This is the opening statement given by Sir Anthony Colman QC at the first sitting of the Colman Commission on Friday 11th March 2011.

https://afraraymond.net/wp-content/uploads/2011/03/commission-of-enquiry-clico-sir-a-colman.pdf

This is the opening statement given by Sir Anthony Colman QC at the first sitting of the Colman Commission on Friday 11th March 2011.

https://afraraymond.net/wp-content/uploads/2011/03/commission-of-enquiry-clico-sir-a-colman.pdf

If you think this title is for the latest brand of household cleaner, you would be wrong. I drew that title from the famous statement by deceased US Supreme Court Justice Louis Brandeis, in reference to corruption and fraudulent dealings: ‘sunlight is said to be the best of disinfectants.‘

If you think this title is for the latest brand of household cleaner, you would be wrong. I drew that title from the famous statement by deceased US Supreme Court Justice Louis Brandeis, in reference to corruption and fraudulent dealings: ‘sunlight is said to be the best of disinfectants.‘

Of course, this is all about the impending Colman Commission of Enquiry into the failure of CL Financial and other companies (including CMMB) and the Hindu Credit Union.

We are attempting to understand our situation in this financial fiasco – how was the entire collapse caused? Who is responsible? What can we do to avoid a repetition?

Our House needs a serious cleaning and we need a new commitment to serious retrospection if we are to succeed in understanding this scandalous situation.

To set the stage, there are four principalities being represented in this Enquiry –

My first point about this Colman Commission is how welcome it is, as a tangible sign of a change in how our country is being run. No, I did not vote for either group in the last election, but it seems to me that neither of the last two regimes (Manning or Panday) would have initiated a public enquiry into this financial fiasco.

As much as I approve the decision to have this public enquiry, the purpose of this article is to warn against some of the forces now being assembled to erode the enquiry’s effectiveness. Even though, in this respect, political times have changed, we need to remain vigilant if the Colman Commission is to be effective.

To be sure, the four principalities I listed comprise very powerful players for whom this enquiry is a literal nightmare, since they will be obliged to explain some of their biggest decisions and actions, which they would never have had to explain to anyone outside of their own circle.

If the Enquiry takes place as intended, we are going to be afforded an unprecedented insight into the workings, dealings, arrangements and situations in our leadership class – all of it at a depth and range never before recorded. Matters that had been only the subject of picong, ole talk and so-called urban legends will all now become part of the official record. Yes, our Republic will be coming of age.

Our country is a Republic, which to me means that no class of citizen ought to enjoy rights which are superior. But there has been a pattern of behaviour in this fiasco which has been very disturbing because it violates those Republican expectations. Of course, I am referring to the fact that a three-tier system seems to have been in operation during the entire meltdown.

Maybe I am entirely wrong and there was complete surprise when the CL Financial group collapsed. But if that is the case, one is really contemplating a slack system of management systems and an entire swath of our ruling elite who are not ‘fit and proper’. The question of who knew what and when, will be a main point of dispute, because either way you slice it, the picture is unappealing.

You can be sure that the people in the top layer will do anything in their power to protect themselves from the stern scrutiny of those in the lowest group, not to mention the public, who are paying for all this.

I wrote a previous column in this series, entitled ‘Taking in front‘ and on this occasion, in light of what is at stake, I, too, am taking in front. Having suffered a defeat in that the Colman Commission has now been established, the members of the Code of Silence can be expected to try halting, delaying or just diluting the Commission.

We have already had former Hindu Credit Union (HCU) chief, Harry Harnarine, defeated in the High Court in an attempt to stop the Colman Commission. I was not surprised to read reports that Harnarine is planning to appeal that decision. We can expect other strong challenges as this historic process unfolds.

If the members of the Code of Silence are unable to derail the Commission itself, we should not be surprised if they try to cloak the proceedings in some kind of blanket to prevent too much information escaping.

Readers, please note that the process of asking the Court to prevent publication of a particular piece of evidence is a very swift one, with the ruling expected in the very same sitting. That is because if those proceedings are too drawn-out, it can be actually self-defeating, since the matter which they are seeking to have concealed can be published and discussed while a decision is awaited.

That is the reason we need to beat this drum now. We cannot wait for the filing of injunctions and then seek to publish. By then, it would be too late.

The new algebra is simple and inescapable –

Expenditure of Public Money – Transparency = CORRUPTION

Whatever the negatives of the American Imperium, there are still aspects of that society which are worthy of emulation. The example which comes to mind is the recently-published report of the Financial Crisis Inquiry Commission.

The preface of that Report contains an instructive paragraph, at page xii –

“…This report is not the sole repository of what the panel found. A website — www.fcic.gov — will host a wealth of information beyond what could be presented here. It will contain a stockpile of materials — including documents and emails, video of the Commission’s public hearings, testimony, and supporting research — that can be studied for years to come. Much of what is footnoted in this report can be found on the website. In addition, more materials that cannot be released yet for various reasons will eventually be made public through the National Archives and Records Administration…”

The US legislature is determined that the inner lessons and testimony on this important crisis are available to all interested parties for the years ahead. That represents a solid commitment to a learning society, which will at least attempt to draw lessons from the bitterest of experiences. In my opinion, that commitment is worthy of emulation.

Has our society reached the stage of maturation to commit to an entirely transparent process of retrospection? That is the question which will be tested in the weeks and months to follow.

The entire proceedings of the Colman Commission must be held in public. The proceedings must be on TV and available on the internet. The Colman Commission needs a strong internet presence, with its own website.

Sunlight Disinfectant cleans brighter, you see?

14th February 2011

Afra Raymond’s second submission to the Commission of Enquiry into the failure of CL Financial Limited, Colonial Life Insurance Company (Trinidad) Limited, Clico Investment Bank Limited, Caribbean Money Market Brokers Limited, and The Hindu Credit Union Credit Union Co-operative Society Limited

My name is Afra Martin Raymond and I am a Chartered Surveyor, being a Fellow of the Royal Institution of Chartered Surveyors. I am Managing Director of Raymond & Pierre Limited – Chartered Valuation Surveyors, Real Estate Agents and Property Consultants. I am also the President of the Joint Consultative Council for the Construction Industry (JCC), an umbrella organisation which represents the interests of Engineers, Surveyors, Architects, Town Planners and Contractors in this Republic.

This submission is being made in my personal capacity and does not represent the position of either Raymond & Pierre Limited or the JCC.

My work on this vital issue has all been based on the public record and can be seen at www.afraraymond.com.

I am willing to give oral evidence before the Commission.

My areas for focus in this submission are –

Fiduciary Duty of Directors and Officers

The burning question is – When did the Directors and Officers of CL Financial (CLF) know that the group was heading to collapse? When did the Directors and Officers of the failed subsidiaries know? What did they know and when did they know it? How much warning did their management controls give them?

The question is pertinent and the time-line is instructive –

So, there is this contradictory financial manoeuvre in the dying stages of the group. I am speaking about the CMMB share purchase, in which CLF purchases Jamaica Money Market Brokers’ 45% shareholding in CMMB at a reported $41.37M USD. That price equates to 16.5 times earnings, given that CMMB’s profit as at March 2008 was $35M. It is impossible to reconcile that earnings multiple with CMMB’s exceedingly low profit rate and the rapidly-approaching collapse.

Was a professional, independent valuation of those shares obtained prior to the purchase? How can it have been a proper discharge of their fiduciary duty to shareholders for the CLF Directors to have agreed such a massive, questionable purchase without proper advice?

That transaction drew $262M out of CLF’s rapidly-depleting coffers on terms which are suspect. It demands close examination.

Another inescapable episode is the last CLF Annual General Meeting, the timing could hardly be better for an insight into the sensibilities of these chiefs. At the date of that AGM, Friday 23rd January 2009, the bailout letter was 10 days’ old, the dividend cheques were one week old and the bailout itself was a week ahead.

What was the atmosphere at that meeting? Were the shareholders told frankly of the major challenges and that the group had been forced to seek a State bailout? Did the Directors offer an explanation for the failure of the group?

It would be important to examine that AGM very carefully.

The Second issue is the treatment of departing Directors and Officers. Note that three of the most important and senior CLF chiefs departed in the 12 months prior to the collapse. It is most unlikely that those departures were mere good fortune or coincidence.

It is difficult to probe and verify such agreements when they are oral, much less when they are between parties who are actively collaborating. Memory can be notoriously unreliable.

I am submitting that those departures can be examined from the documents if one were to approach from the compensation aspect. What I mean is that these chiefs would have been paid upon departure and that would likely have been documented.

If that approach were taken, the suggested questions would be

This would make it possible to have some insight into the way these chiefs treated with themselves, their shareholders and the other stakeholders of the group.

Executive Flexible Premium Annuity (EFPA)

I have written extensively on the EFPA, its growth and the effect of that size upon the entire CL Financial group.

I have no further points to make on those aspects. My submission here is on the point of set-off and the burden to the taxpayer.

My submission is that in relation to the intended payments from the State to EFPA claimants is that the State must conduct itself in an exemplary fashion. The State must not be placed at any further disadvantage, having already shouldered this enormous, exceptional payout.

There are now anti money-laundering (AML) laws which require depositors to make declarations as to the Source of Funds, all in an effort to prevent the proceeds of crime from entering the legitimate economy. In my view it is necessary for the government to be satisfied that the various sums being claimed were properly declared under the AML laws. We have had shocking reports about the elementary management controls which were either absent or awry in the CL Financial group, so it would not surprise me if their AML-compliance was lax. That needs to be thoroughly checked. It would not be at all acceptable for our taxpayers’ monies to be used to rinse ‘dirty money’.

Also, the claimants who owe on their taxes – VAT, PAYE, Corporation Tax, Income Tax and so on – should not be refunded.

Finally, there is the issue of the many borrowers from Clico, British-American, Clico Investment Bank (CIB). In the case of CIB alone, we are told that about $1.0Bn of those loans are ‘non-performing’ – which means that the borrowers are not repaying their loans. It would be perverse for some of those non-performing borrowers to receive refunds from the State. This is a live part of this situation, since in the case of CIB itself, the very Inspector of Financial Institutions swore in his affidavit filed in the winding-up action for that failed bank –

…With respect to the Creditors of the Petitioner, the Petitioner has met the statutory obligations for the Board of Inland Revenue (except for Corporation Tax Returns for 2007, 2008 and 2009 which are being prepared and remain outstanding)…

That is a glaring example of the kind of wanton wrongdoing at the heart of this mess. CIB fails to file its Corporation Tax returns for three years, yet keep their banking licence and arrange for the taxpayer to bail them out when it all goes sour.

Some claimants may try to invoke the ‘corporate veil’ to shield themselves from various breaches committed by their companies, but this is an exceptional situation in which the State is making an offer. In my view, the corporate veil ought properly to be ignored, so that the long-standing commercial principle of ‘set-off’ can be applied to the claimants.

I am submitting to the Commission that everyone over seeking bailout funds exceeding $75,000 be subject to a BIR audit for themselves and any business interests that they may have earned revenues from and they should be denied a taxpayer-funded bailout if they were found to have not paid their taxes.

Political Party Financing

It is my submission that the means by our political parties are financed is at the very heart of this affair.

Governance models, regulatory frameworks and accounting conventions are all important parts of the interlocked issues, but those pale into insignificance beside the influence of this major party financier.

There can be no doubt that CLF was one of the leading contributors to political parties in this country.

In the case of the United National Congress (UNC), which is the leading element of the existing coalition government, their last leader was convicted and imprisoned for failing to declare substantial donations received from Lawrence Duprey – see here and here.

In the case of the People’s National Movement (PNM), there have been published reports as to the payment of sums of the order of $20M to that party by CLF in the 2007 general election – see here and here.

In the case of the former political party, the entire CLICO issue was raised by the respected economist Trevor Sudama MP in the 2002 budget debate. Sudama was a UNC Cabinet member and posed the question as to whether CLICO, having been found to be insolvent by the Supervisor of Insurance, should be allowed to continue in business. Sudama was strongly opposed in the debate and eventually removed from the Cabinet. This can be corroborated from Hansard (p. 757 and 800) and the reports of the Supervisor of Insurance.

In the case of the PNM, the link was even deeper, with the same individual being that party’s Treasurer, CLF’s Group Finance Director and Chairman of two banks – Home Mortgage Bank and CLICO Investment Bank as well as two major State enterprises in the construction sector – Housing Development Corporation and the Education Facilities Company Limited. That individual is Louis Andre Monteil.

It is clear from the many statements of the Governor of the Central Bank that they were very limited in what they could do as regulators and it is difficult to escape the impression that an undue influence was brought to bear in the case of CLF.

The last Minister of Finance, Karen Nunez-Tesheira – a former law lecturer – was found to have withdrawn her own and her family’s monies from the CLF group just before the crash, was a shareholder of CLF and accepted dividends after the bailout was requested by the beleaguered group.

Only when Nunez-Tesheira was confronted by an informed and relentless media did she admit any of those transactions. We have never had an account of those dividends.

There is a long-standing and widely-accepted doctrine of Cabinet secrecy. It is my submission that this is one of those exceptional cases in which the very purpose of the Enquiry will be frustrated unless the Terms of Reference are robustly interpreted. In this case the situation demands an examination of the conduct of these matters at the political level.

For a proper understanding of this issue, it is essential that Karen Nunez-Tesheira, Trevor Sudama and Louis Andre Monteil be cross-examined on this political aspect. It is my view that former Prime Ministers Basdeo Panday and Patrick Manning must be questioned if we are to properly apprehend the extent of the financiers’ influence.

I am basing that submission on part (i) of this Enquiry’s Terms of Reference -To enquire into “…the circumstances, factors, causes and reasons leading to the January 2009 intervention…”. There is no way to satisfy the first part of your mandate, to understand the root causes of the crisis, without getting into this fundamental issue. Political Party financing is at the centre of the fiasco. The learning from the Wall Street crisis on this question is unequivocal as to the pernicious influence of these political financiers and lobbyists.

For this Enquiry to achieve the required level of interrogation, information and insight, it must pierce the conventional veil of Cabinet secrecy. To do that, you need to take a robust view of your Terms of Reference.

I do believe all the items in this submission to be true and correct.

……………………………………………..

Afra M. Raymond B.Sc. FRICS

We are now entering a bizarre endgame in this rounds of musical chairs. The children’s game has returned for us adults, but with a vengeance.

As I wrote on 10th September in this space, the real question is ‘When exactly did the CL Financial group collapse?’.

To understand this huge matter we need to put things in the correct order –

What did they know and when did they know it?

There now appear to be at least four groups representing these investors –

Some of the positions being taken by the various groups are indicative of the degree of desperation of the parties, hence the title of this article. The general view emerging from these groups seems to be that the CL Financial group is basically healthy and profitable, so there should be no issue about returning their investment.

I do not know what those views are based on and it is impractical to continue basing our discussions on the series of rumours and draft reports and suchlike. We need good quality information to make a quality decision and that is not negotiable. We need to insist on that as a minimum.

After the first round of organizing and attorneys’ letters, followed by the Prime Minister’s important address on 1st October, we are now into what appears to be an even stranger place.

Two of the stranger proposals emerging from the CPG’s Port-of-Spain meeting on 24th October were –

It may all just be a series of negotiating positions, but it seems pretty clear that no one from these various investors’ groups intends to take a discount or ‘haircut’ on the monies owed to them. The unstated assumption is that if someone has to stand the bounce or take a haircut, that someone must be the taxpayer. That could never be the correct position. So, we need the facts.

The most startling development is the Central Bank’s full page adverts on Thursday 28th October, repudiating the claims that it had offered any guarantees in this situation. The reaction was immediate, with the CPPA publishing large adverts in opposition the next day and a new anti-bailout group emerging for the first time – at last! The CPG’s response was a nadir in their campaign, with the Trinidad Guardian reporting that – “…Permell went on to say that they do not care where the Central Bank gets the money from once they guarantee the policyholders’ contracts…” – I could scarcely believe what was on the page before me. Even the most militant Trade Unionists use more reasonable language.

Which brings us right to the meat of the matter, the order of things. What is the reason that the investors’ groups are now at the front of the line for assistance from this government? I could be wrong, but it is easy to get that impression when one hears of Cabinet discussing the matter twice in one week, certain groups giving threatening timetables and so on. I do not know if our Cabinet – PNM, UNC or PP – has ever given such a total priority to any matter in the past.

There are other claims on the limited monies available to the State. All of those claims existed before these investors groups. All.

Many people have poor water supply. Outstanding payments to contractors and suppliers are in excess of $7.0Bn, according to Central Bank estimates. Insufficient money for OPVs – the estimated cost of $3.0Bn is too much for the country to bear, so national security is falling behind. More guns and drugs entering our homeland. Public Servants claims are about $3Bn and that is also a strain on the Treasury. Not enough police cars. Sad situation in the public hospitals.

The CPG issued a 2 page advert in the Guardian on Thursday 4th November and it deserves careful reading. It was good to see their call for the publication of the correct financial information before making a decision. They set out their proposals for the relief of CPG members – those are the latter of the two above, with the added condition that they be given two seats on the boards of CL Financial and Clico.

The CPG claims that its proposals place no additional burden on the taxpayers, which is a good thing, if that is truly so. The CPG’s proposals are silent as to how the monies already spent are to be recovered.

The real test will be if the accounts and asset valuations reveal the group to be insolvent. Will the various investors’ groups accept that or are we in for a long, bitter fight?

The Attorney General recently announced that he had withdrawn Sir Gavin Lightman QC as the sole Commissioner, due to an apparent conflict of interest. Lightman had appeared for Clico in a 1991 court case and the PNM did well to have stopped this before it went too far.

Two important further points, though –

Last week I wrote about the Code of Silence observed by our ruling class. I gave examples to support my idea, but there was not enough space to mention everyone.

The Bankers Association of Trinidad & Tobago (BATT) and the Association of Trinidad & Tobago Insurance Companies (ATTIC) are also part of the situation.

The Bankers Association of Trinidad & Tobago (BATT) and the Association of Trinidad & Tobago Insurance Companies (ATTIC) are also part of the situation.

We have a long history of our rulers making huge, stupid, destructive decisions without any commitment to transparency or accountability. That lack of transparency is what allows corrupt to flourish. We can never eliminate corruption, but if we are serious about reducing it, we need to proceed differently.

Maybe, just maybe, this is the kind of colossal event which could force some of us to drastically change our ways, despite the positions we now assume. This is a moment of national peril and the continued observance of the Code of Silence is going to cost our country plenty money.

As it is, we already have been bound to a rotten bailout of the wealthiest individual in the Caribbean by our Treasury at ZERO interest. Anybody looking to set up a small business has to face the bank and pay interest. None of that for Lawrence Duprey and the CL Financial chiefs. They have been able to enrich themselves and when the entire thing went wrong, they were able to negotiate a handsome handshake for themselves and then leave the mess for our government to clean-up.

As it is, we already have been bound to a rotten bailout of the wealthiest individual in the Caribbean by our Treasury at ZERO interest. Anybody looking to set up a small business has to face the bank and pay interest. None of that for Lawrence Duprey and the CL Financial chiefs. They have been able to enrich themselves and when the entire thing went wrong, they were able to negotiate a handsome handshake for themselves and then leave the mess for our government to clean-up.

That is the plain meaning of the bailout. Is not policyholders we bailing-out, is the richest, smartest characters in the country. The bailout script is unfolding so well that almost the entire discussion is now about the fairness/unfairness of the government’s position with respect to retired policyholders etc.

Real Anansi antics.

The CLICO Policyholders Group (CPG)

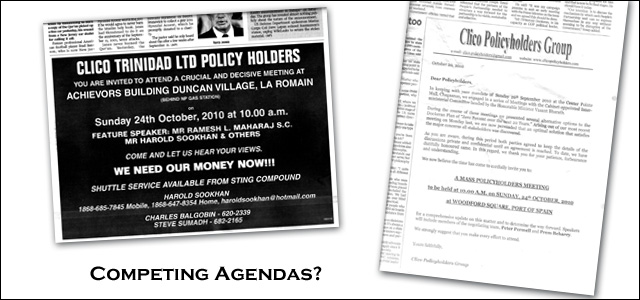

There was an EFPA group and a CLICO Policyholders group formed just after the budget on 8th September, but they soon merged under the latter name. I am now seeing what appears to be a substantial split with 2 competing meetings being organised for 10am today – one in Port-of-Spain and the other in San Fernando.

There was an EFPA group and a CLICO Policyholders group formed just after the budget on 8th September, but they soon merged under the latter name. I am now seeing what appears to be a substantial split with 2 competing meetings being organised for 10am today – one in Port-of-Spain and the other in San Fernando.

The CPG group has been very successful at getting their views known and making the media circuit, with the eventual meetings with the advisory group set up by the PM.

The main concern being advanced by the CPG is for the recovery of the funds deposited with CLICO and there has been no reply whatsoever to the point that, despite its labelling, the EFPA was largely sold and understood as a deposit. The accounting rule of thumb as to ‘substance over form‘ in interpretation is an irrefutable part of the debate on this, but CPG have been silent on this point.

Almost all the many people with whom I have discussed this issue, have been very plain in their language – ‘I had my money deposit with CLICO‘ and so on. But the word Policyholder is more likely to attract sympathy, so the games continue.

We already spent $7.3Bn in cash since the bailout was announced. Please note that nobody is even talking about how the State is going to recover that loan. The only talk is about how are they, the depositors, going to recover their monies.

There is a real principle of financial equity being shredded to pieces in the conduct of this bailout and it was disappointing that Mr. Dookeran, as an Educator in the field, did not take the opportunity to expand on this.

The intent is plainly to deprive the Treasury of its limited funds so that the assets of 15,000 people can be preserved.

So, What about those negotiations?

When the Prime Minister spoke on 1st October, she created an advisory group (headed by Minister of Food Production, Vasant Bharath) to meet with the policyholders to seek other options.

The Prime Minister was to meet with concerned persons and activists on Wednesday 7th October in Chaguanas, but that meeting was cancelled at short notice, with no alternative dates given.

What we are left with is lengthy, secret meetings to discuss the review of the bailout terms, with no concrete information emerging. That secrecy is totally unsatisfactory. It smacks of secret deal-making and does nothing to inspire the confidence which is supposedly the very purpose of this exercise.

The last regime, with all of their noble intentions and devout Ministers, lost their way in a morass of muddled purposes, secret deals, mixed-up with misleading and false public statements from the highest office in the land. We all know how that ended. The question is whether we have learned anything from that bitter experience. The Peoples’ Partnership were the main beneficiaries of those PNM errors, have they learned from that?

Our money is being spent on this massive exercise and it is not good enough to emerge from these closed meetings with agreed phrases like ‘constructive or meaningful’. This emerging pattern speaks of disrespect for the acumen of our people.

To re-state my equation:

Imagine these bold-faced people declaring that when they are done and settled, the terms will be announced to us who paying for the whole thing. The first sign of a bad marriage is when the husband is the last to know – some say, the wife. But the main point is that the public cannot be the last to know.

The simple and painful fact is that public confidence in our leaders is at an all-time low. The time-honoured notion that a leader is someone wiser, more mature, less reckless and of overall higher ideals has been tested to destruction by events. In this particular case, it is easy to understand the charged atmosphere, hence the need for extra ventilation and transparency.

I was recently emailed by a well-meaning group asking that I start setting out some ideas of how CLICO might be rescued and I had to remind them that without basic information, all we can do is argue emptily with each other. All to the amusement of the masterminds of this, the greatest economic crime in our nation’s history.

I was even ‘phoned, while writing this, by an acquaintance who is a leading member of the CPG to join him and an un-named UK guest in a TV studio on Monday morning to discuss all this. Yes, I dismissed the request – too much secret-thing for my taste – and challenged the caller to name the person, supposedly a top UK expert.

What would be ‘constructive and meaningful’ would be to publish these long-outstanding reports so that we in the public can inform ourselves on the vital issues –

The Mottley Report – There was a team of three advisers – Wendell Mottley, Colin Soo Ping Chow and Steve Bideshi – appointed to examine the CL Financial group and we need to know what were the findings of this group.

The Mottley Report – There was a team of three advisers – Wendell Mottley, Colin Soo Ping Chow and Steve Bideshi – appointed to examine the CL Financial group and we need to know what were the findings of this group.We have seen reports in the press about the very long Cabinet meeting on Thursday 21st at which the CLICO issue was said to be part of that agenda.

It would be totally unacceptable for a deal to be sealed without properly informing us, the taxpaying public, as to the true background.

The People’s Partnership has already distinguished itself, positively, by announcing Commissions of Enquiry into the attempted coup in 1990 and the Financial collapse (CL Financial and HCU). This is no time to get diverted into back-room deals.

I am working for betterment and from you, our elected rulers, I expect better.

I am bringing this analysis to a close by asking the question as to which individuals are ultimately responsible for this scandalous situation. The age-old questions persist – Are we mere creatures of circumstance? What influence can one individual have on transforming a situation? Do modern outlooks over-emphasise the power of the individual?

We need to close the circle to understand the role of the high-powered individuals in charge of this policy.

Calder Hart, then CEO of Home Mortgage Bank and well-known to be a protégé of Andre Monteil’s, claimed to have authored our National Housing Policy – ‘Showing Trinidad & Tobago a new way home‘

In October 2002, Hart told me that in his office and he made a point of seeking my views of the new policy.

I questioned the originality, relevance and feasibility of the proposed policies and a frank discussion ensued. It seemed clear, from Hart’s reaction and subsequent behaviour, that he had indeed taken authorship of that misguided policy.

That policy can be viewed at here. Given their non-involvement in the later stages, it is interesting that the cover-page of the housing policy highlights UdeCOTT as a main state agency in its implementation.

The Minister of Housing with longest tenure through this period was Dr. Keith Rowley, M.P., currently leader of the Opposition PNM – he was in that office from November 2003 to November 2007 – see http://www.ttparliament.org/members.php?mid=26&pid=5&id=KRO01.

The HDC was launched on 1st October 2005 to replace the National Housing Authority. The Trinidad and Tobago Guardian newspaper reported Dr. Rowley’s remarks at that time – see http://legacy.guardian.co.tt/archives/2005-10-15/news7.html

Earlier, Rowley said the NHA was restructured because it lacked accountability.

There are a lot of things that did not go right in the NHA and one of those things had to do with accountability…The HDC is not going to function like that. We are required by law to have the accounts ready in a certain period of time. The CEO will be held accountable and the Cabinet will hold the minister accountable and the Parliament will hold the Cabinet accountable. That is what the HDC means.