The PP government is establishing a ‘new normal’ insofar as ethics and acceptable standards of behaviour in public office are concerned. As with any real-time and complex situation, the signals are mixed, but from my point of view, the direction is a welcome one.

To me, the main positive signs were –

- Coup Enquiry – The July announcement of the Commission of Enquiry into the 1990 attempted Coup, now underway, was most welcome. It seems certain that we would still be waiting in vain, if either Manning or Panday were still in power.

- CL Financial bailout – Dookeran’s decision to review the payout to beneficiaries of the bailout was necessary and long-overdue. Dookeran has done his cause no favours by with-holding the accounts and seeming to suppress vital information, but the decision to revise the bailout terms was a sound one. On that occasion, he also took the steps of introducing relief for Hindu Credit Union depositors, which was a step in the direction of equity. Even those of us who did not support any bailout can concede that point.

- On October 1, the Prime Minister resisted the temptation to use the PP’s Parliamentary majority to force through a new law to limit the legal rights of CLICO policyholders. The PM chose to set aside that legislative proposal and embark on an act of persuasion. That was a defining moment in our nation’s development of a democratic culture. The announcement of a Commission of Enquiry into the entire financial collapse (CL Financial and HCU) was another high point.

- Nizam Mohammed’s removal as Chairman of the Police Service Commission was overdue in my view, but not because of his ‘last-ditch/red-herring‘ attempts to martyr himself. His primary and unpardonable offence, given his position, was his bold-faced abuse of power in that traffic police episode.

-

Mary King Even Mary King’s removal from office earlier this week was a welcome sign despite the doubts over who knew what and when. That was a good move because it is the first time a Minister has been fired for acting in a manner which causes reasonable suspicion. Up until now in this country the rule followed by the various Ruling Parties has been the ‘wrong and strong‘ one, joined-up with the ‘do as I say and not as I do‘ one. To have moved away from those immoral practices is a big step in the right direction, despite the ragged edges.

Even when I consider the disastrous Reshmi-gate episode, that list adds up to substantial progress in the right direction. Democracy is a messy affair and coalition politics has particular challenges, so progress will be uneven, with some pauses along the way. But progress we must.

The Prime Minister reportedly commented that there was no pressure from COP to replace Mary King with another of its members, so that the replacement would be chosen on merit.

I am very concerned at the fact that the CL Financial collapse has cast a literal shadow over our country. Aside from the financial costs, there are significant areas of collateral damage which are now becoming visible. I referred in an earlier article to one of the main externalities in this episode being the fact that many of the CL Financial chiefs are deeply embedded in our political parties.

Even now, with this new government – their honeymoon will end on the first anniversary, I think – we are witnessing acts which can make one wonder if the CL Financial disaster ever really happened.

The official Terms of Reference for the Colman Inquiry into this financial fiasco were published in the Trinidad and Tobago Gazette of 17th November 2010 – No. 144 in Volume 49. Here is the first sentence in the second paragraph –

…And whereas the President on the advice of the Cabinet has deemed it advisable and for the public welfare that a Commissioner be appointed to enquire into the failure of CL Financial Limited, Colonial Life Insurance Company (Trinidad) Limited, CLICO Investment Bank Limited, British American Insurance Company (Trinidad) Limited, Caribbean Money Market Brokers Limited and the Hindu Credit Union Cooperative Society Limited with a view to ascertaining why such events occurred…

Caribbean Money Market Brokers (CMMB)

The first example is Robert Mayers, former Managing Director of CMMB up until 7 December 2008 – see here. Mayers is also a Deputy Political Leader of the Congress of the People (CoP), a leading element in the Peoples’ Partnership government. CMMB collapsed along with some of the significant companies in the CL Financial group – the Terms of Reference for the Colman Commission refer.

On 20 November, there were reports that Robert Mayers had been offered a position as a Director of our Central Bank. Mayers is reported to have declined that offer on the basis of a conflict of interest. The burning question has to be ‘What kind of process could produce such a recommendation?’

Consider this arresting headline ‘Investment pros set up new business‘ at page 10 of the Business Guardian of 9th December. It was reported that a new investment house, KSBM, was launched and it seemed that they were profiling.

Given that all four of KSBM’s Executive Directors are ex-CMMB chiefs, Robert Mayers among them, there are inescapable questions –

How come the former chiefs of CMMB, a financial institution which is known to have failed on this scale, can be permitted to open another one? We are acting as if we have no capacity to learn from our errors. Just carrying on as though nothing happened. What is the role of the SEC and the Central Bank in all this? Have we learned nothing?

Clico Investment Bank (CIB)

Mervyn Assam was the Chairman of CIB at the time of the collapse. Assam had been one of CIB’s founders in 1990 and was reportedly ‘cleaning house’ at the bank, which I do believe to be true.

But the picture is far from a simple one. On 22 January 2009, CIB hosted its inaugural Investment Seminar at the CL Duprey box at the Queen’s Park Oval – I spoke at that event, together with Professor Patrick Watson. Now, according to para 5 of the April 2010 affidavit submitted to the High Court by the Inspector of Financial Institutions, Carl Hiralal, in the CIB winding-up petition, the CIB liquidity problem was disclosed to him in a meeting on the 15 January. I have serious doubts as to the veracity of that statement, but yes, it is still a full week before the Investment Seminar.

Assam held 7,500 shares in CLF as at 7 February 2009.

Assam also launched a lawsuit to recover $1M he had deposited with CIB, that case went against him in January this year – see the judgment – and he is reported to have filed an appeal.

In October, Assam was appointed as Ambassador Extraordinaire and Plenipotentiary of Trade and Industry. He has served in the NAR period as High Commissioner to London and as a UNC Senator, both in Cabinet and during their recent spell in opposition.

CL Financial (CLF)

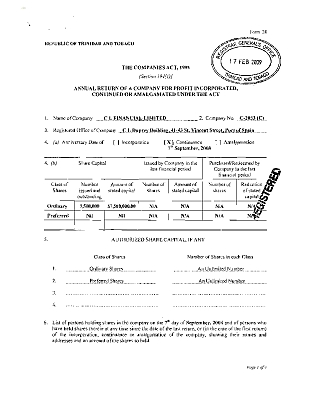

Dr Tewarie was a Director on the Board of the parent company, CLF, which wrote to the Central Bank, seeking a bailout, on 13 January 2009. On 16 January 2009, CLF paid dividends of $3.00 per share to its shareholders. According to the CLF Annual Return of 7 February 2009, Dr Tewarie held 1,171 shares.

As I write this, we are informed that Dr Tewarie has been sworn in, to replace Mary King.

To be perfectly clear, I am making no allegation of theft against Mayers, Assam or Dr. Tewarie.

Does the ‘fit and proper’ criteria apply to these CLF chiefs? Should those criteria apply to the holders of high office in our country? What do you think?

We need new politics like no time before in our country, but that must involve new thinking. The State must behave in an exemplary fashion if we are to uplift ourselves without civil disturbance and unnecessary confusion. The State needs to set the standard.

I trust that the Colman Commission will give the proper attention to these episodes.

In preparing my submissions for the Colman Commission it occurred to me that the financial provisions made for the 3 CL Financial chiefs who departed in the last 12 months before the group collapsed is central to understanding the entire fiasco. It is rich in irony.

In preparing my submissions for the Colman Commission it occurred to me that the financial provisions made for the 3 CL Financial chiefs who departed in the last 12 months before the group collapsed is central to understanding the entire fiasco. It is rich in irony.

There were several important developments in the Colman Commission last week, with the widely reported appeals of Sir Anthony Colman QC for the Central Bank to change its position with respect to the presentation of accounts to the Enquiry.

There were several important developments in the Colman Commission last week, with the widely reported appeals of Sir Anthony Colman QC for the Central Bank to change its position with respect to the presentation of accounts to the Enquiry.

If you think this title is for the latest brand of household cleaner, you would be wrong. I drew that title from the famous statement by deceased US Supreme Court Justice Louis Brandeis,

If you think this title is for the latest brand of household cleaner, you would be wrong. I drew that title from the famous statement by deceased US Supreme Court Justice Louis Brandeis,