EFPAs – of the order of $12Bn.

So what we are seeing is insurance companies whose non-insurance business is twice the size of their insurance portfolio and what is more, the supposedly guaranteed investment is nowhere to be found, hence the tremendous problem in repaying the EFPA holders. That is the dilemma facing the country now and that is what Dookeran was explaining to us – a Shadow Banking arena that has grown to eclipse the core business and threaten the entire nation.

Another important part of the false discourse in all this is the promotion of the utter nonsense that there is any such thing as a ‘Guaranteed Investment’. Absolute and complete lies. There is no such thing and that is the fact. Yet we have had CL Financial’s Boards of Directors of the ‘Great & Good’ promoting that kind of deceptive dangerous nonsense. You Investment Professionals need to find the courage of your convictions to speak-out on this smartman behaviour.

We had a product being promoted as offering twice the market rate of interest and also your entire investment is guaranteed and blah blah blah. The Central Bank and the Supervisor of Insurance sat there and allowed that deceptive advertising to take place and it was a campaign, with thousands of letters. A straightforward assault on good sense and the gatekeepers stood silent.

The final point we need to drive home is that, whatever the temptations, we must not lay the entire blame onto Lawrence Duprey & Andre Monteil. It took plenty more than the main CL Financial chiefs to get us to this point. There is a network of lawyers, accountants, agents who pretended to be financial advisers and of course, the many Board Directors. That network is hundreds of people all of whom share a responsibility, quite probably culpability, for this crisis.

The Colman Commission has to work very hard to preserve its effectiveness.

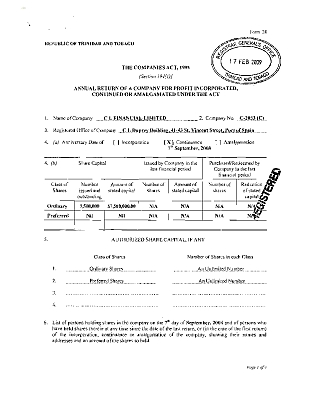

In preparing my submissions for the Colman Commission it occurred to me that the financial provisions made for the 3 CL Financial chiefs who departed in the last 12 months before the group collapsed is central to understanding the entire fiasco. It is rich in irony.

In preparing my submissions for the Colman Commission it occurred to me that the financial provisions made for the 3 CL Financial chiefs who departed in the last 12 months before the group collapsed is central to understanding the entire fiasco. It is rich in irony.

There were several important developments in the Colman Commission last week, with the widely reported appeals of Sir Anthony Colman QC for the Central Bank to change its position with respect to the presentation of accounts to the Enquiry.

There were several important developments in the Colman Commission last week, with the widely reported appeals of Sir Anthony Colman QC for the Central Bank to change its position with respect to the presentation of accounts to the Enquiry.