This special publication is dedicated to the important issue of Public Procurement. It is written by the a private sector group, headed by the Joint Consultative Council for the Construction Industry (JCC). The JCC consists of:

- Association of Professional Engineers of Trinidad & Tobago (APETT)

- Trinidad & Tobago Institute of Architects (TTIA)

- Board of Architecture of Trinidad & Tobago (BOATT) – observer status

- Trinidad & Tobago Society of Planners (TTSP)

- Trinidad & Tobago Contractors’ Association (TTCA)

- Institute of Surveyors of Trinidad & Tobago (ISTT) comprising Land Surveyors, Quantity Surveyors and Valuation Surveyors.

The private sector group consisted of –

- Joint Consultative Council for the Construction Industry

- Trinidad & Tobago Chamber of Industry & Commerce

- Trinidad & Tobago Manufacturers’ Association

- Trinidad & Tobago Transparency Institute.

The members of that Private Sector group were part of the Working Party on the Public Procurement White Paper, which was published in August 2005 and laid in Parliament the following month.

The Peoples’ Partnership’s manifesto, at page 18, commits to –

Procurement

- Prioritise the passing of procurement legislation and appropriate rules and regulations

- Establish equitable arrangements for an efficient procurement system ensuring transparency and accountability by all government departments and state enterprises…

In keeping with those campaign promises, the Minister of Finance tabled two legislative proposals in Parliament on 25 June 2010. Those were a Bill to amend the Central Tenders’ Board Act (originally prepared in 1997, when Ramesh Lawrence Maharaj was Attorney General) and the Public Procurement Bill (originally prepared in 2006, after publication of the White paper). A Joint Select Committee (JSC) was established on 1 October 2010 to examine those proposals, invite submissions and make recommendations.

The stated target of the PP government is to have the new Public Procurement legislation in place by the first anniversary of their electoral victory – i.e. by 25 May 2011.

Our Private Sector/Civil Society group reconvened last year and made a joint submission to the JSC in December 2010 – it is available here from the JCC‘s website. Our Private Sector group has had several meetings with the JSC – which was chaired by Education Minister, Dr. Tim Gopeesingh – but the results of those are not featured in this publication.

This special publication is intended to inform readers of the necessity for new Public Procurement legislation in our country and to set out the objectives of our proposals.

The guiding Principles

These are –

- Transparency

- Accountability

- Value for Money

The broad picture

One of the most serious findings of both the Bernard Enquiry (Piarco Airport Project) and the Uff Report (UDeCOTT and HDC) was the extent to which the largest State projects were being executed outside of any normal system of accountability. The very purpose of setting up these companies and procurement methods was to bypass the Central Tenders Board. The natural consequence of that way of proceeding being that if the CTB could be sidelined as a deliberate act of public policy, then other important elements of the regulatory framework are violated as a matter of course. In the case of both UDeCOTT and NHA/HDC, accounts were not filed for years – since 2006 for the former and 2002 for the latter – in flagrant violation of the rules and laws.

These were the largest State projects – often described as being the flagship or centre-piece of this or that government’s policy – yet they were breaking the main rules and getting away with it. The ‘getting away with it’ is the cloudy part of the picture, because we never hear of any penalty being sought against those State Enterprise Directors who broke the governance rules.

But that is the very centre of the puzzle and we need to understand it before we can try to unlock it. So, we are told, time and again, that the only way to really get important and urgent projects done in the correct fashion is to go outside the rules. The stated reasons are that the old rules are too cumbersome, slow etc… and yet, we end up, time and again, in the same mess.

Some of the features of these fiascos are –

- Huge cost over-runs on virtually every project.

- Unfinished projects which virtually no one can make sense of – to date there is no proper rationale for the huge and loss-leading International Waterfront Project, apart from Calder Hart’s bogus explanation to the Uff Enquiry.

- A gross burden on our Treasury going forward – The continuing delay in completing the accounts for these State Enterprises shows how difficult it is to work out exactly what the State owes and to whom.

What all that tells us is that the existing rule-book seems to be blocking progress and the attempts to bypass it have done little better, if not far worse.

The dismal picture on public procurement is not limited to construction projects and can be found in all the other areas.

A new approach is needed and that is what is at the foundation of these legislative proposals.

What is Public Money?

Central to the new proposals is that any new Public Procurement system must be in full effect whenever Public Money is spent.

‘Public Money’ is defined at page 5 of our proposals as money which is either due to, or ultimately payable by, the State.

Our proposals are intended to form part of a financial management reform package to include for a National Audit Office and a Financial Management and Accountability Bill.

The intended move is towards a greater transparency and duty of care in terms of how taxpayers’ money is spent. Our citizens, particularly the unborn ones who will have to pay for some of the wasteful schemes which are littering the landscape, deserve no less.

The new equation confronting us is –

Expenditure of Public Money

minus Accountability

minus Transparency

equals CORRUPTION

We must fix that.

So, what is at stake here?

Our society is beset by large-scale corruption, which sustains wrong-headed decision-making. The wider social consequences of that toxic culture are now hatching, with a vengeance, in the naked violence and wily crimes which pre-occupy our head-space.

The killing-fields of East POS, the decimation of African urban youths, the URP and CEPEP gangs and the battle for turf are all part of this picture.

As long as our society continues to applaud and reward dishonest, corrupt behaviour, we will continue sliding downhill.

The structure of our economy is that most of the country’s foreign exchange is earned by the State in the form of oil & gas earnings. The rest of the society relies on the State and its organs to recycle those earnings for the benefit of those of us not directly engaged in the energy sector.

For that reason, the State casts a very long shadow in our country, far more so than in other places. Virtually every substantial business relies on the State and its organs for a significant part of its earnings. A healthy connection with the State is essential for good profits.

But that is where the particular problem is, since the conduct of the State and its organs is often found to be lacking in the basic ingredients of fairplay, accountability and transparency.

If the State is the biggest source of funds in the place and the State is not playing straight at all, a serious question arises – How can we hope to uplift our society?

The State has an over-riding duty to behave in an exemplary fashion in its policy and operations.

Due to its tremendous footprint, the State has to behave in that exemplary fashion if we are to move out of this mess. A positive shift in State conduct will have a salutary effect on the commercial culture and wider society, one that is long overdue.

So, who spends Public Money?

We have a vast, expensive and confusing array of organs, all of which are authorized to spend our money. For a country of about 1.4M people, we have 26 Ministries. Just consider that the UK, with a population of about 65 million, has 19 Ministries and the USA, with a population of about 300 million, has 16 Ministries. For a Caribbean example, Jamaica has twice our population and 16 Ministries.

Quite apart from the number of Ministries, there are two further layers of agencies which also have the power to spend – our country has 73 Government Bodies and 58 State Enterprises.

Given the vast range of operations undertaken by these agencies, any new system would have to be flexible in order to cover all those types of transactions.

The main features of the new system

Three new independent organs will be created –

- The Procurement Regulator (PR), with the duty to create overall Guidelines and a common handbook to guide the public procurement process. The Regulator is appointed by the President in his own discretion and reports only to the Parliament. Agencies can create their own procurement handbooks, once these conform to the overall Guidelines, as approved by the Procurement Regulator.

- The Public Procurement Commission (PPC) will be the investigative arm of the new apparatus to which complaints will be directed.

- The National Procurement Advisory Council (NPAC) will be purely advisory and comprises 14 members from a broad range of named private sector/civil society organisations – the JCC, Manufacturers’ Association, Chamber of Commerce, Transparency Institute – as well as the Ministry of Finance and the Tobago House of Assembly.

All expenses are to be drawn on the Consolidated Fund, with the Procurement Regulator and Advisory Council required to report annually to Parliament.

A vital part of our proposals is that Cabinet, Government Ministers or politicians are prohibited from instructing or directing these new agencies in any way.

They are intended to be entirely independent of political influence, which conforms to the proposals in the White Paper.

That freedom from political influence was also specified in both the 1997 and 2006 draft legislation.

A Complaints Procedure

The proposed system will create clear rights to make complaints or report wrongdoing. Those rights are an important aspect of any modern procurement system and we propose three types of complaints/investigations –

- Potential tenderers/suppliers can complain, in the first instance directly to the Agency with which the tendering opportunity resides, then, if that is not dealt with satisfactorily, they can complain to the Public Procurement Commission. Ultimately, the right to seek the protection of the High Court is preserved, once the established complaints procedure has been followed.

- The Whistleblower – We are proposing that whistleblowers be given legislative protection and practical means to bring their complaints direct to the Public Procurement Commission.

- The Public Procurement Commission can also, on its own initiative, start an investigation into an area of concern.

There are strict time-limits for acknowledgement and resolution of complaints.

Our proposal is for the Public Procurement Commission to have powers to punish both frivolous complainants as well as parties found to be in breach of the new system. Those can range from fines to embargoes, during which offending parties can be banned from tendering opportunities. Offending public officers can be subject to both fines and/or imprisonment.

The concern over the cost of the new apparatus

One of the most frequently expressed criticisms is that as critics of the rationale and operations of significant State Enterprises, we seem to be proposing a new series of state-funded agencies. Some people have pointed out that these offices are unlikely to be cheap, particularly the PPC, which is to be constituted as a standing Commission of Enquiry under those existing legal provisions.

Yes, there will be new agencies and yes, they will cost money.

Given the recent revelations as to the cost of the Uff Enquiry – already estimated to exceed $50M – there are genuine concerns that we could soon have three new state-funded agencies which could absorb maybe $100M a year.

The challenge here is to move beyond the obvious and factual observations so that we can consider the decisive factors. Our proposals have the promotion of Value for Money as one of its founding principles and that is good for the public. So, how can we measure the value for money of these proposals, at this stage?

The scale of public procurement spending

In the case of expenditures direct out of the Ministries, the 2011 Budget has an anticipated capital expenditure for the Ministries of $7.050Bn, as per para 8 at page 4 of the Public Sector Investment Program (PSIP).

Also in that Budget there is an anticipated capital expenditure for the State Enterprises of $6.725Bn, as per the Foreword at page 4 of the Supplementary Public Sector Investment Program (Supplementary PSIP). The combined figure of $13.775Bn is only for projects, so it excludes the salaries, rents and normal running expenses. Please note that other elements in public expenditure, beyond just capital projects, will be covered by these proposals. The guiding principle being that those activities involve the expenditure of Public Money.

There are very limited exemptions from the proposed provisions and those can be viewed at the JCC website.

I am also sure that there are other ways in which Public Money is being expended which are not shown in the national Budget, so the amounts are surely larger than that estimate.

The potential for savings

The scale of the public transactions, involving Public Money, which will come under the control of this new system is huge, at least $14Bn in size. Even if the new system only saves 5% of that sum every year, we can easily justify an annual running expense in the $100M range, as mentioned earlier. 5% of $14Bn is $700M.

In the next 30 days, we expect our Legislators to make the crucial decisions on this series of proposals and we all need to be vigilant to preserve the key points.

Those key points would include –

- Heads of Independent organs to be appointed by the President

- Separation of the Regulator from the Investigator

- Regulations laid in Parliament for negative resolution, with no Ministerial or Cabinet approval required.

- Independent Organs funded from the Consolidated Fund, with no requirement to seek a Ministerial approval or Budget vote.

- Accountability is ensured by the requirement to report annually to Parliament.

- Private Sector/Civil Society oversight via the National Procurement Advisory Council.

- Proper provisions for complaints and Whistle-Blowers.

The ultimate question, given what we know now, is – Can we afford not to take this step?

At this unique and challenging moment in what has been a long, twisted journey, the prospects of more corruption and waste are grim.

For these proposals to succeed, the legislators will have to vote in favour of a new law which reduces their power and discretion. To some, that might be an impossible contradiction and an unreasonable thing to expect, but there will be considerable political credit to the account of those who make this change happen. Our citizens deserve no less.

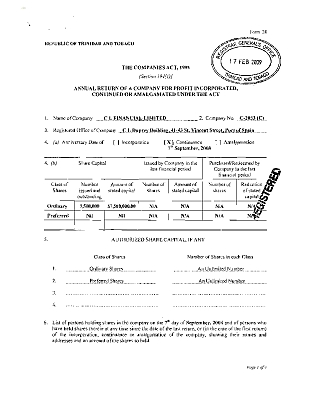

In preparing my submissions for the Colman Commission it occurred to me that the financial provisions made for the 3 CL Financial chiefs who departed in the last 12 months before the group collapsed is central to understanding the entire fiasco. It is rich in irony.

In preparing my submissions for the Colman Commission it occurred to me that the financial provisions made for the 3 CL Financial chiefs who departed in the last 12 months before the group collapsed is central to understanding the entire fiasco. It is rich in irony.

There were several important developments in the Colman Commission last week, with the widely reported appeals of Sir Anthony Colman QC for the Central Bank to change its position with respect to the presentation of accounts to the Enquiry.

There were several important developments in the Colman Commission last week, with the widely reported appeals of Sir Anthony Colman QC for the Central Bank to change its position with respect to the presentation of accounts to the Enquiry.

If you think this title is for the latest brand of household cleaner, you would be wrong. I drew that title from the famous statement by deceased US Supreme Court Justice Louis Brandeis,

If you think this title is for the latest brand of household cleaner, you would be wrong. I drew that title from the famous statement by deceased US Supreme Court Justice Louis Brandeis,