The previous article delved into the meaning of counterfactual, that being a ‘baseless claim, hypothesis or belief’. I started my Season of Reflection by confronting the false narratives of certain thought leaders who are seemingly oblivious to the irrefutable and considerable achievements of the CL Financial group.

The size and scope of the CLF group make it impossible to really discuss business, investment, finance or real estate at a national or regional level without that group being a significant element in that discussion. To discuss those important topics at a national or regional level and be silent on CLICO and the CLF group is to literally ignore the Elephant in the Room. You see?

Considering that the CLF group was established, managed and owned by an African-descended group, it is mind-boggling to hear these repeated claims of Black non-achievement from people who ought to know better.

About a year ago, one of these eminent people published an article making those points about the decline of Black business in T&T and so on. When I wrote to remind him of the existence of CLICO and CLF as a fact, irrespective of what one thought of that company, his response proposed that there were many truths and so on. Postmodernism is a broad field of philosophy, but even that one was way beyond the boundary.

This week, I will examine the second counterfactual in this series – that is the ‘baseless claim, hypothesis or belief‘ that East Indian people are especially corrupt, especially those who are Hindus. We have all heard it, the love of money and the love of land and so on and so forth. Up to a few nights ago my ears twitched as a well-regarded Minister in the current administration confided those views to me, I am not sure if he recognised the sheer disbelief on my features, but he was called away before my response could be delivered.

The case I am making in this article is that the CL Financial bailout is the single largest and most corrupt act in our country’s history, if not the entire region’s history.

The CLF bailout is the hugest loan ever of perpetually-scarce Public Money to the wealthiest people in the Caribbean on the most generous terms. Sweetheart Deal does not even begin to describe this level of access to our Treasury, our Cabinet and our very Future.

The CLF bailout is the hugest loan ever of perpetually-scarce Public Money to the wealthiest people in the Caribbean on the most generous terms. Sweetheart Deal does not even begin to describe this level of access to our Treasury, our Cabinet and our very Future.

That agreement is recorded in the 30 January 2009 Memorandum of Understanding and the 12 June 2009 CLF Shareholders’ Agreement, both of which are publicly available.

Consider these points about the CLF bailout –

-

Amount

No limit or ceiling was ever set, so the State effectively agreed to write a blank cheque to the CLF shareholders. As we are now told, the total cost is in excess of $25 Billion. By way of comparison, the Wall Street bailout in 2008 was estimated in December 2010 by the USA Treasury Secretary, Timothy Geithner, to cost about 1% of GDP. The CLF bailout cost more than 10% of our GDP, according to the Ministry of Finance in the 2011 Budget Statement.

-

No repayment period

Neither of the two agreements contain any provisions to cover repayment period. In the event, the shareholders’ agreement was extended seventeen times.

-

Interest

Neither agreement contains any provisions as to the interest to be paid on this huge loan of Public Money. As it unfolded the first $4.9 Billion, which was paid to CLICO was done via issuing a 4.5% preference share. On the basis of a weighted average cost of capital analysis, the interest payable for that loan of over $25 Billion in Public Money is less than 1%. Yes, that is the real interest rate. In comparison, companies bailed-out on Wall Street paid over three times the prevailing base-rate to get Federal funds.

One of the questions I was examining in getting the details of this bailout is the cost of interest and financing to the State. You see, the State had to borrow heavily to lend the CLF shareholders. That sum is $4,830,506,986.33, as at 30th June 2018. By my analysis, the monthly cost of interest and financing escalated from $30,640,697.82 per month between 30 January 2009 and 30 April 2016 to $85,895,308.99 per month between 30 April 2016 to 30 June 2018. You see?

On this single aspect of interest, the loss of Public Money has been huge.

-

Rationale for the bailout was what, really?

The public was sold the CLF bailout by appeals to the plight of pensioners and the stability of the economy and so on.

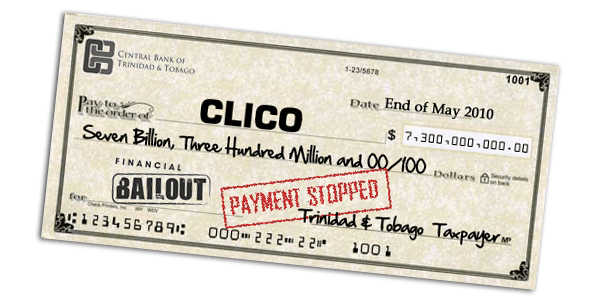

The first estimates of cost were about $5.0 Billion, but when the PP won the May 2010 election it was reported that some $7.3 Billion had been spent. The proposal made by then Finance Minister Winston Dookeran in his inaugural budget was to offer 20-year bonds to ease the burden on the Treasury. The protests and rapid organisation which followed that announcement were epic, with various Policyholders and Depositors groups being formed. When then PM, Kamla Persad-Bissessar, addressed the Parliament on 1 October 2010, her question was pregnant –

The first estimates of cost were about $5.0 Billion, but when the PP won the May 2010 election it was reported that some $7.3 Billion had been spent. The proposal made by then Finance Minister Winston Dookeran in his inaugural budget was to offer 20-year bonds to ease the burden on the Treasury. The protests and rapid organisation which followed that announcement were epic, with various Policyholders and Depositors groups being formed. When then PM, Kamla Persad-Bissessar, addressed the Parliament on 1 October 2010, her question was pregnant –“…Because if it is today after the $7.3 Billion, all these EFPA people, the policy group and so on, they are out there, where is their money? Where is their money? Did you have a priority listing of who should be paid? Why did you go—and you are now crying crocodile tears about trade unions, credit unions, the poor man and the small man—why did you not pay them first? Why did you not pay them first? Where did that $7 Billion go?…”

In closing, ask yourself who were the Chiefs in negotiating and agreeing to this epic toxic deal? How many of them were East Indian, or Hindu, for that matter? It’s a straight case of ‘Nearer to Church, further from God‘, as the old people used to say.

Succinct explanation of the most diabolical thievery.

I believe that we can lobby to make those four points four governmental policies for individual borrowing. That will eradicate its illegitimacy and create a portal for entrepreneurs and the masses to reduce poverty to zero. Other global communities are blatantly doing so at the highest levels and we can become, as Thomas Sankara successfully did, truly independent. Our Caribbean peers can follow suit and soon the region can boast as being ‘upright.’ We have always been pioneers or is it do so eh like so?

The amounts of money involved here are beyond my ability to visualize. Still, they pale in comparison with the Sandals billions. We rich!

Meanwhile a new entrant made an appearance in the teefing arena.

Pale in comparison because Sandals was a private company…

Thanks for your comments, Magintob, but the reality is that the money spent on this bailout is in excess of $25 Billion TTD, based on the details released at this stage…the Tobago Sandals proposals, the many other examples of corruption are all a mere fraction of $25 Billion…

Afra who are the shareholders?

Hello Indira, there were 325 CL Financial shareholders at the time of the bailout, according to CLF’s 17th February 2009 Annual Return with the Registrar General’s Department see here https://afraraymond.files.wordpress.com/2011/03/cl-financial-annual-returns-17-february-2009.pdf – those shareholders included of course, Lawrence Andre Duprey; Andre Louis Monteil, then Finance Minister Karen Nunez-Tesheira (listed as #89 at pg18 of 20 in the official filing) and of course Dr Bhoendradatt Tewarie…

and I still would like to know why what is the biggest perceived fraud on public purse still cannot be forensically investigated by our so called white collar TTPS ?and main shareholders help culpable as is done in USA etc? certainly dereliction of duty / misuse and abuse of public office / breach of fiduciary duties to name but few …

oh yes I forget when PNM teif is not a crime only when UNC & anti govt folks talk they will hunt you down

what is good for goose not good for gander !.

I suggest THA billions also unaccounted for .need your scrutiny AFRA….

these are d real crooks and if we continue to abdicate to vote for real change not exchange nor rearrange ..we will continue to have no oncology hospital, no good roads , no better infrastructure while the thief absconds to hiding wealth abroad..

we need to be the change we want …