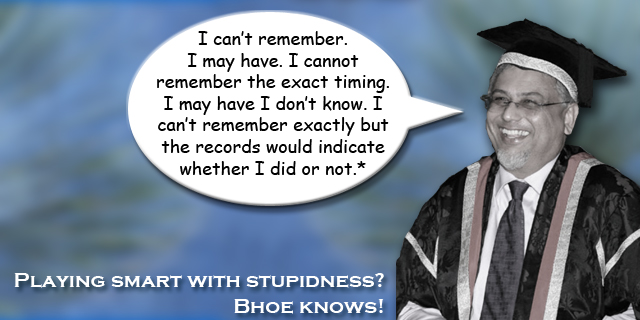

* In response to a question whether he took part in the reported decision to pay CLF dividends even after the approach to the State in 2009.

* In response to a question whether he took part in the reported decision to pay CLF dividends even after the approach to the State in 2009.

CL Financial’s final Annual General Meeting was the most interesting meeting in the saga of its collapse.

That meeting took place at the Trinidad Hilton on Friday 23 January 2009, so consider the timeline –

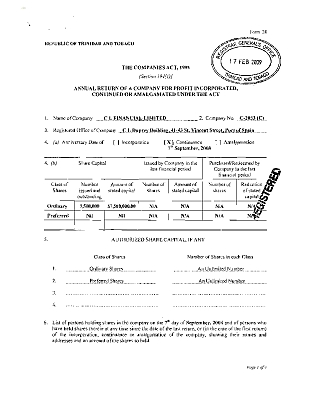

- 18 November 2008 – CLF publishes its 2007 Annual Report, including its audited accounts, which showed assets of $100.666Bn and after-tax profits of $1.74Bn.

- 13 January 2009 – CLF writes, under Lawrence Duprey’s signature, to the Governor of the Central Bank to request urgent financial assistance. See pg 628 of Hansard of 4 February 2009 for the text of that letter, which specified that CLF’s asset value was $23.9Bn.

- 16 January 2009 – CLF pays a dividend of $3.00 per share.

- 23 January 2009 – CLF convenes its final AGM before the ‘official’ collapse.

- 30 January 2009 – The bailout of CLF is announced at a Press Conference at the Central Bank. All the speakers at that event stated the CLF asset value at $100Bn.

Given that the normal function of an AGM is to inform a company’s shareholders and stakeholders of its performance and prospects, that timeline raises some intriguing questions.

For whatever reason, there have been no published reports of that final CLF AGM, so I posed these questions to a CLF shareholder in an email exchange –

Q Did you attend that AGM?

A Yes

Q Was it at the Ballroom of the Trinidad Hilton on Friday 23rd January 2009?

A It was at the Hilton but not in their ballroom. It was in one of the restaurants/meeting rooms that overlooks the Savannah. Can’t remember the name.

Q About how many shareholders were there in attendance?

A I would guess about 30-40

Q Which Directors were present?

A Clinton Ramberansingh, Rampersad Motilal, Bhoe Tewarie, Gita Sakal and Michael Carballo.

Q Which Executive Directors were present?

A Roger Duprey (I think)

Q What was the ‘tone’ of the meeting? Was there any clue as to the grave difficulties facing the CLF group? Was the ‘bailout letter’ mentioned at all?

A The tone of the meeting was “normal”. There certainly was no indication that CLF (or the CLF group) was in any imminent danger. The effects of the global downturn was mentioned in light of the reduced dividend (from $5 to $3) and we were told by Carballo that although the group, like everyone else, was feeling the effects of the global recession, it was still performing well and that he expected the performance to improve over the course of the coming year. One interesting “fact” that did emerge (I say “fact” because I have no idea as to the veracity of the claim) had to do with the value of CLF shares. One shareholder had complained about not really being able to derive any value from his CLF shares apart from receiving a dividend. No bank would accept it as security. Carballo advised that CIB would accept the shares as security for a loan………….had I known I’d have taken a big loan and never paid it back!! Certainly the bailout letter was never disclosed to the shareholders.

If true, this account of the events is deeply disturbing.

The question is whether CLF’s Independent Directors were aware of its true position. Could it be that the Board was unaware of Duprey’s letter and that they were surprised when the bailout was announced? If that were the case, it would mean that Board of Directors was kept in the dark over this bailout.

If the Board was informed as to the bailout letter, we would be contemplating an even more unacceptable case. If that is what happened, it would have been fraudulent for the CLF Directors to have carried out that AGM without informing the shareholders of the company’s true position.

Michael Carballo was the CLF Group Financial Director since Andre Monteil’s retirement in early 2008. Given Carballo’s position in the group and the high quality of his professional skills, it is very difficult to accept that he did not himself know CLF’s true position.

According to this email exchange, neither Lawrence Duprey nor Andre Monteil attended CLF’s final AGM. With only one week to go, they would likely have been attaching more priority to the negotiations for the bailout.

So, Dr. Tewarie – a shareholder and former Director of CLF – is now appointed to Cabinet at the very moment that it is reviewing the bailout of the same CL Financial group. That man, noted in the field of business education – his last post, before this appointment, being Director of UWI’s Institute of Critical Thinking – when asked about his attendance and participation in the Board meeting which approved those CLF dividends is reported to have said – “…I cannot remember, I may have, I cannot remember the exact timing, I may have—I don’t know…The records would indicate whether I did or not...”.

We are being asked to believe that Dr. Tewarie cannot really remember this meeting, probably the final one before CL Financial folded and likely the most eventful in even a high-profile career such as his. The old people have a saying that you start as you mean to go on. Dr. Tewarie’s reply can hardly inspire confidence. It verges on being dismissive and disrespectful of the public. We are paying for all the mess created by CL Financial and yes, that is the same public Dr. Tewarie just swore to serve. It does not augur well.

The essential questions for Dr. Tewarie include his attendance and participation in this final AGM and what he knew about the state of the group at the time.

It seems unacceptable to me for holders of high office in our country to be persons who would be disqualified under the ‘fit and proper’ criteria. That practice must be revised as part of the New Politics we are being promised.

Given the tremendous stakes and the complete silence by all the responsible people, we need to ensure that this affair does not carry our country any further into peril.

These responsible and silent people must be banished into obscurity, at the very least.

SIDEBAR

PricewaterhouseCoopers

It is a well-established custom that AGMs of large organisations are attended by the responsible partner of the auditor’s firm, who reads the auditor’s letter to the audience. Did a partner of PriceWaterhouseCoopers attend this meeting? Which one? Did a PwC partner read aloud that auditor’s letter?

Real Responsibility

On the one hand, a Cabinet Minister is dismissed over a $100,000 contract and I consider that to be good progress in the correct direction. The fact that a reasonable suspicion had arisen cost that Minister her job, which is good. In keeping with the State’s exemplary behaviour, our leaders should not behave in a fashion which causes suspicion or derision.

On the other hand, we are seeing a replacement Cabinet Minister, who at last record was known to be a shareholder of the huge, failed CL Financial group and one of its Board Directors at the time of the colossal crash. The official version is that CL Financial is a $100Bn group. There have been recent reports that the Cabinet is about to consider a new approach to the bailout and the public is bound to wonder at the timing of this appointment.

Fit and Proper

The Central Bank’s ‘Fit and Proper’ Guideline (sic) sets out the official position as to the type of person held to be ‘fit and proper’ to be a Director or Officer of a Financial Institution.

It states –

3.1 In accordance with governing legislation a person is considered to be fit and proper if the person essentially is of good character, competent, honest, financially sound, reputable, reliable and discharges and is likely to discharge his/her responsibilities fairly.

If you think this title is for the latest brand of household cleaner, you would be wrong. I drew that title from the famous statement by deceased US Supreme Court Justice Louis Brandeis,

If you think this title is for the latest brand of household cleaner, you would be wrong. I drew that title from the famous statement by deceased US Supreme Court Justice Louis Brandeis,