In this provocative talk, Afra Raymond takes a deeper look at race and racism. He successfully uses the talk to place a new perspective on how we think about race and its role in corruption. TEDxPortofSpain. 14 October 2015.

Tag: British-American Insurance

CL Financial bailout – Finding the Facts

On 10 August 2015, the then Minister of Finance and the Economy appealed the High Court’s 22 July 2015 judgment which ordered the release of the details on the CL Financial bailout. My protest at this action was published in this space as ‘Studied Disdain‘. Since then, the General Election of 7 September 2015 brought about a change of government – the People’s Partnership is now the official Opposition and the People’s National Movement is once again the government.

It is essential to now determine the areas in which we can expect changes in policy and the areas in which we can expect business as usual. Those perspectives informed my letter of 15 September 2015 to the new Minister of Finance & the Economy, Colm Imbert.

Imbert asked for more time to consider my request, so I consented to his application to the Appeal Court – the next hearing in this matter is therefore set for 25th January 2016.

My exchanges thus far with Imbert have been straightforward ones, but it is always important for us to be vigilant and aware.

By email & hand

Mr Colm Imbert MP,

Minister of Finance & the Economy,

Ministry of Finance & the Economy,

8th Floor,

Eric Williams Financial Complex,

Brian Lara Promenade,

Port-of-Spain

The High Court ruled in my favour on 22 July 2015 and ordered the publication of the requested details, but on 10th August 2015 the Ministry of Finance appealed that ruling (P201 – 2015). Our next hearing is set for Monday 19th October 2015, to argue the State’s application for extension of the stay of execution. It is my intention to strongly oppose that application for any extension of the stay of execution.I am formally requesting that you take the necessary actions to restore the Public Interest in the Accountability, Transparency and Good Governance in relation to this vast, opaque expenditure of Public Money.In specific terms, I am requesting three actions from you –

- Formal withdrawal of the State’s appeal in this matter;

- Urgent publication of the details of the CL Financial bailout to include the audited accounts for CL Financial 2008-2014 or any interim, preliminary, draft or unaudited statements of CL Financial Limited; the full details of the official briefing to Independent Senators in September 2011 preparatory to the debate on The Central Bank (Amendment) Bill and The Purchase of Rights and Validation Bill 2011 (to include copies of all slides. Power-Point slides, tables, charts, schedules, text or other information which comprised that presentation) and details of the funds paid in the bailout to include – a full list of creditors as at the commencement date of the bailout and at the date of my FoIA request (8th May 2012); the names of the EFPA holders; the dates of the repayments of the EFPA holders, together with details of the amounts received; the identities of all those who have received public money in the conduct of this exercise, together with details of the amounts received. These details are no doubt electronically stored, so I would request that the answers be provided in a searchable database;

- Refund of my reasonable legal fees in this matter – The High Court awarded 70% of my costs.

In anticipation of objections to disclosing these details on the grounds of the right of private investors to confidentiality, my response would be to point out that all other recipients of Public Funds are liable to having detailed information disclosed, upon request and without notice. A request for information on the details of a Public contract would include the identities of the parties; the contract itself; the dates and amounts of payments. Such requests are routinely handled without resort to attorneys or even the Courts, even if administrative delay is also a reality. That is the common and accepted practice in relation to all Public contracts and payments, which is fortified by the provisions of the Freedom of Information Act, under which my litigation was successful. There is no case made for any special status of financial investors to enjoy rights of confidentiality which are not available to other recipients of Public Funds.

The only way for the required level of transparency and accountability to be achieved is by the responsible officials publishing all the details of all the payments of Public Money.

The equation for the reality check is –

Expenditure of Public Money Minus Transparency Minus Accountability Equals CORRUPTION

I can appreciate that the impending 2016 budget would likely demand your attention for the next three weeks. I would like to know the State’s position in this matter before the next Appeal Court hearing on Monday 19th October 2015, so I would appreciate your reply by Friday 9th October 2015.

This request was made in the Public Interest, so I trust that it will receive your positive attention.

Yours sincerely,

……………………………………………….

Afra Raymond

c.c. – Dr. Keith Rowley MP, Prime Minister,

Mr. Faris Al Rawi MP, Attorney General

How much has the CL Financial bailout cost?’

TIMELINE

-

-

DATE

EVENT

SOURCE

with live hyperlinks

30th January 2009

Bailout announced at an estimated cost of $5.0 Billion

12th June 2009

CL Financial Shareholders’ Agreement signed, which for the first time made it a priority to protect shareholders’ rights.

– see Para ‘A’ of the Preamble at page two.

8th September 2010

Winston Dookeran’s first Budget Statement, in which he formally proposes to drastically reduce the rate of payout of Public Money in the bailout.

pages eight through ten.

1st October 2010

Then PM confirms that $7.3 Bn had been spent and that a further $7.0 Bn needed to be spent (pg 31). The burning need for an explanation of where the $7.3 Bn went…(pgs 25-26)

Hansard for 1st October 2010 –

pages 19 through 34.

3rd April 2012

Then Finance Minister Winston Dookeran confirms that $12 Bn had been spent.

Affidavit to High Court in Percy Farrell & Ors vs AG –

para 21.

1st October 2012

New Finance Minister Larry Howai confirms that $19.7 Bn had been spent, which is an additional $7.7 Bn in six months.

page six.

17th May 2013

Formal confirmation of bailout cost “…over $25 Bn…”

Formal Press Release from Office of the AG –

para eight.

2nd April 2014

Then Finance Minister Howai confirms bailout cost as – “… the cost to the country of the CL Financial bailout—the actual cash that has been put out—is approximately$20.8 billion...”

Hansard for Senate sitting of 2ndApril 2014 –

page 35.

7th August 2015

Then Finance Minister Howai confirms bailout cost as ‘not quite $20 Bn‘.

CNMG interview

-

CL Financial Bailout – Studied Disdain

SIDEBAR: How much Public Money has been spent on this CL Financial bailout?

These are the official statements as to the actual cost of the bailout since 2012. It really resembles the ‘carefully cultivated confusion‘ which I deplored recently in relation to the Invader’s Bay fiasco.

- 3 April 2012 – Affidavit of then Finance Minister, Winston Dookeran, which specifies the Public Money committed to this colossal bailout as –

Para 21 (a) $5.0Bn already provided to CLICO; (b) $7.0Bn paid to holders of the EFPA and Para 22 $12.0Bn estimated as further funding to be advanced.Dookeran is saying in April 2012 that $12 Billion had been paid and an estimated $12 Billion remained to be paid, which is a total of $24Bn in public money to be spent to satisfy the creditors of the CLF group.

- 1 October 2012 – Senator Larry Howai, delivering his first Budget Statement, stated the cost of the CL Financial bailout at page six –

“…The cost to the national community has been substantial—an amount of $19.7 billion or 13.0 per cent of our current GDP; yet this expenditure was necessary and decisive for containing an economic and financial crisis…”

Howai is telling the Senate in October 2012, a mere six months after Dookeran’s Affidavit, that $19.7 Billion has been spent. If we follow this official account, which fixed the total spent in April 2012 at $12 Billion, an additional $7.7 Billion of Public Money was spent in six months. I continue to contest whether this bailout was at all necessary, but it was certainly an incredible rate of expenditure, that cannot be contested. - 4 May 2013 – In this newspaper, under the headline ‘$25b and counting – Cost to taxpayers of CLICO bailout and enquiry‘ –

“…However, Government’s intervention into the CLICO fiasco has cost taxpayers more than $25 billion…” - 17 May 2013 – UNCTT’s website contains a formal Press Release from the office of the then Attorney General, Anand Ramlogan SC –

“…It should be noted that efforts to stabilize and resuscitate CLICO have thus far cost taxpayers over $25 billion dollars…” - 2 April 2014 – At the Senate sitting , Minister Howai stated at page 35 of Hansard –

“…Mr. President, as you would perhaps be aware, the cost to the country of the CL Financial bailout—the actual cash that has been put out—is approximately $20.8 billion. This was done in an effort to preserve the stability of the economy of Trinidad and Tobago…” - 7 August 2015 – I was therefore astonished to hear the Minister of Finance, Larry Howai, stating on CNMG TV, that the cost of this bailout is ‘not quite $20 Billion‘.

The first item, Dookeran’s April 2012 affidavit, is the one for which Howai is now being required by the Court to produce the details.

Some of my views on this, from last week –

“…Well, this is the usual practice, in which the public right to know is subordinated to private, undisclosed interests…it seems to me at these moments that the job of the State’s attorneys is to shroud the entire indecent affair in ‘something resembling an important principle’, but ultimately the effort is intended to wear me down and let the issue fade from collective memory…I am continuing to fight this very hard…what we have here is the ultimate collapse of our Republic by Public Officials who are sworn to uphold the Public Interest without fear or favour, but end up exposed as serving the toxic interests of the financial robber barons…I am reminded of Simon Johnson’s ‘The Quiet Coup‘ published in The Atlantic of May 2009…in T&T, we too, had a quiet coup…”

As the Season of Reflection and the impending election flow together, there is a bitter brew now being offered in relation to the CL Financial bailout.

Disdain is an attitude which denotes someone or something as being unworthy of proper consideration. I think that in relation to our collective interests in the CL Financial matter, we are now being subjected to Larry Howai’s ‘studied disdain’ in relation to our collective interests in the CL Financial matter.

On Tuesday 10 August 2015, the State announced its decision to appeal the recent High Court ruling that the details of the CL Financial bailout must be published. That appeal was also filed that day and the State applied to have the stay of execution extended to the end of the appeal process – the latter issue will be heard on 19 October 2015.

The Minister of Finance & the Economy is the main public official with responsibility to account for how Public Money is spent. The Public Money being used to bailout the CL Financial creditors is our money. The Minister of Finance therefore has a fundamental duty to publicly account for how our money has been spent.

Our collective interests in this matter, of exactly how $25 Billion of our dollars were spent, far outweigh the undisclosed interests on whose behalf the Minister is now appealing.

This appeal is against every one of the orders made in the High Court judgment of 22 July 2015 and therefore represents an utter abdication of the fundamental duties of the Minister of Finance and the Economy.

Our collective interests could benefit from the unintended juxtaposition of national elections, the apparent halt of USD sales by the country’s leading bank and the hostility of the Minister of Finance to the truth. These are rare moments in which we might gain insight and regain fundamental rights, but we have to be aware of what is at stake.

The Ministry’s Press Release deserves stern scrutiny, so these are my points. Continue reading “CL Financial Bailout – Studied Disdain”

CL Financial Bailout – The Hidden Truth

Sad to say, this CL Financial bailout is resembling a situation in which well-connected persons are getting what they can, anyway they can, but making sure not to get caught. Who were the beneficiaries of this lavish payout? What is this reluctance to release details?

That is the Code of Silence in effect.

I was not at all surprised at the reported statements of the Minister of Finance, Larry Howai, on the 22 July 2015 High Court judgment ordering him to provide the detailed information I had requested on the CL Financial bailout. The High Court granted a 28-day stay of execution and the Ministry is reportedly in consultation with its lawyers, claiming that “A decision will be made within the period of time allowed by the court,”. The article closed with this quote –

“…Finance Minister Larry Howai said in the statement it should be noted, none of the requests refer to “how over $25b was spent in the Clico bailout”…”

Given that the very request was for the detailed financial information which has been deliberately suppressed since 2009, it is of course impossible to say with any certainty just how much Public Money was actually spent on this CL Financial bailout. That is the inescapable fact at the centre of this scandal. The Minister’s tautology is really a powerful explanation of this point.

Continue reading “CL Financial Bailout – The Hidden Truth”

CL Financial Bailout – The Real Case

In 2013 I sued the Minister of Finance & the Economy for his continuing failure or refusal to provide the details relating to the huge $25 Billion bailout of the failed CL Financial group.

On Wednesday 22 July 2015, the High court ruled in my favour by ordering the release of all the requested information.

The basic principle behind the Freedom of Information Act is that the information held by Public Authorities belongs to the public, unless one of the valid exemptions is applicable.

The Court also granted the State a 28-day stay of execution which seems intended to allow them the time to decide whether to appeal before they have to provide the requested information. Given the ongoing Information War and the high stakes to maintain the ‘Code of Silence’ in relation to this bailout, I would not be at all surprised if the State were to appeal against this ruling.

The unexplained gap

On 1 October 2010, the Prime Minister addressed Parliament to explain that $7.3 Billion had been spent on the bailout and that a further estimated $7.0 Billion was required to settle all debts. That is a 2010 estimate of $14.3 Billion to settle the CL Financial bailout, but the current estimated cost of the bailout is in excess of $25 Billion. That means that over $10.5 Billion more than the 2010 estimate has been spent, so where did all that extra money go? That information and the defined official policy of secrecy are at the heart of this scandal. Continue reading “CL Financial Bailout – The Real Case”

CL Financial Bailout – Steal of a Deal

The CL Financial bailout was a steal of a deal for the owners of that troubled company. After all, the wealthiest man in the Caribbean was able to obtain an interest-free loan exceeding $25 Billion in Public Money at a time when no one else would lend him. Our Treasury was effectively the ‘lender of last resort’, so those terms were hugely in favour of CL Financial and its controlling shareholder, Lawrence Duprey. What is more, the shareholders kept all their shares.

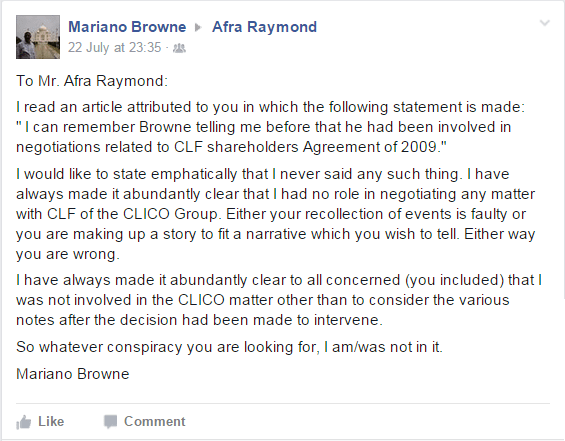

In the previous column, I stated my view that Mariano Browne had taken what seemed to be a position supportive of Lawrence Duprey’s attempt to regain control of CLICO. I also pointed out that Browne was a member of the Cabinet when that fateful and detrimental deal was made to bail out CL Financial in 2009 and called on the significant members of that Cabinet to explain their rationale. I went further to say that Browne was one of the five significant persons who had been requested to testify and refused to do so.

I am pleased that Mariano Browne has replied on the record, so this column will deal with those valuable points. For starters, it is even clearer than before that former Minister of Finance, Karen Nunez-Tesheira, has serious questions to answer in relation to her central role in this bailout. Given that financial training and experience formed a weak part of her profile, one can only wonder at what prompted Manning to appoint Nunez-Tesheira to that position. We will see. In addition, the terms which were negotiated between the State and CLF are essential to understand today’s dilemma with respect to Duprey’s ambitions. A related issue which needs clarity is the role of the powerful, unelected ‘bigger heads’ who are seemingly in control of our country.

I am pleased that Mariano Browne has replied on the record, so this column will deal with those valuable points. For starters, it is even clearer than before that former Minister of Finance, Karen Nunez-Tesheira, has serious questions to answer in relation to her central role in this bailout. Given that financial training and experience formed a weak part of her profile, one can only wonder at what prompted Manning to appoint Nunez-Tesheira to that position. We will see. In addition, the terms which were negotiated between the State and CLF are essential to understand today’s dilemma with respect to Duprey’s ambitions. A related issue which needs clarity is the role of the powerful, unelected ‘bigger heads’ who are seemingly in control of our country.

Duprey and his cohorts benefitted from an unprecedented degree of access to key decision-makers in the Cabinet and the Central Bank.

One of the enduring paradoxes in how our society is governed is the lopsided distribution of information. There is an abundance of relatively unimportant information, alongside a severe scarcity of critical facts on the big issues of the day. It seems that we are now ‘Amusing ourselves to Death‘, to borrow an insightful phrase from Neil Postman.

There is a world seen and a world unseen. The challenge is to discern the scope and influence of the unseen world. The current lexicon describes the unseen world as the ‘Deep State‘. I have no doubt that such a state of affairs exists in our country. So what do we know about the huge decisions in our society’s governance and how do we come to know those things?

For instance, the most serious decisions are taken by the Cabinet, which consists only of members of Parliament – some directly-elected as MPs and others appointed as Senators. Some of those decisions are announced at the Thursday afternoon post-Cabinet Press Conference. But the coverage is always partial with my suspicion being that stories are often presented so as to conceal their less-favourable aspects.

Cabinet seems to operate according to two conventions – the first being ‘Collective Cabinet Responsibility’ and the second being that the discussions of Cabinet are secret. The Freedom of Information Act gives Cabinet documents a 10-year embargo against publication. So, the first problem is that the highest decision-making Chamber in our Republic is essentially a secret one. I have always felt that the veil of secrecy which covers Cabinet’s deliberations is most times severely detrimental to our collective interests. This sordid CLF bailout fiasco fortifies that view.

Another critical aspect of the current arrangements is the role of the powerful Party Political Financiers, which is rarely revealed, but often suspected. In the case of the CL Financial group, we know that CLICO was a major funder of both major parties, which gives this bailout fiasco its lingering, bitter, flavour. There are few opportunities for us to get a real insight, beyond rumours, as to the true role of the party financier. Apart from the role of CL Financial as financiers, we also learned in the Colman Commission that Nunez-Tesheira’s 2007 campaign benefitted from Hindu Credit Union (HCU) financing.

The 2009 negotiations

One question I always ask is whether Karen Nunez-Tesheira told her colleagues that CLF had paid a dividend three days after it requested a bailout? As a shareholder, she would have been in receipt of dividends. If the Cabinet was told, they should have insisted on immediate repayment of any dividend since an insolvent company cannot pay a dividend. If the Cabinet was not told, we are dealing with a most deceptive course of action. Which was it?

So, what did Browne say about those negotiations?

…I have said that Duprey’s (and other shareholders) legal position is strong as the government depended on a MOA (memorandum of Agreement) the time frame of which has long since passed. On that basis, the shareholders have rights. Even if the state has expended money, the State and or its agents (the Central Bank) must do so in way that protects both the policy holders and the shareholders.

That was my advice in cabinet and at the Finance Policy Committee. The view of the Minister of Finance prevailed. I am of the opinion that Karen Nunez Tesheira was wrong then and is wrong now…

Browne is concurring with my view that the State’s position is weak in this bailout endgame, the key point being “…the shareholders have rights…”. Being bound by the first convention of ‘Collective Cabinet Responsibility’, Browne kept his silence during the raging controversy of the past 6 years, but he has now chosen to break the secrecy convention. I am grateful to him and it is telling that the most expert Cabinet member in that critical arena of finance and economics is now revealing his recollections of these critical events.

Nunez-Tesheira needs to share the rationale for the bailout formula which let Duprey and the other shareholders keep their shares and loaned those huge sums of Public Money to the wealthiest man in Caribbean on an interest-free basis. What were the public policy considerations which could possibly have supported such a course of action?

Browne goes further to outline a situation in which he seems to have been excluded from the negotiations –

…And for the record I have not been part of any negotiations with Clico or CLF as part of the bailout action. Neither was I a part of the cabinet which took the decision to support the CLF/ CLICO Group. Those decisions were taken at a Cabinet meeting of which I was not a part on 29th January 2009 as I was in Barbados representing the Minister of Finance at a COFAP meeting. This bailout was always the province of the Minister of Finance and the Governor of the Central Bank and (sic) had no part in those decisions.

Further, Clico/CLF/Duprey made no contributions to the PNM during my tenure as Treasurer…

I can remember Browne telling me before that he had been involved in negotiations related to the CLF Shareholders Agreement of June 2009. That Agreement, at para A of its preamble, undertakes to protect the interest of shareholders. Note – Browne has since denied this claim of mine, so that has to be noted.

Of course, we know that Browne was part of the Cabinet which made those decisions, even if he was not in attendance at those particular meetings (I have no reason to doubt him), it is immaterial. As a member of that Cabinet he bears collective responsibility.

Duprey’s intended re-entry

Browne contested my statement that he seemed to be supporting Duprey’s attempt to regain control of CLICO –

…With regard to your opinion, I am am (sic) supporting nothing…The state only owns 49% of the company. If the shareholders act in concert there is nothing to prevent them from having an extra ordinary shareholders (EGM) Meeting and replacing the state appointed Directors. It is unlikely that Lawrence Duprey can pass the fit and proper rule and therefore cannot be appointed to CLICO’s Board, but he can be appointed to the CLF Board…

Browne listed the reasons which seemed to favour Duprey’s position, which position is fortified by his interpretation of the fit & proper rules. In his view, those rules would have prevented Duprey’s appointment to CLICO’s Board, but he would have still been eligible to sit on CL Financial’s Board. If we are considering a situation in which CLICO would still have CLF as its majority shareholder, that is an entirely misplaced view.

In the Central Bank’s ‘Fit and Proper Guideline‘, the question of ‘Who should be Fit and Proper?’ is addressed at page 2 –

“…4.1 According to governing legislation the following persons referred to in this Guideline as holding “key positions” are required to be fit and proper: -…

…4.1.4 Controlling Shareholder – may be an individual or a corporate entity

- Under the IA, any person who is entitled to control at least one-third of the voting power at any general meeting of the company.

- Under the FIA, any person who controls twenty five per cent or more of the voting power at any general meeting…

Before the bailout about 89% of CLICO’s shares were owned by CLF, so Duprey cannot regain control of CLICO, either directly or via a holding company, if the fit and proper regulations are enforced. As I said previously, the acid question is whether the Central Bank will summon the will to apply those rules without fear or favour.

This is no academic dispute, since Duprey has made it clear that he is seeking to regain control of CLICO, so that financial company and the rules which govern it, must be central concerns in this matter.

Sunlight is the best disinfectant. Come clean.

AUDIO: Election Hardtalk interview on Power 102FM – 16 Jul 2015

Afra Raymond and Peter Permell are interviewed on the ‘Election Hardtalk‘ show on Power 102FMFM by Tony Fraser about the continuing impact of the CL Financial bailout on the economy and the request to get back the company by Lawrence Duprey. 16 July 2015. Audio courtesy Power 102FM

Afra Raymond and Peter Permell are interviewed on the ‘Election Hardtalk‘ show on Power 102FMFM by Tony Fraser about the continuing impact of the CL Financial bailout on the economy and the request to get back the company by Lawrence Duprey. 16 July 2015. Audio courtesy Power 102FM

- Programme Date: Thurday, 16 July 2015

- Programme Length: 1:19:47

CL Financial Bailout – Impunity Insanity?

The headline ‘Duprey wants back CLICO‘ in the Sunday Express of June 28th 2015, did not surprise me at all. That is exactly the threat against which I have been warning throughout my campaign against this appalling and unprecedented bailout.

To allow Lawrence Duprey to regain control of CLICO would do serious violence to the fundamental notions of the law not allowing persons to benefit from their wrongdoing.

Already, we can see various positions being taken – the Movement for Social Justice and Peter Permell of the CLICO Policyholders’ Group stating their objections, while Mariano Browne (former PNM Treasurer and Minister in the Ministry of Finance) and Mary King (economist and former Minister of Planning) setting out what seem to be supportive positions.

Continue reading “CL Financial Bailout – Impunity Insanity?”

Everything but the Truth

On 1st June 2014, my former colleague and Business Guardian Editor, Anthony Wilson, made a call for a ‘national debate’ on the proposed disposal of CLICO’s traditional portfolio of insurance business. This is the first of my responses.

We are now entering the chaotic endgame of this epic CL Financial bailout fiasco. Some of the recent official statements are –

- CL Financial’s other assets, including majority shareholdings in Republic Bank Limited and Methanol Holdings to be sold;

- Full repayment of Public Money advanced in this bailout is expected.

- CLICO’s traditional insurance policy portfolio is being professionally valued prior to its intended disposal;

- Atrius Ltd., set up in 2013 as an alternative vehicle for CLICO’s continuing business, is to be effectively abandoned;

- All of CLICO’s sales agents are to be terminated by the end of this month, June 2014;

The recent statements of both the Minister of Finance, Larry Howai, and the Governor of the Central Bank, Jwala Rambarran, could give the public an impression that this financial disaster has now been mostly resolved and we are on some kind of smooth track to a complete solution.

The recent statements of both the Minister of Finance, Larry Howai, and the Governor of the Central Bank, Jwala Rambarran, could give the public an impression that this financial disaster has now been mostly resolved and we are on some kind of smooth track to a complete solution.

I remain sceptical as to the extent to which these problems have been resolved. The complete lack of detailed information, despite many requests by myself and others, leaves one to wonder just what is the basis for these serious decisions.

So, why am I saying this?

The money being used in the CL Financial bailout is ‘Public Money’, which we sometimes call tax-payers’ dollars. The leading learning from which we have to draw serious lessons is Lord Sharman’s 2001 Report to the British Parliament ‘Holding to Account‘, which was a thorough examination of the definition, role and need for control of ‘Public Money’. In the Public Procurement campaign we expanded on Sharman’s definition of ‘Public Money’ so as to capture the full range of possibilities, but we have accepted his key finding as to the requirement that ‘Public Money’ is to be managed to a higher standard of Accountability and transparency than Private Money – see 2.23 on pg 15.

The contemporary, best-practice position in respect of the management of and accountability for Public Money being that the private sector rules are the bare minimum.

CL Financial Ltd. is a holding company for the Duprey empire, comprising major companies such as Republic Bank Ltd.; the Angostura Group; Methanol Holdings Trinidad Ltd; Home Construction Group of Companies; British-American Insurance Company Ltd; Lascelles-Mercado Ltd. (the Jamaican owners of Appleton and Wray & Nephew rums).

The last audited accounts for the CL Financial group were published on 18 November 2008, for the financial year ending 31 December 2007. The function of consolidated audited accounts is to give investors and management the necessary information with which to make decisions as to the future of the company.

Since 2009 I have been making requests under the Freedom of Information Act for these items of information –

- Audited Accounts for the CL Financial group, or the basis of the various statements by successive Ministers of Finance;

- Senate Briefing – details of the high-level briefing given to Independent Senators in September 2011 prior to the vote on the two new laws – one to allow the State to borrow an additional $10.7 Billion to settle the bailout and the Act to shield the Central Bank from the supervision of the Courts;

- Payments – details of the payments to the various claimants under the terms of the bailout, in particular EFPA-holders;

- Integrity Commission – confirmation of whether the Minister of Finance was requiring the CL Financial Directors to file declarations as required by law.

I have effectively withdrawn the last of those requests and am now in litigation against the Minister of Finance & the Economy for the first three items. The State has resisted those claims and the litigation continues. I have continued my quest on the compliance of CL Financial’s Directors with the Integrity in Public Life Act with the Integrity Commission, despite the serial delays and unresponsiveness which have beset those requests.

The question before us now is, “How can the State and our government be making these serious, long-term decisions in the absence of the basic information?” Put another way, “How can we continue to allow these serious decisions to be made in our name on our behalf and supposedly, for our benefit, while the State continues to withhold the basic information?”

We have now entered the unimaginable territory of unexamined State power being exercised on an unprecedented scale in the pursuit of an unknown agenda.

This is the big picture and it is an ugly one.

Try to imagine the Board of a major, privately-owned, holding company proposing to its Shareholders that its major assets be disposed-of without the basic information, such as audited accounts or details of meetings with major stakeholders. Such an action would be seen as a gross violation of elementary norms of corporate governance and quite likely be rejected with swift, high-level dismissals. Yet, here we have our government (the Board of Directors) proposing these actions while refusing the reasonable requests of shareholders (citizens such as myself and others) for the rationale for and basic information underlying this process.

The fundamental, best-practice principle that Public Money is to be managed to and accounted for to a higher standard than Private Money has seemingly been rejected. Rejected by the Minister of Finance & the Economy and the Governor of the Central Bank.

That is the scale of this ‘thing without a name’. I tell you.

We, the citizens and taxpayers of this Republic, are being told that this unprecedented expenditure of Public Money of $25 Billion is to be resolved by a questionable process. The long-time saying is buzzing through my head – ‘What eh meet yuh, eh pass yuh‘.

Some points to remember in thinking about this issue –

- CL Financial Shareholders’ Agreement expires at the end of June 2014;

- Asset Sales have continued with the unadvertised sales of Valpark and Atlantic Plazas;

- No Interest was charged on the huge sums of Public Money spent to settle the indebtedness of the CL Financial group. The Board of Inland Revenue is a Division of the Ministry of Finance & the Economy and annual interest of 20% is charged to taxpayers who are late in their payments.

- ‘Fit & Proper’ regulations have never been applied to this CL Financial collapse, as mandated by Central Bank’s regulations, despite my continuing calls. One has to wonder if the stage is being set for a return of Lawrence Duprey & his cohorts to our country’s high-level corporate lifestyle.

On 28 May 2014, the Business Express ‘Opinion‘ was entitled ‘Bringing closure to the CLICO debacle‘ and one of the statements in that editorial was stunning –

“…Thus far, Rambarran and Finance Minister Larry Howai have been forthcoming in their handling of the CLICO issue…”

I could not agree less. The taxpayers and citizens of Trinidad & Tobago are being abused in this entire process.

CL Financial bailout – Paying the Devil

Today is the 30th of January 2014: five years since the State bailout of CL Financial was announced to a shocked nation and region. It is necessary to mark this moment in time with solid facts and stern meditation.

Today is the 30th of January 2014: five years since the State bailout of CL Financial was announced to a shocked nation and region. It is necessary to mark this moment in time with solid facts and stern meditation.

The Carnival season is upon us, so J’ouvert is near the front of my thoughts. J’ouvert is simple, yet tremendous, because of the experience of passing from night into daylight and of course those around you becoming clearer as the light overcomes the darkness. For me, the defining feature of Jouvert is the terrifying portrayals of ‘Devil mas‘ in its various forms – ugly and dirty, covered with mud, oil or paint; real noisy, beating pitch-oil tins and such; forceful, in demanding payment from you before you could pass. You have to pay the Devil to go away. Pay the Devil, so he could leave without dirtying you up.

The vast amount of detail which has emerged in the last five years, means that I can only focus on one key aspect of the CL Financial bailout scandal.

My main theme is that vast amounts of Public Money have been committed to repay the debts of CL Financial, while the chiefs who directed and controlled that conglomerate seem free to come and go as they please. Or, in the case of Duprey, who refused to testify at the Colman Commission, to go and refuse to come. Once again, Trinis in the running for some awards for innovation and so on, with Duprey being the world’s first ‘Penniless Philanthropist‘.

How much Public Money has been spent on this exercise? How much of that Public Money will the State recover? That is my focus.

When the Memorandum of Understanding was signed on 30th January 2009, it was on the basis that CL Financial assets would be sold to recover the Public Money being advanced, which was estimated to be about $5Bn.

Winston Dookeran’s first budget speech on 8th September 2010 was a critical turning-point, as it appeared to me that he was attempting to stem the flow of Public Money out of the Treasury. Dookeran made a case which was based on the huge and unprecedented liabilities facing the State at pg 9 –

“…The total funding provided as at May 2010 by the Government and the Central Bank, excluding indemnities and guarantees to First Citizens Bank amounted to approximately $7.3 billion. As of June 2010, CLICO and British American combined total liabilities were approximately $23.8 billion but total assets were $16.6 billion…” .

Immediately, in protest at Dookeran’s attempt to limit the cost to our Treasury, there were several ‘Policyholders’ and Depositors’ groups‘ formed. The word ‘Depositors’ was soon omitted when it was realised that it would not suit their purposes.

With Dookeran isolated and the government under mounting pressure from these new protest groups, there were new laws drafted to stifle the protestors’ legal options. At this point, we had the historic address to Parliament by the PM on 1st October 2010 – historic because even with the required majority of votes to pass the intended new laws, the PM chose to explain and persuade the public. The bailout was extended to Hindu Credit Union and the Commission of Enquiry was announced to find the causes of the collapse of the CL Financial group and HCU.

Most notable was the PM’s outrage at the mystery of the bailout – at pgs 25-26

“…The $5 Billion has been spent—we are advised—to repay matured EFPA policies in an ad hoc and unstructured manner where payment arrangements were entered into based on levels of funds invested. What criteria did you use to repay investors? Whom did you choose to pay? How were they chosen? These questions need to be answered. Because if it is today after the $7.3 Billion, all these EFPA people, the policy group and so on, they are out there, where is their money? Where is their money? Did you have a priority listing of who should be paid? Why did you go—and you are now crying crocodile tears about trade unions, credit unions, the poor man and the small man—why did you not pay them first? Why did you not pay them first? Where did that $7 Billion go? We need those answers, Mr. Speaker. We deserve those answers. The taxpayers need to know. Because when a parent has to buy school books and bags to send his/her children to school but they have to pay tax out of the little money, they need to know where that money has gone…Where, how and why; we need to know…”

In September 2011 Parliament approved a new law authorising the State to borrow an additional $10.7 Billion to fund the bailout.

Winston Dookeran’s affidavit of 3rd April 2012 specifies that $24 Billion of Public Money is committed to the bailout, at paras 21 & 22…

Para 21 (a) $5.0Bn already provided to CLICO;

(b) $7.0Bn paid to holders of the EFPA and

Para 22 $12.0Bn estimated as further funding to be advanced.

Recent estimates have now risen to ‘$25b and counting‘ according to the Sunday Express report of 4th May 2013. Given the shock with which the estimated bailout cost of $5 Billion was received a mere five years ago, it is sobering that $25 Billion can now be bandied-about by Public Officials in this fashion.

Will our money ever be repaid? If so, how and when?

Now and again, official statements are made to assure the public that the matter is being resolved and the CL Financial Shareholders Agreement is extended for this reason or that. There is an appearance of diligence and purpose, but there are also other statements which we must consider.

Finance Minister Howai is recorded in Hansard of 30th January 2013, speaking about the CL Financial bailout – at pgs 16-17

“…Mr. President, we shall never recover all the funds that have been put into the group, but our focus is to try and maximize what we can and to reduce the borrowing that we need to do…”.

Even more concerning is that there has been secretive disposal of assets of the CL Financial group – to cite one example, Valpark Shopping Plaza was recently sold to Courts, without any public advertisement.

All the while, the State is mounting strong resistance to my lawsuit to force publication of the details of this bailout. The secrecy is inimical to the wider public interest, which is being sacrificed for the comfort and benefit of the ruthless few.

Every single established mechanism for oversight, transparency and accountability in public affairs has been sidelined in this sordid CL Financial scandal. Integrity in Public Life Act – nothing. Audited Accounts – not available. Freedom of Information Act – legally disputed. Briefing to Parliament – exempted.

Ask yourself – “Would you trust a public official with $1M to spend if there were no requirement for them to account properly?” If not, why should we trust any public official or institution with the authority to spend 24,000 million dollars with no oversight or accounting.

Hence my title – we really Paying the Devil.