I have been preparing my submissions for the Colman Commission and took some time-out to start reading the Report into the USA’s financial crisis. Of course I am referring to the Financial Crisis Inquiry Report, which was published at the end of last month, about a year after its first hearings.

I have been preparing my submissions for the Colman Commission and took some time-out to start reading the Report into the USA’s financial crisis. Of course I am referring to the Financial Crisis Inquiry Report, which was published at the end of last month, about a year after its first hearings.

Even though I have barely scratched the surface of this 662-page work, it has already been a deeply fascinating read, filled with cautionary insights. The first conclusion of that Report is worth citing –

“We conclude this financial crisis was avoidable.

The crisis was the result of human action and inaction, not of Mother Nature or computer models gone haywire. The captains of finance and the public stewards of our financial system ignored warnings and failed to question, understand, and manage evolving risks within a system essential to the well-being of the American public. Theirs was a big miss, not a stumble. While the business cycle cannot be repealed, a crisis of this magnitude need not have occurred. To paraphrase Shakespeare, the fault lies not in the stars, but in us.

Despite the expressed view of many on Wall Street and in Washington that the crisis could not have been foreseen or avoided, there were warning signs. The tragedy was that they were ignored or discounted…”

It is an epic failure in that the world’s strongest and most diversified financial system was brought, literally, to its knees by a tidal wave of greed. Some of the main features were –

- Slack regulators, who had looser and looser control of market activity, yet did little or nothing to propose the need for better controls.

- Corrupt politicians, who accepted huge political donations from the financial institutions – yes, both parties – so that there was an absence of real debate on major policy shifts and consequences

- A sheer overdose of hubris in an atmosphere in which it seemed, against all good sense, that tangible risk had been abolished. The catchphrase among market players was ‘IBGYBG – I be gone, you be gone’ – denoting a total abandonment of the notion of customer service. In many cases the salespersons knew what they were selling was of such poor quality that their own firms were betting against it.

If any of this sounds familiar, yes, you are right; it is almost the same as our own crisis. The old aphorism ‘When Uncle Sam catch a cold, the Caribbean get pneumonia’ comes to mind.

I have to say that the reading is a sobering experience as one starts to reflect that the deep and broad USA economy has been crippled by these ‘smartmen’ and their political minions. So what hope do we have of resisting those elements? That is the question we need to grapple with in this rounds.

But for all the parallels, there are two important differences –

- Firstly, the guilty actors are not going to own-up. This is one pie they won’t want a piece of. They may try to seek exoneration in a version of the truth which locates blame somewhere on Wall Street. Those assertions need to be strongly challenged; they represent a piece of pure mischief.

- Secondly, the US crisis is far smaller, proportionally, than our own. The Minister of Finance stated in the 2011 Budget (pg. 8) that the CL Financial bailout was costing our country more than 10% of its Gross Domestic Product (GDP). In comparison, the US bailout was estimated, in December 2010, by their Treasury Secretary to be costing about 1% of that country’s GDP. These facts show the double-mischief of these bold-faced people trying to tell us that this is just like in America.

According to those sources, this crisis is costing us 10 times more than the Wall Street one we keep on about. The relevant Ministry of Finance Press Release of 17th January 2011 states, “…With the Government’s planned bailout of CLFG (CL Financial Group), Standard and Poor’s expect net general government debt will rise to 28% of GDP in fiscal 2011 from 15% in fiscal 2010, though it will remain below the 36% median for ‘A’ rated sovereigns…” That is a difference of 13%. Yes, that is 13 times more than the USA…

This crisis will require us to properly compare and contrast those situations.

It has been two years, but at last the Commission of Enquiry into the T&T financial collapse is about to start its hearings. For the first time and against all their schemes and plans, the main agents of the Code of Silence are going to be forced into the direct sunlight to face questions and of course I mean the several court cases and the Colman Commission as discussed in ‘Testing the Code of Silence‘.

The final date for submissions to the Colman Commission is Monday 14th February, which means that all written evidence must be filed by then. I am not sure if electronic evidence, like the 55-minute interview Brian Branker (former Executive Chairman of British American Insurance Co.) gave on Up Next! in September 2010 is allowable, but it seems worth it to try. So this is my call for the producer of that show, Jerry George, to please do submit it. If you are interested, it is at http://vimeo.com/15145888.

I expect that by now the main actors in this Code of Silence are all rehearsing their lines and agreeing who will speak on which piece and in fact which parts to be silent on. In my opinion we can expect nothing but self-serving and defensive statements, if not outright lies, from the main actors in this mess – the CL Financial chiefs, the wayward Regulators and of course, the auditors. The burning question is therefore how is the public interest going to be defended and advanced? By whom? On what terms?

To make the obvious comparison with the Uff Enquiry, we are looking at the same kind of procedure. The decisive difference is that, in this case, the balance of forces is entirely different.

You see, in the Uff Enquiry there were the forces of the State and its agents all lined up to defend their way of operating – that included UDeCOTT, Calder Hart, National Insurance Property Development Company (NIPDEC), Housing Development Corporation (HDC) and of course the State itself was in the Enquiry in the person of the Attorney General. On the other side there were the Joint Consultative Council and Dr. Keith Rowley, MP. All those parties were strongly represented. There were also independent forces at the Enquiry – the Trinidad & Tobago Transparency Institute (TTTI), Carl Khan and myself – the only two witnesses whose testimony stood without hostile cross-examination.

Due to the balance of forces in that forum, the Uff Enquiry was satisfactory in that all versions were strongly contested under cross-examination and also by conflicting testimonies – the Enquiry was forced to decide on the veracity and relevance of evidence…there was no easy middle road or settling for a version because no one had spoken against it.

Here, in the Colman Commission, we face an entirely different order of challenge. Let me explain –

- Firstly, the quantities of money involved are several times larger – at least ten times more, in my estimation.

- Secondly, the entire establishment seems to have capitulated to the ‘Duprey Dream’. That is a state in which no serious questioning of the actions of the CL Financial chiefs is undertaken. In the USA experience, this phenomenon is described as Regulatory Capture. It is one in which regulators are actually ‘occupied’ by forces who are the people they are supposed to police. That is not unfamiliar to us here in Trinidad & Tobago, but that is why we must fight against it. It is a true nadir of absolute corruption. A roaring silence of the formal and informal regulators.

- Finally, based on that record, the Colman Commission will be dominated by these people, the ones who caused the entire mess. If that is the case, there is a real danger that the truth could be compromised or even sacrificed. That peril is what we have to work against.

Some of us have insisted on this Enquiry as a necessary step in preventing a repetition and further looting of the society. The facts and the versions of the facts are about to be tested in the crucible of the Colman Commission.

The only way we can avoid the US fate, and possibly worse, is by doing our very best to learn from the bitter experience. Those of us, who have insisted on this crisis being a real turning-point, must make the most of this moment. In my opinion, that can take place on two levels –

- The publicity level, with lobbying to ensure that the process receives the maximum possible exposure, generally, and spot-lobbying to ensure that the key players in the mess are spotlighted when it is their turn to testify. The sole Commissioner was reported to have said that the hearings will be televised. How can we check on and ensure that takes place? Also, we should be insisting on a similar arrangement to Uff with the transcripts being on-line.

- The evidential level, at which we need to make submissions to contend with the rotten and dishonest discourse from the utterly unresponsible parties who are ultimately responsible. We not only have to contend with and destroy the ‘Anansi-stories‘, we also have to advance our own arguments into the spaces and places they do not want us to go into.

The key person from whom I would like to see a submission is the respected former MP and economist Trevor Sudama, who was the first person to put onto the public record these serious concerns over the health of the CL Financial group. That was in the 2001 Budget debate and of course we all know that Sudama and his colleagues – Ramesh Lawrence Maharaj and Ralph Maraj – were strongly attacked, ostracized and ultimately forced from the political Head Table. All by their own party colleagues.

Mr. Sudama, we need your input in this vital matter. The background for your intervention in this matter, your debate on it and the political attack must form part of the record in this Enquiry.

Some of the key commentators who should put in written submissions are Camini Marajh of the Express, Andre Bagoo of Newsday and Anthony Wilson, the Ag Editor-in-Chief of this newspaper.

Our professional Institutions have been pointedly silent and I would hope to see submissions from –

- Institute of Chartered Accountants of Trinidad & Tobago – To be fair, the ICATT President, Anthony Pierre, joined me as a guest to discuss this crisis on Sunday Morning Politics on 26th September 2010 .

- The Law Association

- Bankers’ Association of Trinidad & Tobago

- Association of Trinidad & Tobago Insurance Companies,

Our institutions of higher education should join in with their perspectives –

- Arthur Lok Jack School of Business, part of UWI

- School of Business and Computer Studies

- School of Accounting and Management

- Caribbean Centre for Monetary Studies, also a part of UWI

- UWI’s Economics Department

- UWI’s Government Faculty

I am going to close by sketching just one parallel.

To go back to the main points of the Wall Street experience as outlined above, we hear of these complex debt swap instruments and their toxic consequences. The fatal flaw of these instruments, according to the reports I have read, seems to be that they seemed to be a good way to invest with high returns and little or no risk. The truth turned out to be just the opposite.

It all seems remote from our own situation, but that is not the only way to look at it. The most controversial single item in this entire situation here has been the EFPA, an annuity duly approved by the Supervisor of Insurance. When we consider the promotional literature for that product, it is nothing less than scandalous that a leading company should have been allowed to advertise an investment product with exceptional rates of return and the repeated phrase ‘guaranteed investment’. There is absolutely no such thing as a guaranteed investment. It is a complete contradiction in terms, but yet it went out to tens of thousands of people, who suspended their disbelief and went along for the ride. That is the Trini parallel with those complex debt swap instruments.

You see?

The new situation is charged with peril and one is reminded of Naipaul’s father, the intrepid journalist from A House for Mr. Biswas whose favourite tagline was “…amazing scenes were witnessed…”

The new situation is charged with peril and one is reminded of Naipaul’s father, the intrepid journalist from A House for Mr. Biswas whose favourite tagline was “…amazing scenes were witnessed…”

The Bankers Association of Trinidad & Tobago (BATT) and the Association of Trinidad & Tobago Insurance Companies (ATTIC) are also part of the situation.

The Bankers Association of Trinidad & Tobago (BATT) and the Association of Trinidad & Tobago Insurance Companies (ATTIC) are also part of the situation. As it is, we already have been bound to a rotten bailout of the wealthiest individual in the Caribbean by our Treasury at

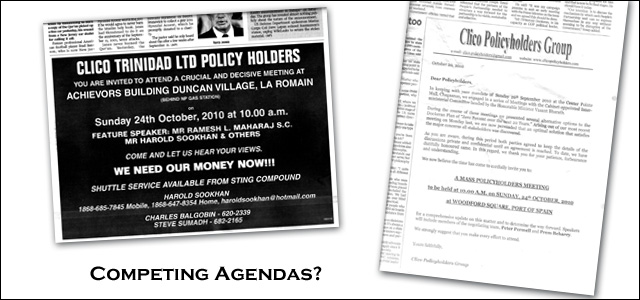

As it is, we already have been bound to a rotten bailout of the wealthiest individual in the Caribbean by our Treasury at  There was an EFPA group and a CLICO Policyholders group formed just after the budget on 8th September, but they soon merged under the latter name. I am now seeing what appears to be a substantial split with 2 competing meetings being organised for 10am today – one in Port-of-Spain and the other in San Fernando.

There was an EFPA group and a CLICO Policyholders group formed just after the budget on 8th September, but they soon merged under the latter name. I am now seeing what appears to be a substantial split with 2 competing meetings being organised for 10am today – one in Port-of-Spain and the other in San Fernando.

The Mottley Report – There was a team of three advisers – Wendell Mottley, Colin Soo Ping Chow and Steve Bideshi – appointed to examine the CL Financial group and we need to know what were the findings of this group.

The Mottley Report – There was a team of three advisers – Wendell Mottley, Colin Soo Ping Chow and Steve Bideshi – appointed to examine the CL Financial group and we need to know what were the findings of this group.