We are now entering a bizarre endgame in this rounds of musical chairs. The children’s game has returned for us adults, but with a vengeance.

As I wrote on 10th September in this space, the real question is ‘When exactly did the CL Financial group collapse?’.

To understand this huge matter we need to put things in the correct order –

- Firstly, the CL Financial chiefs left others holding the risks. Some dates and names, to support the theory –

- L.A. Monteil – retired at the end of March 2008

- M.A. Fifi – retired in August 2008

- Robert Mayers – retired in December 2008.

What did they know and when did they know it?

- Secondly, there was a series of large-scale, rapid withdrawals of funds which preceded the start of the bailout. That pattern of activity would have speeded-up the collapse. It would be very interesting to see details of who broke their deposits and failed to ‘roll-over’ in that crucial final stage.

- Thirdly, post-January 2009, we have the massive payout of State funds, as detailed in the Guardian editorial of 25th October. Who was the recipient of those funds? Who benefited? On 1st October, the Prime Minister promised to publish that list and we await with interest.

- Now, with the PP government taking the decision to review the bailout process, we have entered a truly bizarre stage of this matter. This is the part where all those trusting people who were told to wait and have faith, are realizing that the people in the know have already withdrawn and secured themselves. Some of those people in the know were the same ones who were telling the faithful to keep on waiting. What a thing.

There now appear to be at least four groups representing these investors –

- The Clico Policyholders’ Group (CPG) – which is the most visible one with Peter Permell, Manny Lawrence and Norris Gomez etc.

- The Clico Policyholders’ Protection Association (CPPA), which is the one with Harold Sookhan and Ramesh Lawrence Maharaj.

- South Action Group – with Solomon Hem Lee

- Denbow Group – a small number of Clico investors who are being represented by Dr. Claude Denbow SC.

Some of the positions being taken by the various groups are indicative of the degree of desperation of the parties, hence the title of this article. The general view emerging from these groups seems to be that the CL Financial group is basically healthy and profitable, so there should be no issue about returning their investment.

I do not know what those views are based on and it is impractical to continue basing our discussions on the series of rumours and draft reports and suchlike. We need good quality information to make a quality decision and that is not negotiable. We need to insist on that as a minimum.

After the first round of organizing and attorneys’ letters, followed by the Prime Minister’s important address on 1st October, we are now into what appears to be an even stranger place.

Two of the stranger proposals emerging from the CPG’s Port-of-Spain meeting on 24th October were –

- Prem Beharry of the CPG was reported in the Trinidad Guardian to have said – “…Ryan ALM are saying they would take US$600 million and would convert it to the best debt instrument in the world which is US Treasury Bills,” Beharry said.

“The Ryan ALM group is saying, within three months if they are engaged, they would be able to sell those bonds and get in cash of US$1.8 billion which is equal to the debt of TT$10.5 billion—that money would be used to pay all the policyholders…” That is literally too good to be true. It is the same approach that created this mess in the first place – both at the CL Financial group and Hindu Credit Union. It seemed to me that the CPG was recommending that the government put $600M USD of our taxpayers’ money into this scheme. Yes, I said scheme. Maybe if it was really so good they should have just accepted the discounted rates being offered in the budget and invested those funds with Ryan ALM. After one time is really two times, yes. I recently read that one Prem Beharry was appointed to the National Gas Company Board. - Another proposal, this one reportedly stated by Peter Permell, the CPG’s most prominent spokesperson was for the state to pay 40% immediately with the balance being payable in 5 to 7 years. The persons waiting for delayed payments would earn interest of 4-4.5% on those unpaid balances and also be entitled to a 51% share of any uplift in the value of sold assets. No, there was no proposal for those CPG members to share in any losses if assets had declined in value.

It may all just be a series of negotiating positions, but it seems pretty clear that no one from these various investors’ groups intends to take a discount or ‘haircut’ on the monies owed to them. The unstated assumption is that if someone has to stand the bounce or take a haircut, that someone must be the taxpayer. That could never be the correct position. So, we need the facts.

The most startling development is the Central Bank’s full page adverts on Thursday 28th October, repudiating the claims that it had offered any guarantees in this situation. The reaction was immediate, with the CPPA publishing large adverts in opposition the next day and a new anti-bailout group emerging for the first time – at last! The CPG’s response was a nadir in their campaign, with the Trinidad Guardian reporting that – “…Permell went on to say that they do not care where the Central Bank gets the money from once they guarantee the policyholders’ contracts…” – I could scarcely believe what was on the page before me. Even the most militant Trade Unionists use more reasonable language.

Which brings us right to the meat of the matter, the order of things. What is the reason that the investors’ groups are now at the front of the line for assistance from this government? I could be wrong, but it is easy to get that impression when one hears of Cabinet discussing the matter twice in one week, certain groups giving threatening timetables and so on. I do not know if our Cabinet – PNM, UNC or PP – has ever given such a total priority to any matter in the past.

There are other claims on the limited monies available to the State. All of those claims existed before these investors groups. All.

Many people have poor water supply. Outstanding payments to contractors and suppliers are in excess of $7.0Bn, according to Central Bank estimates. Insufficient money for OPVs – the estimated cost of $3.0Bn is too much for the country to bear, so national security is falling behind. More guns and drugs entering our homeland. Public Servants claims are about $3Bn and that is also a strain on the Treasury. Not enough police cars. Sad situation in the public hospitals.

The CPG issued a 2 page advert in the Guardian on Thursday 4th November and it deserves careful reading. It was good to see their call for the publication of the correct financial information before making a decision. They set out their proposals for the relief of CPG members – those are the latter of the two above, with the added condition that they be given two seats on the boards of CL Financial and Clico.

The CPG claims that its proposals place no additional burden on the taxpayers, which is a good thing, if that is truly so. The CPG’s proposals are silent as to how the monies already spent are to be recovered.

The real test will be if the accounts and asset valuations reveal the group to be insolvent. Will the various investors’ groups accept that or are we in for a long, bitter fight?

SIDEBAR: The Commission of Enquiry

The Attorney General recently announced that he had withdrawn Sir Gavin Lightman QC as the sole Commissioner, due to an apparent conflict of interest. Lightman had appeared for Clico in a 1991 court case and the PNM did well to have stopped this before it went too far.

Two important further points, though –

- Firstly, this is the second such occasion. In the first case, the Commission of Enquiry into 1990 was announced with retired Appeal Court Judge Mustapha Ibrahim as its chair, until he pointed out that he too had a conflict of interest. There needs to be some more care taken on this count.

- Secondly, the terms of reference need to be qualified, since the AG was reported to have said that “…The COI, he said, covers CL Financial, Colonial Life Insurance Company (Clico), Clico Investment Bank, British American Insurance Company and the HCU…” Having been frustrated in my efforts for the past fortnight to get confirmation of the Terms of Reference from the AG’s Ministry, I am forced to rely on press reports. Question being, why is CMMB being omitted?

The Bankers Association of Trinidad & Tobago (BATT) and the Association of Trinidad & Tobago Insurance Companies (ATTIC) are also part of the situation.

The Bankers Association of Trinidad & Tobago (BATT) and the Association of Trinidad & Tobago Insurance Companies (ATTIC) are also part of the situation. As it is, we already have been bound to a rotten bailout of the wealthiest individual in the Caribbean by our Treasury at

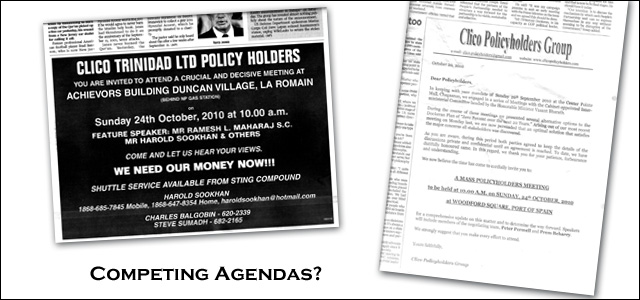

As it is, we already have been bound to a rotten bailout of the wealthiest individual in the Caribbean by our Treasury at  There was an EFPA group and a CLICO Policyholders group formed just after the budget on 8th September, but they soon merged under the latter name. I am now seeing what appears to be a substantial split with 2 competing meetings being organised for 10am today – one in Port-of-Spain and the other in San Fernando.

There was an EFPA group and a CLICO Policyholders group formed just after the budget on 8th September, but they soon merged under the latter name. I am now seeing what appears to be a substantial split with 2 competing meetings being organised for 10am today – one in Port-of-Spain and the other in San Fernando.

The Mottley Report – There was a team of three advisers – Wendell Mottley, Colin Soo Ping Chow and Steve Bideshi – appointed to examine the CL Financial group and we need to know what were the findings of this group.

The Mottley Report – There was a team of three advisers – Wendell Mottley, Colin Soo Ping Chow and Steve Bideshi – appointed to examine the CL Financial group and we need to know what were the findings of this group. Winston Dookeran’s budget proposals to re-order the ongoing CL Financial bailout have sparked considerable controversy. Dookeran stated his first priority to be “…Stop the drift and indecision…” – ironically enough, it appears that the sentiments of the public are moving in another direction entirely. A new mood of protest and threats of impending lawsuits have emerged. This is a live example of the law of unintended consequences.

Winston Dookeran’s budget proposals to re-order the ongoing CL Financial bailout have sparked considerable controversy. Dookeran stated his first priority to be “…Stop the drift and indecision…” – ironically enough, it appears that the sentiments of the public are moving in another direction entirely. A new mood of protest and threats of impending lawsuits have emerged. This is a live example of the law of unintended consequences.