It seems that the current administration intends to execute its three largest projects on the sole selective basis and in my view that is a serious concern.

Sole Selective is a non-competitive contracting approach in which a single firm is selected to participate in a commercial opportunity. I have not limited the definition to the provision of goods, works or services since there are many other ways in which commercial arrangements can operate.

The sole selective approach can be readily adopted if the provider is someone with a proven track record which has created a sound working relationship. The other side of the coin is that this approach can be difficult to justify on value-for-money grounds due to the lack of competition.

In terms of public procurement and the disposal of public property there is an over-riding duty on public institutions to ensure transparency, accountability and value for money in their operations. Of course those important standards are not always attained, so it is important to be alert to situations in which Public Money or Public Property are transacted on a sole selective basis.

Sole selective is an inadvisable approach if value for money is being pursued, but is not an illegal procurement method. If the Public Procurement and Disposal of Public Property Act had been implemented, there would have been serious tests in place to greatly limit the decision to choose the sole selective route, together with heavy penalties for breaches. But we are not yet there, we are here.

Sandals Tobago is the main proposal under discussion and it seems clear from several points made by Minister Imbert during the 2017 budget presentation that it is proceeding. I am unclear as to the basis for the statement –

Sandals Tobago is the main proposal under discussion and it seems clear from several points made by Minister Imbert during the 2017 budget presentation that it is proceeding. I am unclear as to the basis for the statement –

“…Original projections indicate Sandals’ contribution to the Trinidad and Tobago economy to be of the order of $500 million per year…” (pg 24)

The decisive point is that Sandals Resorts International had a high-level invitation from our government and discussions are underway for the construction of this huge 750-room luxury resort with no sign of any competition.

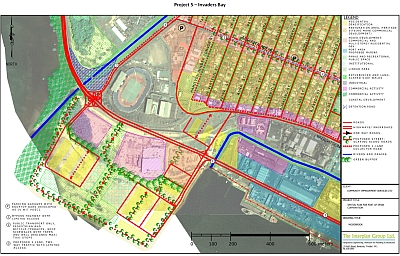

On Invaders’ Bay, during the Mid-Year Budget Review on Friday 8th April 2016, the Minister of Finance and the Economy, Colm Imbert advised that –

On Invaders’ Bay, during the Mid-Year Budget Review on Friday 8th April 2016, the Minister of Finance and the Economy, Colm Imbert advised that –

“…We have now begun discussions with some foreign investors on a set of integrated projects comprising an expanded international financial centre, a five star hotel and a convention centre, located in Invaders Bay…The International Financial Centre could include one or more Chinese banks as anchor tenants, dedicated to servicing China’s considerable lending programmes in Latin America and the Caribbean…”

On 16th June 2016, this newspaper reported these details –

“…the proposal envisages the construction of a new IFC tower, a convention centre, a five-star hotel and a free trade zone catering to Chinese and other international conglomerates…this is a unique proposal the Government is giving urgent consideration…talks between the state-owned Chinese company and the Trinidad & Tobago government on TTIFC’s expansion have been going on for the last few years…”

In contrast, on 10 August 2016, two requests for Expressions of Interest in relation to new Trinidad hotels were published by State Agencies –

- UDeCOTT – for a luxury hotel on the site of the Ministry of Agriculture at St Clair Circle in north POS.

- CDA – for a Full-Service hotel at Old Tracking Station, Macqueripe, Chaguaramas.

Those examples show that open competition is still being preferred in relation to certain projects, so one wonders why a similar approach was not taken in relation to either Sandals Tobago or the Invaders’ Bay project.

The third arrangement which appears to be sole selective is described at pg 43 of the 2017 budget –

“…The Government also intends to pursue in 2017 the partial divestment of Lake Asphalt to an International Strategic Partner…”

The proposed partial divestment of Lake Asphalt is of particular concern to me since it was reported in this newspaper on 31st May 2013 that Lake Asphalt of Trinidad and Tobago (1978) Ltd had signed a Memorandum of Understanding and a Confidentiality Agreement with Beijing Oriental Yuhong Waterproofing Technology Co Ltd of the People’s Republic of China.

The two deals with Chinese concerns require further attention since they are good candidates to fit within the loophole at S 7 (2) of the Public Procurement and Disposal of Public Property Act. That loophole allows Government to Government agreements to escape the oversight of the PPDPP Act, unless they are for the provision of goods, works and services. The lack of proper oversight of transactions in Public Money and Public Property can only jeopardise our collective interests. The risk would be even greater if the public were under the mistaken belief that the new law will cover these types of transactions.

A final, but secondary, concern is that these sole selective arrangements are all being pursued with foreign elements. In this reduced season of sacrifice, one has to ask just how much of an opportunity is being given to local firms.

One thought on “Property Matters – Sole Selectives”