The CL Financial bailout was a steal of a deal for the owners of that troubled company. After all, the wealthiest man in the Caribbean was able to obtain an interest-free loan exceeding $25 Billion in Public Money at a time when no one else would lend him. Our Treasury was effectively the ‘lender of last resort’, so those terms were hugely in favour of CL Financial and its controlling shareholder, Lawrence Duprey. What is more, the shareholders kept all their shares.

In the previous column, I stated my view that Mariano Browne had taken what seemed to be a position supportive of Lawrence Duprey’s attempt to regain control of CLICO. I also pointed out that Browne was a member of the Cabinet when that fateful and detrimental deal was made to bail out CL Financial in 2009 and called on the significant members of that Cabinet to explain their rationale. I went further to say that Browne was one of the five significant persons who had been requested to testify and refused to do so.

I am pleased that Mariano Browne has replied on the record, so this column will deal with those valuable points. For starters, it is even clearer than before that former Minister of Finance, Karen Nunez-Tesheira, has serious questions to answer in relation to her central role in this bailout. Given that financial training and experience formed a weak part of her profile, one can only wonder at what prompted Manning to appoint Nunez-Tesheira to that position. We will see. In addition, the terms which were negotiated between the State and CLF are essential to understand today’s dilemma with respect to Duprey’s ambitions. A related issue which needs clarity is the role of the powerful, unelected ‘bigger heads’ who are seemingly in control of our country.

I am pleased that Mariano Browne has replied on the record, so this column will deal with those valuable points. For starters, it is even clearer than before that former Minister of Finance, Karen Nunez-Tesheira, has serious questions to answer in relation to her central role in this bailout. Given that financial training and experience formed a weak part of her profile, one can only wonder at what prompted Manning to appoint Nunez-Tesheira to that position. We will see. In addition, the terms which were negotiated between the State and CLF are essential to understand today’s dilemma with respect to Duprey’s ambitions. A related issue which needs clarity is the role of the powerful, unelected ‘bigger heads’ who are seemingly in control of our country.

Duprey and his cohorts benefitted from an unprecedented degree of access to key decision-makers in the Cabinet and the Central Bank.

One of the enduring paradoxes in how our society is governed is the lopsided distribution of information. There is an abundance of relatively unimportant information, alongside a severe scarcity of critical facts on the big issues of the day. It seems that we are now ‘Amusing ourselves to Death‘, to borrow an insightful phrase from Neil Postman.

There is a world seen and a world unseen. The challenge is to discern the scope and influence of the unseen world. The current lexicon describes the unseen world as the ‘Deep State‘. I have no doubt that such a state of affairs exists in our country. So what do we know about the huge decisions in our society’s governance and how do we come to know those things?

For instance, the most serious decisions are taken by the Cabinet, which consists only of members of Parliament – some directly-elected as MPs and others appointed as Senators. Some of those decisions are announced at the Thursday afternoon post-Cabinet Press Conference. But the coverage is always partial with my suspicion being that stories are often presented so as to conceal their less-favourable aspects.

Cabinet seems to operate according to two conventions – the first being ‘Collective Cabinet Responsibility’ and the second being that the discussions of Cabinet are secret. The Freedom of Information Act gives Cabinet documents a 10-year embargo against publication. So, the first problem is that the highest decision-making Chamber in our Republic is essentially a secret one. I have always felt that the veil of secrecy which covers Cabinet’s deliberations is most times severely detrimental to our collective interests. This sordid CLF bailout fiasco fortifies that view.

Another critical aspect of the current arrangements is the role of the powerful Party Political Financiers, which is rarely revealed, but often suspected. In the case of the CL Financial group, we know that CLICO was a major funder of both major parties, which gives this bailout fiasco its lingering, bitter, flavour. There are few opportunities for us to get a real insight, beyond rumours, as to the true role of the party financier. Apart from the role of CL Financial as financiers, we also learned in the Colman Commission that Nunez-Tesheira’s 2007 campaign benefitted from Hindu Credit Union (HCU) financing.

The 2009 negotiations

One question I always ask is whether Karen Nunez-Tesheira told her colleagues that CLF had paid a dividend three days after it requested a bailout? As a shareholder, she would have been in receipt of dividends. If the Cabinet was told, they should have insisted on immediate repayment of any dividend since an insolvent company cannot pay a dividend. If the Cabinet was not told, we are dealing with a most deceptive course of action. Which was it?

So, what did Browne say about those negotiations?

…I have said that Duprey’s (and other shareholders) legal position is strong as the government depended on a MOA (memorandum of Agreement) the time frame of which has long since passed. On that basis, the shareholders have rights. Even if the state has expended money, the State and or its agents (the Central Bank) must do so in way that protects both the policy holders and the shareholders.

That was my advice in cabinet and at the Finance Policy Committee. The view of the Minister of Finance prevailed. I am of the opinion that Karen Nunez Tesheira was wrong then and is wrong now…

Browne is concurring with my view that the State’s position is weak in this bailout endgame, the key point being “…the shareholders have rights…”. Being bound by the first convention of ‘Collective Cabinet Responsibility’, Browne kept his silence during the raging controversy of the past 6 years, but he has now chosen to break the secrecy convention. I am grateful to him and it is telling that the most expert Cabinet member in that critical arena of finance and economics is now revealing his recollections of these critical events.

Nunez-Tesheira needs to share the rationale for the bailout formula which let Duprey and the other shareholders keep their shares and loaned those huge sums of Public Money to the wealthiest man in Caribbean on an interest-free basis. What were the public policy considerations which could possibly have supported such a course of action?

Browne goes further to outline a situation in which he seems to have been excluded from the negotiations –

…And for the record I have not been part of any negotiations with Clico or CLF as part of the bailout action. Neither was I a part of the cabinet which took the decision to support the CLF/ CLICO Group. Those decisions were taken at a Cabinet meeting of which I was not a part on 29th January 2009 as I was in Barbados representing the Minister of Finance at a COFAP meeting. This bailout was always the province of the Minister of Finance and the Governor of the Central Bank and (sic) had no part in those decisions.

Further, Clico/CLF/Duprey made no contributions to the PNM during my tenure as Treasurer…

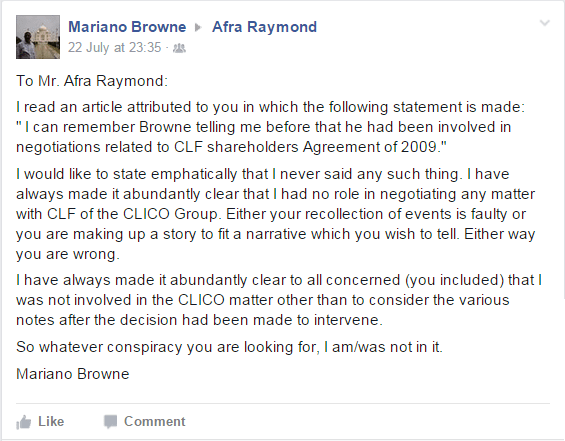

I can remember Browne telling me before that he had been involved in negotiations related to the CLF Shareholders Agreement of June 2009. That Agreement, at para A of its preamble, undertakes to protect the interest of shareholders. Note – Browne has since denied this claim of mine, so that has to be noted.

Of course, we know that Browne was part of the Cabinet which made those decisions, even if he was not in attendance at those particular meetings (I have no reason to doubt him), it is immaterial. As a member of that Cabinet he bears collective responsibility.

Duprey’s intended re-entry

Browne contested my statement that he seemed to be supporting Duprey’s attempt to regain control of CLICO –

…With regard to your opinion, I am am (sic) supporting nothing…The state only owns 49% of the company. If the shareholders act in concert there is nothing to prevent them from having an extra ordinary shareholders (EGM) Meeting and replacing the state appointed Directors. It is unlikely that Lawrence Duprey can pass the fit and proper rule and therefore cannot be appointed to CLICO’s Board, but he can be appointed to the CLF Board…

Browne listed the reasons which seemed to favour Duprey’s position, which position is fortified by his interpretation of the fit & proper rules. In his view, those rules would have prevented Duprey’s appointment to CLICO’s Board, but he would have still been eligible to sit on CL Financial’s Board. If we are considering a situation in which CLICO would still have CLF as its majority shareholder, that is an entirely misplaced view.

In the Central Bank’s ‘Fit and Proper Guideline‘, the question of ‘Who should be Fit and Proper?’ is addressed at page 2 –

“…4.1 According to governing legislation the following persons referred to in this Guideline as holding “key positions” are required to be fit and proper: -…

…4.1.4 Controlling Shareholder – may be an individual or a corporate entity

- Under the IA, any person who is entitled to control at least one-third of the voting power at any general meeting of the company.

- Under the FIA, any person who controls twenty five per cent or more of the voting power at any general meeting…

Before the bailout about 89% of CLICO’s shares were owned by CLF, so Duprey cannot regain control of CLICO, either directly or via a holding company, if the fit and proper regulations are enforced. As I said previously, the acid question is whether the Central Bank will summon the will to apply those rules without fear or favour.

This is no academic dispute, since Duprey has made it clear that he is seeking to regain control of CLICO, so that financial company and the rules which govern it, must be central concerns in this matter.

Sunlight is the best disinfectant. Come clean.

Yet another worrying aspect of the CL Financial (CLF) bailout fiasco is the role of the Integrity Commission (IC) in these turbid dealings. I am referring to the apparent failure or refusal of The Commission to carry out its duties in relation to CLF as required by the Integrity in Public Life Act (IPLA).

Yet another worrying aspect of the CL Financial (CLF) bailout fiasco is the role of the Integrity Commission (IC) in these turbid dealings. I am referring to the apparent failure or refusal of The Commission to carry out its duties in relation to CLF as required by the Integrity in Public Life Act (IPLA).

I am pleased that Mariano Browne has replied on the record, so this column will deal with those valuable points. For starters, it is even clearer than before that former Minister of Finance, Karen Nunez-Tesheira, has serious questions to answer in relation to her central role in this bailout. Given that financial training and experience formed a weak part of her profile, one can only wonder at what prompted Manning to appoint Nunez-Tesheira to that position. We will see. In addition, the terms which were negotiated between the State and CLF are essential to understand today’s dilemma with respect to Duprey’s ambitions. A related issue which needs clarity is the role of the powerful, unelected ‘bigger heads’ who are seemingly in control of our country.

I am pleased that Mariano Browne has replied on the record, so this column will deal with those valuable points. For starters, it is even clearer than before that former Minister of Finance, Karen Nunez-Tesheira, has serious questions to answer in relation to her central role in this bailout. Given that financial training and experience formed a weak part of her profile, one can only wonder at what prompted Manning to appoint Nunez-Tesheira to that position. We will see. In addition, the terms which were negotiated between the State and CLF are essential to understand today’s dilemma with respect to Duprey’s ambitions. A related issue which needs clarity is the role of the powerful, unelected ‘bigger heads’ who are seemingly in control of our country.

This column sets out my reasons for seriously questioning the motivation and priorities of the Integrity Commission. Despite my doubts as to the way in which successive Commissions have operated the Integrity in Public Life Act (IPLA), I have continued to offer suggestions as to how their work could be made more effective.

This column sets out my reasons for seriously questioning the motivation and priorities of the Integrity Commission. Despite my doubts as to the way in which successive Commissions have operated the Integrity in Public Life Act (IPLA), I have continued to offer suggestions as to how their work could be made more effective.

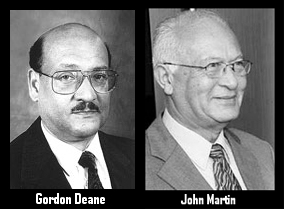

The Commission’s independence was fatally undermined by its decision to write to then Prime Minister, Patrick Manning, to seek his instructions on how the complaint against Dr Rowley was to be handled. At that time, the Commission was chaired by Gordon Deane, with John Martin serving as its Deputy Chairman.

The Commission’s independence was fatally undermined by its decision to write to then Prime Minister, Patrick Manning, to seek his instructions on how the complaint against Dr Rowley was to be handled. At that time, the Commission was chaired by Gordon Deane, with John Martin serving as its Deputy Chairman.