Afra Raymond sits with host, Fazeer Mohammed on the Morning Edition television show to discuss the Colman Commission into the CLICO/HCU collapse. Video courtesy TV6

- Programme Air Date: 24 March 2011

- Programme Length: 0:28:13

Afra Raymond sits with host, Fazeer Mohammed on the Morning Edition television show to discuss the Colman Commission into the CLICO/HCU collapse. Video courtesy TV6

This – clfFoI-1 – is a copy of the letter sent today from my attorney to the Ministry of Finance, requesting that they provide –

The letter invites the Ministry of Finance to send the documents in 10 days or we go to the High Court.

Given the current state of play at the Colman Commission, there are no prizes for guessing which of those is going to happen.

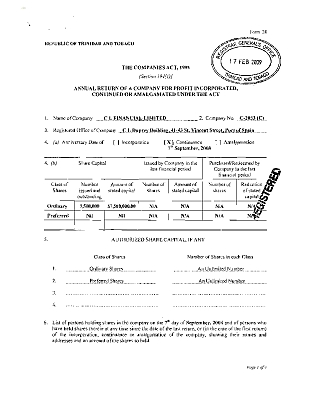

CL Financial Annual Returns 17 February 2009

CL Financial Annual Returns 17 February 2009

This is the official copy of CL Financial’s Annual Return from the Companies Registry, as at 17th February 2009 – it bears the official stamps and is signed by CLF’s then Corporate Secretary, Gita Sakal.

The company had a paid-up capital of $7.5M, with that number of $1.00 shares in issue.

The 325 shareholders are listed alphabetically, as at 7th September 2008, with details of their occupations and addresses also supplied. Of course, that list shows, at #289, the then Minister of Finance – Karen Nunez-Tesheira – as Karen Tesheira, Attorney-at-Law – holding some 10,410 shares.

Another thing that is striking is that Lawrence Duprey would appear to have only three blocks of shares in his ownership –

I am taking that to mean that Lawrence Duprey had under his direct control a maximum of 3,701,313 shares – i.e. 49.35% of the group’s entire shareholding…slightly less than half.

I am leaving it to the better-informed readers to help fill in the gaps in this story.

As to Andre Monteil, the recently-retired Group Finance Director, his 337,269 shares were transferred from Stone Street Capital Limited to First Street Capital Limited on 31st March 2008, the date he retired from the CLF group. Both companies’ registered address is the same – 33b Perseverance Road, Haleland Park, Maraval.

16th March 2011

Afra Raymond’s submission seeking to be made a party to the Commission of Enquiry into the failure of

CL Financial Limited

Colonial Life Insurance Company (Trinidad) Limited

Clico Investment Bank Limited

Caribbean Money Market Brokers Limited and

The Hindu Credit Union Credit Union Co-operative Society Limited

My name is Afra Martin Raymond and I am a Chartered Surveyor, being a Fellow of the Royal Institution of Chartered Surveyors. I am Managing Director of Raymond & Pierre Limited – Chartered Valuation Surveyors, Real Estate Agents and Property Consultants. I am also the President of the Joint Consultative Council for the Construction Industry (JCC), an umbrella organisation which represents the interests of Engineers, Surveyors, Architects, Town Planners and Contractors in this Republic.

This submission is being made in my personal capacity and does not represent the position of either Raymond & Pierre Limited or the JCC.

My work on this vital issue has all been based on the public record and can be seen at www.afraraymond.com.

I am willing to give oral evidence before the Commission.

I have been conducting a campaign in the public interest on this important matter. My work is unfunded and I have no assistance. Indeed, I have no legal adviser at this Enquiry.

Having followed the issue so closely and attended the opening session on Friday 11th March, I am of the view that the parties thus far identified in this Enquiry are all seeking to advance their own interest.

I am here seeking to be made a party to this Enquiry, in seeking the interest of the silent majority, the taxpaying public, who have had to pay for this huge financial fiasco.

I am making this submission under rule 2. of the Commission’s Rules of Procedure, as a person whose “…participation in the Enquiry may be helpful to the Commission in fulfilling its mandate…”

I await your reply.

——————————-

Afra M. Raymond B.Sc. FRICS

Port-of-Spain

This is the opening statement given by Sir Anthony Colman QC at the first sitting of the Colman Commission on Friday 11th March 2011.

https://afraraymond.net/wp-content/uploads/2011/03/commission-of-enquiry-clico-sir-a-colman.pdf

If you think this title is for the latest brand of household cleaner, you would be wrong. I drew that title from the famous statement by deceased US Supreme Court Justice Louis Brandeis, in reference to corruption and fraudulent dealings: ‘sunlight is said to be the best of disinfectants.‘

If you think this title is for the latest brand of household cleaner, you would be wrong. I drew that title from the famous statement by deceased US Supreme Court Justice Louis Brandeis, in reference to corruption and fraudulent dealings: ‘sunlight is said to be the best of disinfectants.‘

Of course, this is all about the impending Colman Commission of Enquiry into the failure of CL Financial and other companies (including CMMB) and the Hindu Credit Union.

We are attempting to understand our situation in this financial fiasco – how was the entire collapse caused? Who is responsible? What can we do to avoid a repetition?

Our House needs a serious cleaning and we need a new commitment to serious retrospection if we are to succeed in understanding this scandalous situation.

To set the stage, there are four principalities being represented in this Enquiry –

My first point about this Colman Commission is how welcome it is, as a tangible sign of a change in how our country is being run. No, I did not vote for either group in the last election, but it seems to me that neither of the last two regimes (Manning or Panday) would have initiated a public enquiry into this financial fiasco.

As much as I approve the decision to have this public enquiry, the purpose of this article is to warn against some of the forces now being assembled to erode the enquiry’s effectiveness. Even though, in this respect, political times have changed, we need to remain vigilant if the Colman Commission is to be effective.

To be sure, the four principalities I listed comprise very powerful players for whom this enquiry is a literal nightmare, since they will be obliged to explain some of their biggest decisions and actions, which they would never have had to explain to anyone outside of their own circle.

If the Enquiry takes place as intended, we are going to be afforded an unprecedented insight into the workings, dealings, arrangements and situations in our leadership class – all of it at a depth and range never before recorded. Matters that had been only the subject of picong, ole talk and so-called urban legends will all now become part of the official record. Yes, our Republic will be coming of age.

Our country is a Republic, which to me means that no class of citizen ought to enjoy rights which are superior. But there has been a pattern of behaviour in this fiasco which has been very disturbing because it violates those Republican expectations. Of course, I am referring to the fact that a three-tier system seems to have been in operation during the entire meltdown.

Maybe I am entirely wrong and there was complete surprise when the CL Financial group collapsed. But if that is the case, one is really contemplating a slack system of management systems and an entire swath of our ruling elite who are not ‘fit and proper’. The question of who knew what and when, will be a main point of dispute, because either way you slice it, the picture is unappealing.

You can be sure that the people in the top layer will do anything in their power to protect themselves from the stern scrutiny of those in the lowest group, not to mention the public, who are paying for all this.

I wrote a previous column in this series, entitled ‘Taking in front‘ and on this occasion, in light of what is at stake, I, too, am taking in front. Having suffered a defeat in that the Colman Commission has now been established, the members of the Code of Silence can be expected to try halting, delaying or just diluting the Commission.

We have already had former Hindu Credit Union (HCU) chief, Harry Harnarine, defeated in the High Court in an attempt to stop the Colman Commission. I was not surprised to read reports that Harnarine is planning to appeal that decision. We can expect other strong challenges as this historic process unfolds.

If the members of the Code of Silence are unable to derail the Commission itself, we should not be surprised if they try to cloak the proceedings in some kind of blanket to prevent too much information escaping.

Readers, please note that the process of asking the Court to prevent publication of a particular piece of evidence is a very swift one, with the ruling expected in the very same sitting. That is because if those proceedings are too drawn-out, it can be actually self-defeating, since the matter which they are seeking to have concealed can be published and discussed while a decision is awaited.

That is the reason we need to beat this drum now. We cannot wait for the filing of injunctions and then seek to publish. By then, it would be too late.

The new algebra is simple and inescapable –

Expenditure of Public Money – Transparency = CORRUPTION

Whatever the negatives of the American Imperium, there are still aspects of that society which are worthy of emulation. The example which comes to mind is the recently-published report of the Financial Crisis Inquiry Commission.

The preface of that Report contains an instructive paragraph, at page xii –

“…This report is not the sole repository of what the panel found. A website — www.fcic.gov — will host a wealth of information beyond what could be presented here. It will contain a stockpile of materials — including documents and emails, video of the Commission’s public hearings, testimony, and supporting research — that can be studied for years to come. Much of what is footnoted in this report can be found on the website. In addition, more materials that cannot be released yet for various reasons will eventually be made public through the National Archives and Records Administration…”

The US legislature is determined that the inner lessons and testimony on this important crisis are available to all interested parties for the years ahead. That represents a solid commitment to a learning society, which will at least attempt to draw lessons from the bitterest of experiences. In my opinion, that commitment is worthy of emulation.

Has our society reached the stage of maturation to commit to an entirely transparent process of retrospection? That is the question which will be tested in the weeks and months to follow.

The entire proceedings of the Colman Commission must be held in public. The proceedings must be on TV and available on the internet. The Colman Commission needs a strong internet presence, with its own website.

Sunlight Disinfectant cleans brighter, you see?

14th February 2011

Afra Raymond’s second submission to the Commission of Enquiry into the failure of CL Financial Limited, Colonial Life Insurance Company (Trinidad) Limited, Clico Investment Bank Limited, Caribbean Money Market Brokers Limited, and The Hindu Credit Union Credit Union Co-operative Society Limited

My name is Afra Martin Raymond and I am a Chartered Surveyor, being a Fellow of the Royal Institution of Chartered Surveyors. I am Managing Director of Raymond & Pierre Limited – Chartered Valuation Surveyors, Real Estate Agents and Property Consultants. I am also the President of the Joint Consultative Council for the Construction Industry (JCC), an umbrella organisation which represents the interests of Engineers, Surveyors, Architects, Town Planners and Contractors in this Republic.

This submission is being made in my personal capacity and does not represent the position of either Raymond & Pierre Limited or the JCC.

My work on this vital issue has all been based on the public record and can be seen at www.afraraymond.com.

I am willing to give oral evidence before the Commission.

My areas for focus in this submission are –

Fiduciary Duty of Directors and Officers

The burning question is – When did the Directors and Officers of CL Financial (CLF) know that the group was heading to collapse? When did the Directors and Officers of the failed subsidiaries know? What did they know and when did they know it? How much warning did their management controls give them?

The question is pertinent and the time-line is instructive –

So, there is this contradictory financial manoeuvre in the dying stages of the group. I am speaking about the CMMB share purchase, in which CLF purchases Jamaica Money Market Brokers’ 45% shareholding in CMMB at a reported $41.37M USD. That price equates to 16.5 times earnings, given that CMMB’s profit as at March 2008 was $35M. It is impossible to reconcile that earnings multiple with CMMB’s exceedingly low profit rate and the rapidly-approaching collapse.

Was a professional, independent valuation of those shares obtained prior to the purchase? How can it have been a proper discharge of their fiduciary duty to shareholders for the CLF Directors to have agreed such a massive, questionable purchase without proper advice?

That transaction drew $262M out of CLF’s rapidly-depleting coffers on terms which are suspect. It demands close examination.

Another inescapable episode is the last CLF Annual General Meeting, the timing could hardly be better for an insight into the sensibilities of these chiefs. At the date of that AGM, Friday 23rd January 2009, the bailout letter was 10 days’ old, the dividend cheques were one week old and the bailout itself was a week ahead.

What was the atmosphere at that meeting? Were the shareholders told frankly of the major challenges and that the group had been forced to seek a State bailout? Did the Directors offer an explanation for the failure of the group?

It would be important to examine that AGM very carefully.

The Second issue is the treatment of departing Directors and Officers. Note that three of the most important and senior CLF chiefs departed in the 12 months prior to the collapse. It is most unlikely that those departures were mere good fortune or coincidence.

It is difficult to probe and verify such agreements when they are oral, much less when they are between parties who are actively collaborating. Memory can be notoriously unreliable.

I am submitting that those departures can be examined from the documents if one were to approach from the compensation aspect. What I mean is that these chiefs would have been paid upon departure and that would likely have been documented.

If that approach were taken, the suggested questions would be

This would make it possible to have some insight into the way these chiefs treated with themselves, their shareholders and the other stakeholders of the group.

Executive Flexible Premium Annuity (EFPA)

I have written extensively on the EFPA, its growth and the effect of that size upon the entire CL Financial group.

I have no further points to make on those aspects. My submission here is on the point of set-off and the burden to the taxpayer.

My submission is that in relation to the intended payments from the State to EFPA claimants is that the State must conduct itself in an exemplary fashion. The State must not be placed at any further disadvantage, having already shouldered this enormous, exceptional payout.

There are now anti money-laundering (AML) laws which require depositors to make declarations as to the Source of Funds, all in an effort to prevent the proceeds of crime from entering the legitimate economy. In my view it is necessary for the government to be satisfied that the various sums being claimed were properly declared under the AML laws. We have had shocking reports about the elementary management controls which were either absent or awry in the CL Financial group, so it would not surprise me if their AML-compliance was lax. That needs to be thoroughly checked. It would not be at all acceptable for our taxpayers’ monies to be used to rinse ‘dirty money’.

Also, the claimants who owe on their taxes – VAT, PAYE, Corporation Tax, Income Tax and so on – should not be refunded.

Finally, there is the issue of the many borrowers from Clico, British-American, Clico Investment Bank (CIB). In the case of CIB alone, we are told that about $1.0Bn of those loans are ‘non-performing’ – which means that the borrowers are not repaying their loans. It would be perverse for some of those non-performing borrowers to receive refunds from the State. This is a live part of this situation, since in the case of CIB itself, the very Inspector of Financial Institutions swore in his affidavit filed in the winding-up action for that failed bank –

…With respect to the Creditors of the Petitioner, the Petitioner has met the statutory obligations for the Board of Inland Revenue (except for Corporation Tax Returns for 2007, 2008 and 2009 which are being prepared and remain outstanding)…

That is a glaring example of the kind of wanton wrongdoing at the heart of this mess. CIB fails to file its Corporation Tax returns for three years, yet keep their banking licence and arrange for the taxpayer to bail them out when it all goes sour.

Some claimants may try to invoke the ‘corporate veil’ to shield themselves from various breaches committed by their companies, but this is an exceptional situation in which the State is making an offer. In my view, the corporate veil ought properly to be ignored, so that the long-standing commercial principle of ‘set-off’ can be applied to the claimants.

I am submitting to the Commission that everyone over seeking bailout funds exceeding $75,000 be subject to a BIR audit for themselves and any business interests that they may have earned revenues from and they should be denied a taxpayer-funded bailout if they were found to have not paid their taxes.

Political Party Financing

It is my submission that the means by our political parties are financed is at the very heart of this affair.

Governance models, regulatory frameworks and accounting conventions are all important parts of the interlocked issues, but those pale into insignificance beside the influence of this major party financier.

There can be no doubt that CLF was one of the leading contributors to political parties in this country.

In the case of the United National Congress (UNC), which is the leading element of the existing coalition government, their last leader was convicted and imprisoned for failing to declare substantial donations received from Lawrence Duprey – see here and here.

In the case of the People’s National Movement (PNM), there have been published reports as to the payment of sums of the order of $20M to that party by CLF in the 2007 general election – see here and here.

In the case of the former political party, the entire CLICO issue was raised by the respected economist Trevor Sudama MP in the 2002 budget debate. Sudama was a UNC Cabinet member and posed the question as to whether CLICO, having been found to be insolvent by the Supervisor of Insurance, should be allowed to continue in business. Sudama was strongly opposed in the debate and eventually removed from the Cabinet. This can be corroborated from Hansard (p. 757 and 800) and the reports of the Supervisor of Insurance.

In the case of the PNM, the link was even deeper, with the same individual being that party’s Treasurer, CLF’s Group Finance Director and Chairman of two banks – Home Mortgage Bank and CLICO Investment Bank as well as two major State enterprises in the construction sector – Housing Development Corporation and the Education Facilities Company Limited. That individual is Louis Andre Monteil.

It is clear from the many statements of the Governor of the Central Bank that they were very limited in what they could do as regulators and it is difficult to escape the impression that an undue influence was brought to bear in the case of CLF.

The last Minister of Finance, Karen Nunez-Tesheira – a former law lecturer – was found to have withdrawn her own and her family’s monies from the CLF group just before the crash, was a shareholder of CLF and accepted dividends after the bailout was requested by the beleaguered group.

Only when Nunez-Tesheira was confronted by an informed and relentless media did she admit any of those transactions. We have never had an account of those dividends.

There is a long-standing and widely-accepted doctrine of Cabinet secrecy. It is my submission that this is one of those exceptional cases in which the very purpose of the Enquiry will be frustrated unless the Terms of Reference are robustly interpreted. In this case the situation demands an examination of the conduct of these matters at the political level.

For a proper understanding of this issue, it is essential that Karen Nunez-Tesheira, Trevor Sudama and Louis Andre Monteil be cross-examined on this political aspect. It is my view that former Prime Ministers Basdeo Panday and Patrick Manning must be questioned if we are to properly apprehend the extent of the financiers’ influence.

I am basing that submission on part (i) of this Enquiry’s Terms of Reference -To enquire into “…the circumstances, factors, causes and reasons leading to the January 2009 intervention…”. There is no way to satisfy the first part of your mandate, to understand the root causes of the crisis, without getting into this fundamental issue. Political Party financing is at the centre of the fiasco. The learning from the Wall Street crisis on this question is unequivocal as to the pernicious influence of these political financiers and lobbyists.

For this Enquiry to achieve the required level of interrogation, information and insight, it must pierce the conventional veil of Cabinet secrecy. To do that, you need to take a robust view of your Terms of Reference.

I do believe all the items in this submission to be true and correct.

……………………………………………..

Afra M. Raymond B.Sc. FRICS

I have been preparing my submissions for the Colman Commission and took some time-out to start reading the Report into the USA’s financial crisis. Of course I am referring to the Financial Crisis Inquiry Report, which was published at the end of last month, about a year after its first hearings.

I have been preparing my submissions for the Colman Commission and took some time-out to start reading the Report into the USA’s financial crisis. Of course I am referring to the Financial Crisis Inquiry Report, which was published at the end of last month, about a year after its first hearings.

Even though I have barely scratched the surface of this 662-page work, it has already been a deeply fascinating read, filled with cautionary insights. The first conclusion of that Report is worth citing –

“We conclude this financial crisis was avoidable.

The crisis was the result of human action and inaction, not of Mother Nature or computer models gone haywire. The captains of finance and the public stewards of our financial system ignored warnings and failed to question, understand, and manage evolving risks within a system essential to the well-being of the American public. Theirs was a big miss, not a stumble. While the business cycle cannot be repealed, a crisis of this magnitude need not have occurred. To paraphrase Shakespeare, the fault lies not in the stars, but in us.

Despite the expressed view of many on Wall Street and in Washington that the crisis could not have been foreseen or avoided, there were warning signs. The tragedy was that they were ignored or discounted…”

It is an epic failure in that the world’s strongest and most diversified financial system was brought, literally, to its knees by a tidal wave of greed. Some of the main features were –

If any of this sounds familiar, yes, you are right; it is almost the same as our own crisis. The old aphorism ‘When Uncle Sam catch a cold, the Caribbean get pneumonia’ comes to mind.

I have to say that the reading is a sobering experience as one starts to reflect that the deep and broad USA economy has been crippled by these ‘smartmen’ and their political minions. So what hope do we have of resisting those elements? That is the question we need to grapple with in this rounds.

But for all the parallels, there are two important differences –

According to those sources, this crisis is costing us 10 times more than the Wall Street one we keep on about. The relevant Ministry of Finance Press Release of 17th January 2011 states, “…With the Government’s planned bailout of CLFG (CL Financial Group), Standard and Poor’s expect net general government debt will rise to 28% of GDP in fiscal 2011 from 15% in fiscal 2010, though it will remain below the 36% median for ‘A’ rated sovereigns…” That is a difference of 13%. Yes, that is 13 times more than the USA…

This crisis will require us to properly compare and contrast those situations.

It has been two years, but at last the Commission of Enquiry into the T&T financial collapse is about to start its hearings. For the first time and against all their schemes and plans, the main agents of the Code of Silence are going to be forced into the direct sunlight to face questions and of course I mean the several court cases and the Colman Commission as discussed in ‘Testing the Code of Silence‘.

The final date for submissions to the Colman Commission is Monday 14th February, which means that all written evidence must be filed by then. I am not sure if electronic evidence, like the 55-minute interview Brian Branker (former Executive Chairman of British American Insurance Co.) gave on Up Next! in September 2010 is allowable, but it seems worth it to try. So this is my call for the producer of that show, Jerry George, to please do submit it. If you are interested, it is at http://vimeo.com/15145888.

I expect that by now the main actors in this Code of Silence are all rehearsing their lines and agreeing who will speak on which piece and in fact which parts to be silent on. In my opinion we can expect nothing but self-serving and defensive statements, if not outright lies, from the main actors in this mess – the CL Financial chiefs, the wayward Regulators and of course, the auditors. The burning question is therefore how is the public interest going to be defended and advanced? By whom? On what terms?

To make the obvious comparison with the Uff Enquiry, we are looking at the same kind of procedure. The decisive difference is that, in this case, the balance of forces is entirely different.

You see, in the Uff Enquiry there were the forces of the State and its agents all lined up to defend their way of operating – that included UDeCOTT, Calder Hart, National Insurance Property Development Company (NIPDEC), Housing Development Corporation (HDC) and of course the State itself was in the Enquiry in the person of the Attorney General. On the other side there were the Joint Consultative Council and Dr. Keith Rowley, MP. All those parties were strongly represented. There were also independent forces at the Enquiry – the Trinidad & Tobago Transparency Institute (TTTI), Carl Khan and myself – the only two witnesses whose testimony stood without hostile cross-examination.

Due to the balance of forces in that forum, the Uff Enquiry was satisfactory in that all versions were strongly contested under cross-examination and also by conflicting testimonies – the Enquiry was forced to decide on the veracity and relevance of evidence…there was no easy middle road or settling for a version because no one had spoken against it.

Here, in the Colman Commission, we face an entirely different order of challenge. Let me explain –

Some of us have insisted on this Enquiry as a necessary step in preventing a repetition and further looting of the society. The facts and the versions of the facts are about to be tested in the crucible of the Colman Commission.

The only way we can avoid the US fate, and possibly worse, is by doing our very best to learn from the bitter experience. Those of us, who have insisted on this crisis being a real turning-point, must make the most of this moment. In my opinion, that can take place on two levels –

The key person from whom I would like to see a submission is the respected former MP and economist Trevor Sudama, who was the first person to put onto the public record these serious concerns over the health of the CL Financial group. That was in the 2001 Budget debate and of course we all know that Sudama and his colleagues – Ramesh Lawrence Maharaj and Ralph Maraj – were strongly attacked, ostracized and ultimately forced from the political Head Table. All by their own party colleagues.

Mr. Sudama, we need your input in this vital matter. The background for your intervention in this matter, your debate on it and the political attack must form part of the record in this Enquiry.

Some of the key commentators who should put in written submissions are Camini Marajh of the Express, Andre Bagoo of Newsday and Anthony Wilson, the Ag Editor-in-Chief of this newspaper.

Our professional Institutions have been pointedly silent and I would hope to see submissions from –

Our institutions of higher education should join in with their perspectives –

I am going to close by sketching just one parallel.

To go back to the main points of the Wall Street experience as outlined above, we hear of these complex debt swap instruments and their toxic consequences. The fatal flaw of these instruments, according to the reports I have read, seems to be that they seemed to be a good way to invest with high returns and little or no risk. The truth turned out to be just the opposite.

It all seems remote from our own situation, but that is not the only way to look at it. The most controversial single item in this entire situation here has been the EFPA, an annuity duly approved by the Supervisor of Insurance. When we consider the promotional literature for that product, it is nothing less than scandalous that a leading company should have been allowed to advertise an investment product with exceptional rates of return and the repeated phrase ‘guaranteed investment’. There is absolutely no such thing as a guaranteed investment. It is a complete contradiction in terms, but yet it went out to tens of thousands of people, who suspended their disbelief and went along for the ride. That is the Trini parallel with those complex debt swap instruments.

You see?

This my Freedom of Information application made on 22nd December 2010 to the Minister of Finance for the ‘Duprey’ letter of 13th January 2009 and the 31st December 2008 accounts of the CL Financial Group.

This my Freedom of Information application made on 22nd December 2010 to the Minister of Finance for the ‘Duprey’ letter of 13th January 2009 and the 31st December 2008 accounts of the CL Financial Group.

Readers who are not familiar with the ‘Duprey’ letter and its implications, should read – ‘Finding the Assets.’

This is the third application I am making for these documents. The first was to the previous Minister of Finance, Karen Nunez-Tesheira, who delayed a long time, then ended-up telling me to go to the Central Bank, since they were the original addressees. Of course that was a transparent ploy to frustrate my application, as we know that the Central Bank is immune from the Freedom of Information Act (FoIA).

My next application was on 28th June 2010 to the present Minister of Finance, Winston Dookeran, who never acknowledged the application, despite several reminders.

Readers, please remember that the FoIA requires that the public authority reply to applications in 30 days. There are no penalties for breaching that requirement, so we have to contend with these tactics.

It is now occurring to me, as I write this, on Thursday 20th January 2011, that by Monday 24th we will have reached yet another deadline, but this time we will go further than just letter-writing.

When you combine the failure to reply by both PNM and PP Ministers of Finance with the bizarre affidavited evidence of our Inspector of Financial Institutions, Carl Hiralal on the background to the Central Bank’s application to wind-up CLICO Investment Bank, it is clear to me that the decision has been taken to suppress that letter. For whatever reason, as we say in these parts.

The new situation is charged with peril and one is reminded of Naipaul’s father, the intrepid journalist from A House for Mr. Biswas whose favourite tagline was “…amazing scenes were witnessed…”

The new situation is charged with peril and one is reminded of Naipaul’s father, the intrepid journalist from A House for Mr. Biswas whose favourite tagline was “…amazing scenes were witnessed…”

Finance Minister, Winston Dookeran, addressed Parliament on the Finance Bill (No. 2) 2010 on Wednesday 24th November. It was a lengthy and detailed statement, which put things into a necessary perspective. For me, it was important that Dookeran gave priority to the claims of the contractors and of course, the last item being the claims being made by the various groups representing Clico policyholders.

The Finance Minister held his position as set out in the 2011 budget, which was no surprise when one considers his statement that the various submissions received from the policyholders’ groups did not withstand scrutiny. I only had two significant concerns in terms of outstanding items which require proper attention.

…Clauses 2.3.3 and 2.3.4. of the SA, require the outgoing CL Financial chiefs to render all assistance to the incoming Board and Management in terms of all records and accounts etc. The question here is ‘Have the new Board and management been receiving the full assistance of the previous CLF chiefs?’ If not, what is being done about it?…

The immediate statements of the Clico Policyholders’ Group (CPG), which targeted Dookeran, are a perturbing sign. For whatever reason, the CPG is ignoring the settled principle of Cabinet’s collective responsibility. That stance seems to be detrimental to effective negotiation and I am beginning to wonder if some person or persons in the Cabinet is ‘giving them basket’.

The threatening statements from the CPG as to the damage their proposed lawsuit can do to our country’s economy are nothing less than scandalous. We are now witness to a grim game of brinksmanship.

We have all heard the arguments and rumours surrounding this bailout, so no point repeating those. It certainly seems that those are going to be ventilated in a high-profile series of lawsuits. I only hope that the hearings remain open and do not take place in a sealed Court. That is what happened in the very first lawsuit after the bailout, in which the Central Bank was attempting to get CL Financial to comply with the terms of the bailout. The stakes are too high now for any concept of privacy to prevail in this matter.

The Minister of Finance also announced that the conditions under which the financial relief would be offered were being considered and it is good to know that there is to be no unconditional relief at our collective expense.

My thoughts on that aspect are that the State must conduct itself in an exemplary fashion and not be placed at any further disadvantage, having already shouldered this enormous, exceptional payout.

There are now anti money-laundering (AML) laws which require depositors to make declarations as to the Source of Funds, all in an effort to prevent the proceeds of crime from entering the legitimate economy. In my view it is necessary for the government to be satisfied that the various sums being claimed by these policyholders were properly declared under the AML laws. We have had shocking reports about the elementary management controls which were either absent or awry in the CL Financial group, so it would not surprise me if their AML-compliance was lax. That needs to be thoroughly checked. It would not be acceptable for our taxpayers’ monies to be used to rinse ‘dirty money’.

Also, the claimants who owe on their taxes – VAT, PAYE, Corporation Tax, Income Tax and so on – should not be refunded. As Dookeran said in that address, if everyone paid the taxes due, our budget would not be in deficit. We cannot go deeper into deficit without these elementary precautions being taken.

Finally, there is the issue of the many borrowers from Clico, British-American, Clico Investment Bank (CIB). In the case of CIB alone, we are told that about $1.0Bn of those loans are ‘non-performing’ – which means that the borrowers are not repaying their loans. It would be perverse for some of those non-performing borrowers to receive refunds from the State. This is a live part of this situation, since in the case of CIB itself, the very Inspector of Financial Institutions swore in his affidavit filed in the winding-up action for that failed bank –

…With respect to the Creditors of the Petitioner, the Petitioner has met the statutory obligations for the Board of Inland Revenue (except for Corporation Tax Returns for 2007, 2008 and 2009 which are being prepared and remain outstanding)…

That is a glaring example of the kind of wanton wrongdoing at the heart of this mess. CIB fails to file its Corporation Tax returns for three years, yet keep their banking licence and arrange for the taxpayer to bail them out when it all goes sour.

Some claimants may try to invoke the ‘corporate veil’ to shield themselves from various breaches committed by their companies, but this is an exceptional situation in which the State is making an offer. In my view, the corporate veil ought properly to be ignored, so that the long-standing commercial principle of ‘set-off’ can be applied to the claimants.

The Colman Commission of Enquiry and its effects on the Code of Silence will be my next topic.